Heavy China platinum imports spur shortages elsewhere, WPIC says

This article from Reuters may be of interest to subscribers. Here is a section:

It was difficult to track what happened to some of the Chinese imports, so the platinum market was in surplus on paper but on the ground tightness sent lease rates surging to the highest levels in a decade, the WPIC said in its latest quarterly report.

And

China may be increasing its platinum loadings in catalytic converters of heavy vehicles due to stricter emission standards, he said.

Nothing emphasised the fact platinum is an industrial metal more than its demise during Volkswagen’s diesel cheating scandal. The price collapsed and has not recovered because investment demand has not compensated for the loss of automaker buying.

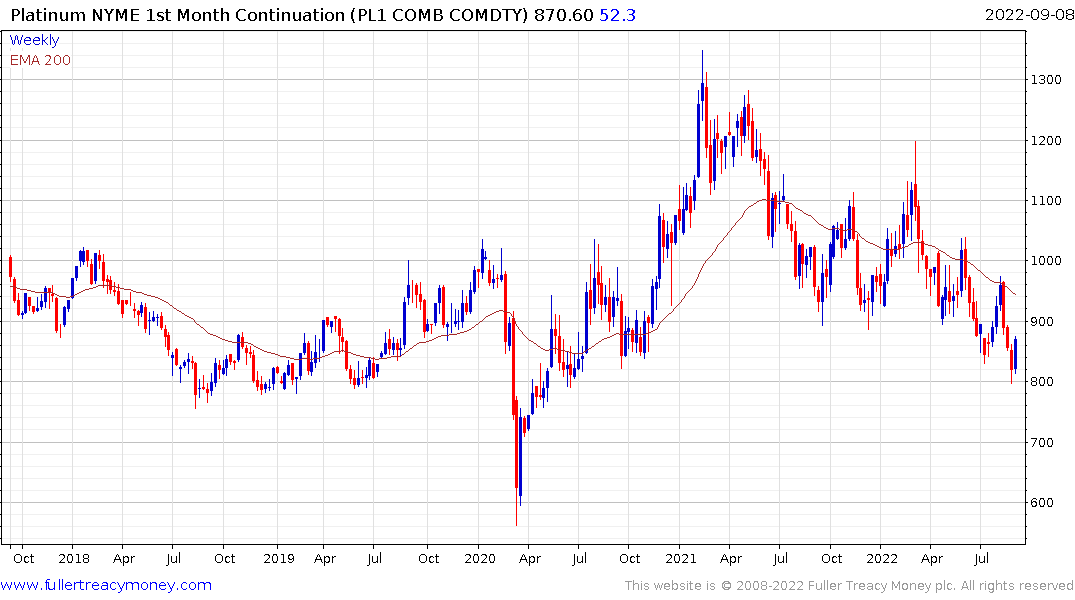

The platinum mining sector was the primary champion of the hydrogen fuel cycle for years because of the metal is vital as a catalyst. Miners are hoping for a renaissance in demand to support prices which have tested the $760 area on several occasions since 2008. The price is beginning to rebound from the most recent retest of that area.

As discussed in recent audios I am unconvinced by the secular bull argument for copper demand because supply is too inelastic. China was the primary demand growth driver following its accession to the WTO. That was driven by growth in manufacturing, infrastructure and housing where it is not a major cost driver in the final price of the end product.

This time around, the battery is the key component of an EV and the metal prices for their construction are a serious inhibiting factor to scaling up production. At the same time, building new copper mines at scale is exceptionally difficult. There is no way mine capacity can double in the next decade to meet the demand growth forecasts of EV analysts.

This time around, the battery is the key component of an EV and the metal prices for their construction are a serious inhibiting factor to scaling up production. At the same time, building new copper mines at scale is exceptionally difficult. There is no way mine capacity can double in the next decade to meet the demand growth forecasts of EV analysts.

That means either those targets will not be met, the prices will have to rise significantly, technology will reduce copper intensity, alternative technologies will displace copper demand or China’s economy will collapse and free up copper supply. Maybe we will get a mix of these factors but at least some are necessary to support the EV push.

Hydrogen is a gas. It does not have to be mined. That alone is enough to make it interesting for the renewable energy sector. Fuel cells have largely been written off in deference to batteries but that might have been presumptuous.

Plug Power, Iwatani Corp, and Bloom Energy are firming from their respective trend means.