Home-Price Gains in 20 U.S. Cities Accelerated in December

This article by Nina Glinski for Bloomberg may be of interest to subscribers. Here is a section:

Twelve cities, including Denver, Cleveland and Seattle, experienced larger year-to-year gains in December compared with the prior month.

Easing credit standards would help draw more first-time buyers into the market, while borrowing costs for those who can obtain credit remain near historic lows. The average rate on a 30-year, fixed mortgage was 3.76 percent in the week ended Feb. 19, according Freddie Mac in McLean, Virginia. That’s still close to the record-low of 3.31 percent reached in November 2012.

Wider credit availability will mean growth for builders like Scottsdale, Arizona-based Taylor Morrison Home Corp.“We are excited to see incremental positive changes in the mortgage market that should continue to move the recovery forward,” Sheryl Palmer, the company’s chief executive officer, said on a Feb. 4 earnings call. Signs of first-time home buyers and reentrants to the market suggest future growth is coming.

Other data show the residential real estate recovery remains uneven. Purchases of previously owned homes fell more than expected in January to a 4.82 million annualized rate, as a tight supply forced up prices, figures from the National Association of Realtors showed Monday.

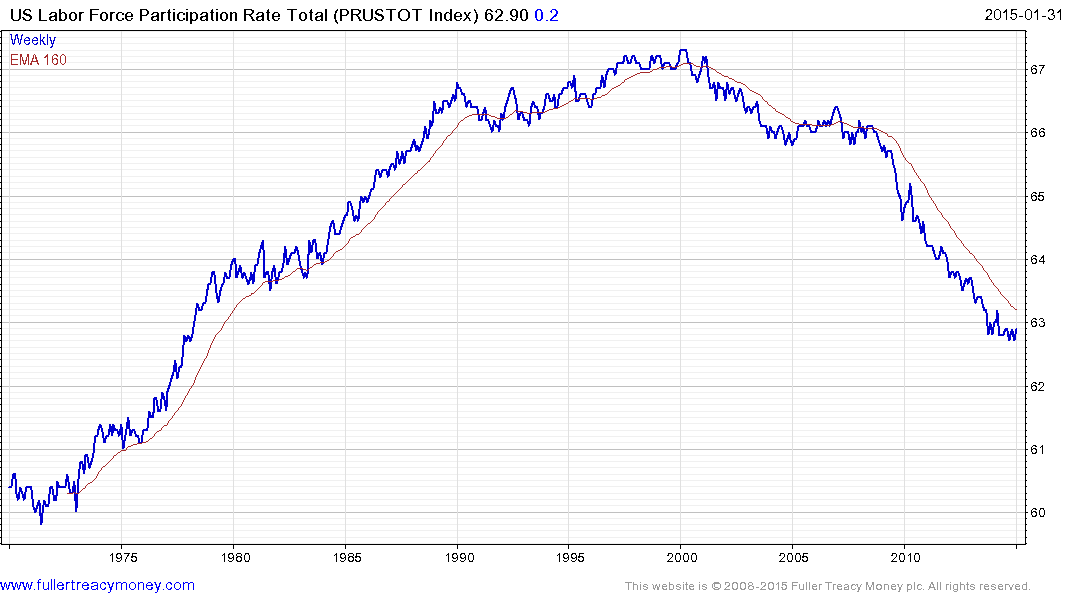

The USA does not have the aging population profile of Europe or much of developed Asia because of the number of immigrants that continue to choose to live here rather than anywhere else. While the aging of the babyboomers is a challenge, the household formation rate of the millennials should pick up over the next decade. It remains to be seen how the housing market will perform as economic growth competes with interest rates in the calculation of affordability for consumers. a further pickup in

Laborforce Participation rates is likely to be a strong influence.

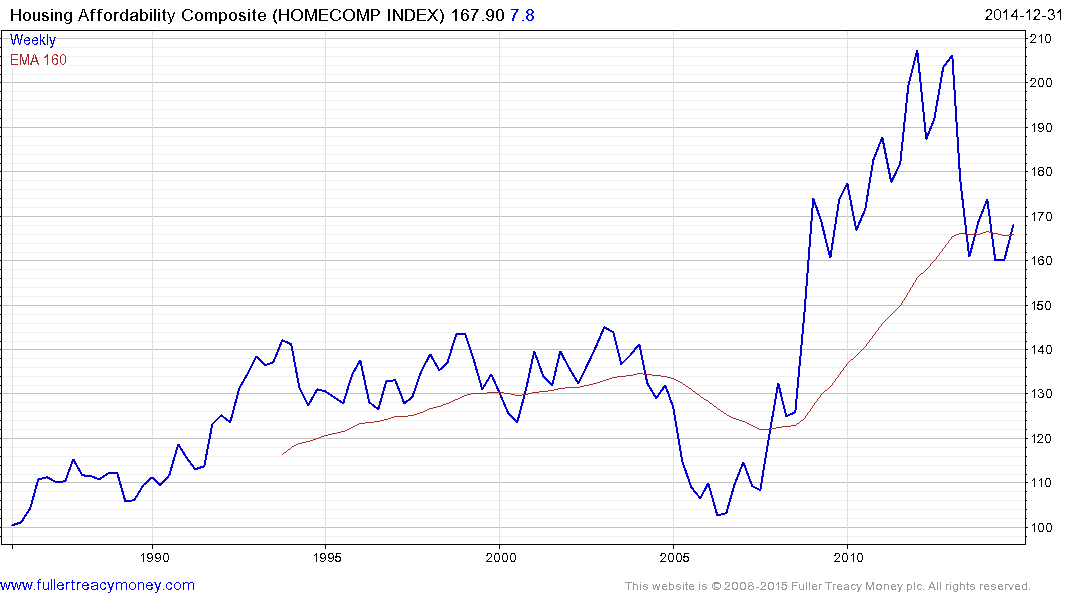

This composite chart of US Home Affordability highlights the fact that while affordability is a long way from the 2009 lows 2012 lows, they are not expensive by historical standards.

