Holiday Price War Heats Up as Wal-Mart, Target Chase Amazon

This article by Lindsey Rupp and Sarah Very for Bloomberg may be of interest to subscribers. Here is a section:

“With the lines between traditional brick and mortar and e-commerce continuing to blur, the need to make a big splash during large retail events like Black Friday is significant,” Traci Gregorski, senior vice president of marketing at Market Track, said in an e-mailed statement. “The ease of comparison shopping across channels is creating a situation that puts a definitive advantage in the consumers’ hands.”

Wal-Mart and others also are steering customers toward online deals, rather than just physical stores. While the chain still offers Black Friday specials at its supercenters, the day marks the beginning of a streak of online promotions called “Cyber Week.” Wal-Mart has tripled its e-commerce selection to 23 million products this year, aiming to better compete with Amazon. The world’s largest retailer said in a statement Friday that Thanksgiving was one of its top online-shopping days this year and that about 70 percent of the traffic to its website came from mobile devices.

Target, meanwhile, is offering 15 percent off almost everything in its stores and website for two days: Sunday and Monday. The aggressive discounts come at a cost. When Target slashed prices last holiday season, its profit margin slipped to 27.9 percent from 28.5 percent.

Retail is becoming increasingly competitive but online only companies like Amazon have a distinct advantage relative to those maintaining large brick and mortar locations.

Nevertheless, the benefit of a large physical location network is brand awareness; meaning companies have to work less hard to create an online shopping footprint. High competition however is likely to ensure margins continue to compress.

What is perhaps more important for retailers generally is that the US consumer has been rebuilding its balance sheet for almost a decade. Higher costs for healthcare, insurance, education and shelter have also eaten into disposable income. Wage demands have begun to rise and that could attract more people back into the labour force. Those are both potentially positive outcomes for retailers who seek to make up in volume what they are losing in margins.

Amazon bounced last week from the region of its trend mean, but some consolidation following such a large pullback is likely before a move to new highs is likely to be sustained.

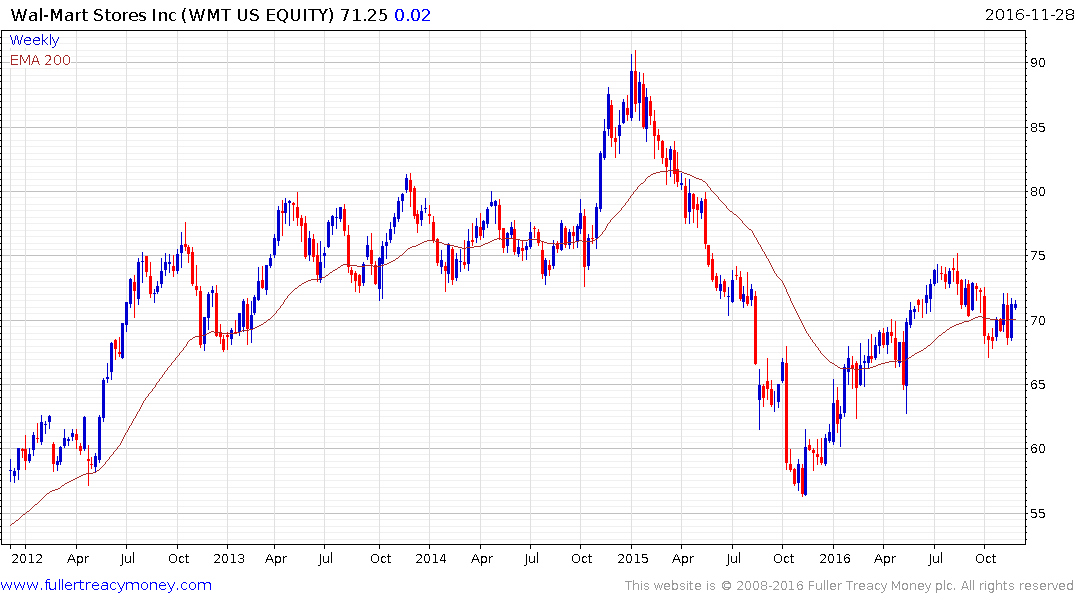

Wal-Mart has held a progression of higher major reaction lows since late last year and a sustained move below $63 would be required to question medium-term scope for contend higher to lateral ranging.

Target has experienced some quite acute volatility over the last 18 months but posted a large upside weekly key reversal following the election. A sustained move below the trend mean would be required to question medium-term scope for continued higher to lateral ranging.

Best Buy hasn’t traded above $40 on a sustained basis since 2008 but broke emphatically above that level at the beginning of the month and a sustained move below it would be required to question medium-term scope for continued upside.

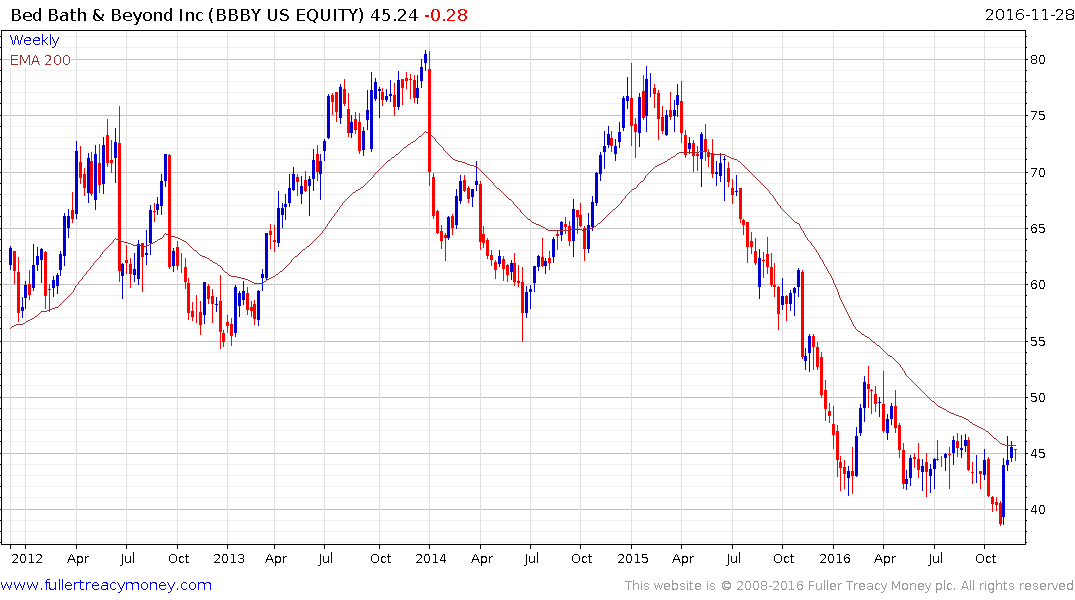

Bed Bath and Beyond failed to sustain the move below $40 earlier this month and rallied to test the upper side of its six-month range. A sustained move above the trend mean will be required to question the consistency of the medium-term downtrend.