HKEx Jumps on Report as Li Backs Shenzhen Stock Link

This article by Kana Nishizawa for Bloomberg may be of interest to subscribers. Here is a section:

Hong Kong Exchanges & Clearing Ltd. jumped the most in a month after a report that Chinese Premier Li Keqiang said a stock link with Shenzhen should be established.

The new exchange program should follow the Hong Kong- Shanghai connect that began in November, Shenzhen Special Zone Daily reported on its tetimes.com website, citing Li during a visit to the city. Shares of Hong Kong Exchanges rose 2.5 percent to HK$177.30, the biggest advance since Dec. 8. The Shenzhen Composite Index extended gains to 1.5 percent, while the Hang Seng Index slid 0.6 percent.

“A Shenzhen-Hong Kong stock link will have a positive effect on HKEx in terms of turnover and profitability,” said Sam Chi Yung, a strategist at Delta Asia Securities Ltd. in Hong Kong. “We still don’t know the timetable of the program, but at least we know that China intends to launch it.”

Shenzhen Special Zone Daily is the official newspaper of the Communist Party committee in the southern Chinese city.The existing cross-border trading connect gives foreign money managers greater access to Shanghai-listed equities while allowing mainland investors a route to buy Hong Kong shares. The program usage has been slower than expected, with about 25 percent of the aggregate quota being used for Shanghai-listed shares, and less than 5 percent for Hong Kong stocks traded through the link.

The design of the stock link is scalable and replicable, and can be expanded to cover other markets or asset classes, Lorraine Chan, spokeswoman at Hong Kong Exchanges, said in an e- mail today. The bourse operator has “excellent working relationships with the Shenzhen exchange,” and will inform the market if there are material developments, she said.

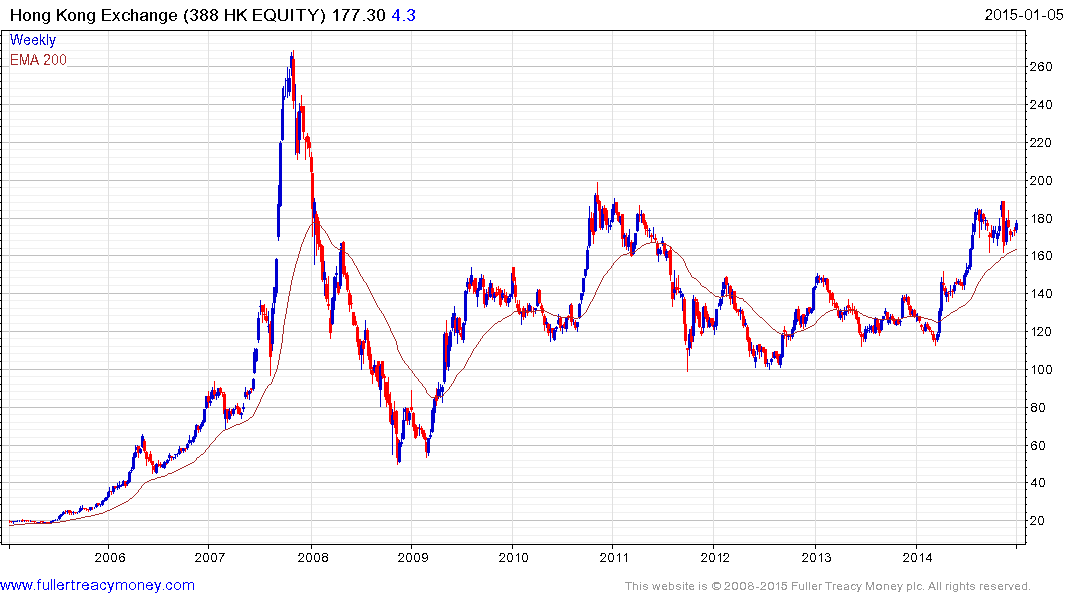

The above headline is somewhat misleading if one considers the action evident on the chart below. Nonetheless, a sustained move below the 200-day MA would be required to question medium-term upside potential.

The extension of the Hong Kong Shanghai Connect program to also include the Shenzhen exchange is a positive announcement. This helps to confirm the intention to internationalise the capital markets by attracting additional inward investment and allowing at least some domestically held capital to migrate.

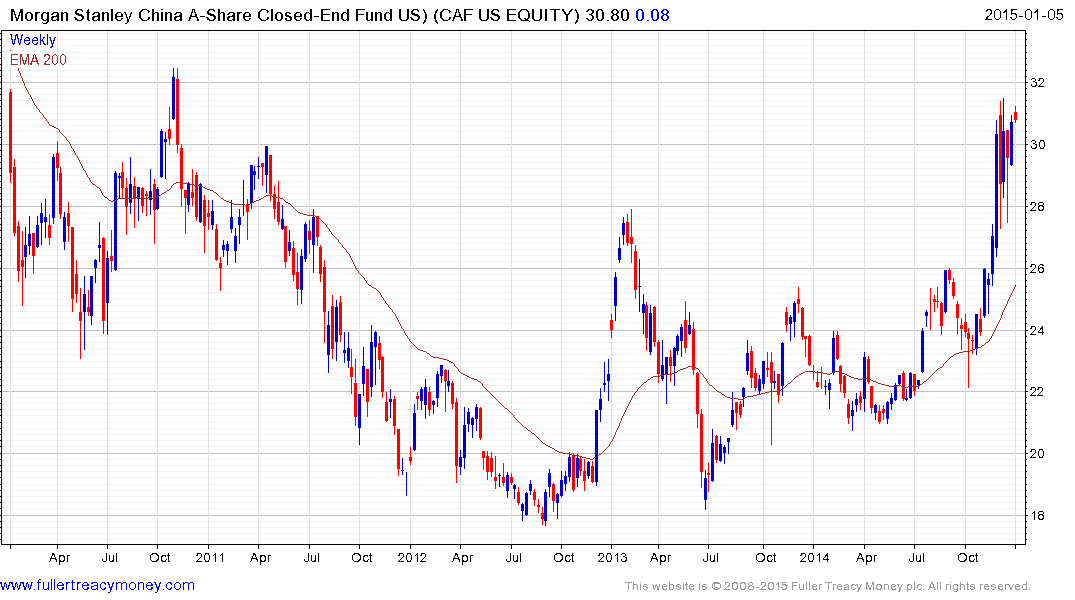

Despite the fact that the capital market is opening up, it is still challenging to buy individual mainland shares for many US investors. The Morgan Stanley A-Share ETF (CAF) offers exposure to the A-Share market but I thought it might also be useful to have a list of US listed Chinese shares and ADRs. I created this today and it can now be found in the USA section of the Chart Library under the US listed Chinese Companies link.

The performance of Chinese shares in the USA has been rather mixed over the last decade with a number of reverse mergers failing in the aftermath of the credit crisis. This situation has changed with the listing of mega caps such as Alibaba, Lenovo, Tencent Holdings, ICBC, China Merchants Bank and a range of additional financial sector shares.

The financial sector represents almost 44% of the CSI300 so it is integral to the performance of the wider mainland market.

.png)

ICBC is currently trading at the upper side of its three-year base.

Bank of China’s ADR broke out in November and continues to extend the advance.

.png)

China Life Insurance’s ADR broke out in mid-December and also continues to extend the advance.

Back to top