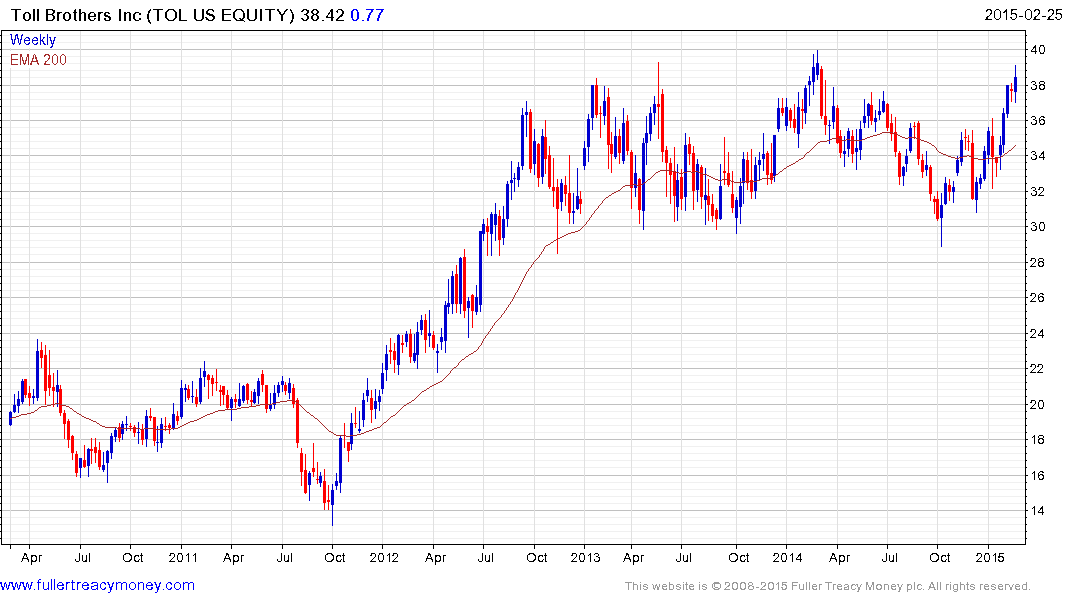

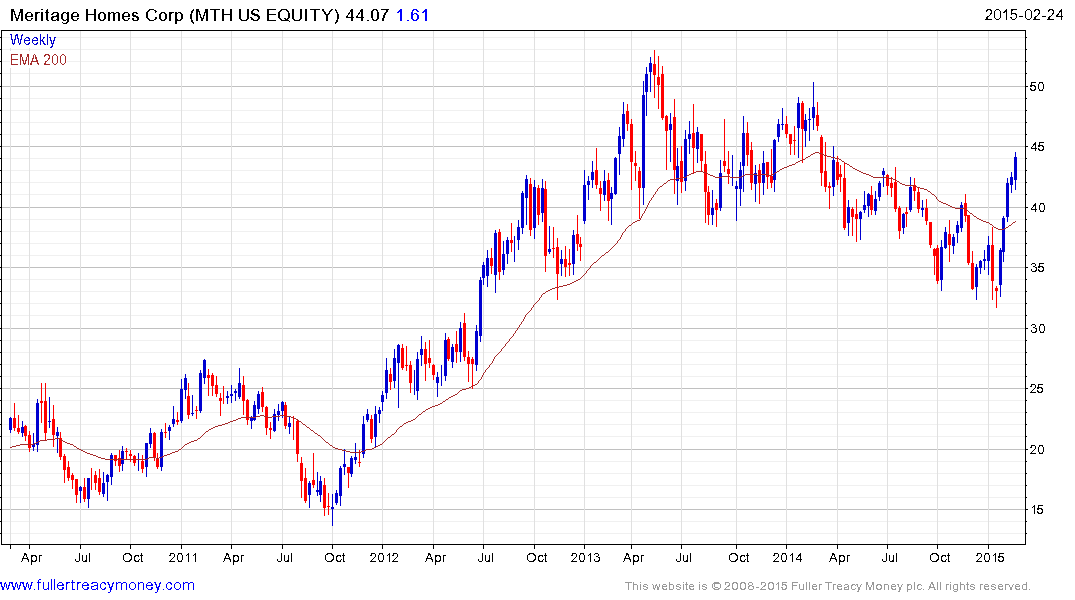

Clicking through the constituents of the US home builders section of the Chart Library, a generally positive tone is evident with the companies such as Lennar Homes breaking out of lengthy medium-term ranges, Toll Brothers testing the upper side of a two-year range and Meritage Homes breaking an eighteen-month progression of lower rally highs.

Back to top