Hawkish Jackson Hole Surprise Will Pop Credit's Summer Bubble

This article from Bloomberg may be of interest to subscribers. Here it is in full:

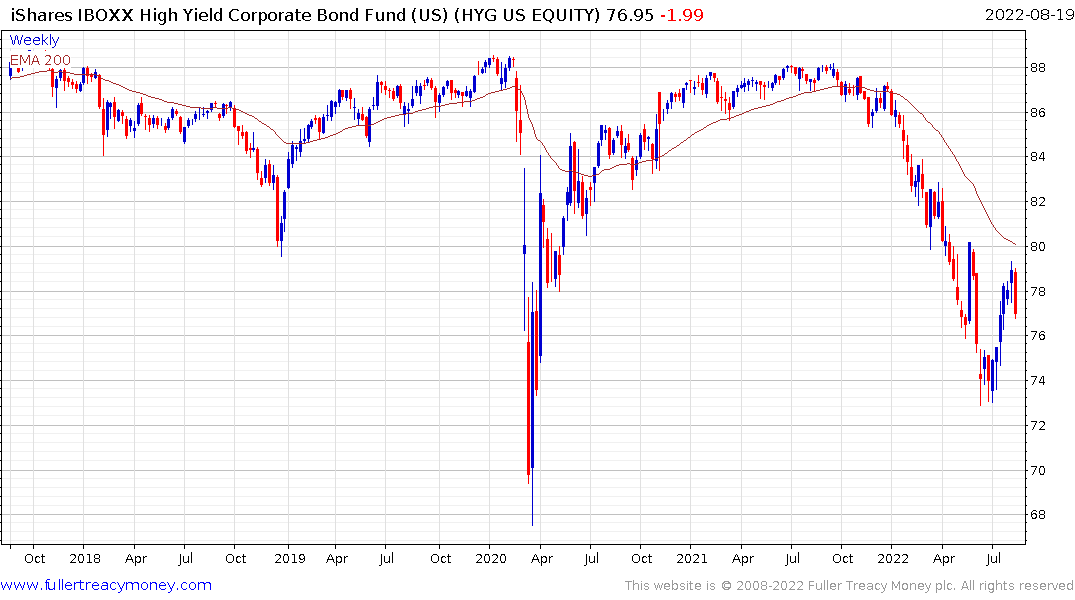

Any sign from this week’s Jackson Hole symposium of more aggressive rate hikes to come will whack credit markets, which have already started to give back summer gains. Misplaced optimism about the US inflation and economic outlook squeezed spreads to unsustainably tight levels, leaving debt vulnerable to a fall that will be exacerbated by dwindling liquidity.

US high-grade bonds got overbought as fund inflows chased better returns, despite a barrage of issuance which will likely resume in September. The high-duration debt stands to lose most from a more hawkish Fed.

Spreads have almost 25 bps to go before hitting the July wide at 160 bps, but investors are keeping powder dry for a move back to May 2020 levels above 180 bps. That would be a fairly extreme move for a market that tends to move in 1-2 bps daily increments, but pre-Labor Day lack of liquidity provides scope to gap out.

Junk’s summer gains were led by the riskiest bonds, which would be battered most by a higher rates/lower growth environment. Some are waiting for a pummeling to 800 bps -- from 432 bps currently -- before buying in.

The biggest factor in the underperformance of portfolios from the beginning of the year had been the strong correlation between bonds and equities. They both fell at the same time and played havoc with the 60/40 portfolio set up. That relationship stopped working from early this month. Treasury prices resumed falling but stock prices rebounded.

The logic for that altered relationship was equity investors were willing to bet the Jackson Hole conference would be the point at which the Fed would pivot to easier monetary policy and not least because stock markets were so oversold in late June. Bond investors were more reticent to believe that narrative and instead worry inflation will stay high even after it “peaks”.

Credit leads the stock market and high yield bonds are rolling over. The Nasdaq-100 has encountered resistance in the region of the 200-day MA again so a retest of the lows near the 1000-day MA is now more likely. If support building is to be given the benefit of the doubt the 11,500 level will need to hold.

Credit leads the stock market and high yield bonds are rolling over. The Nasdaq-100 has encountered resistance in the region of the 200-day MA again so a retest of the lows near the 1000-day MA is now more likely. If support building is to be given the benefit of the doubt the 11,500 level will need to hold.

This article from the Wall Street Journal focusing on shrinking deficits may also be of interest. Here is a section and a PDF:

Thanks to surging tax revenues and a drop in pandemic spending, the federal government has been cutting the sizes of its bond auctions since late 2021. It continued to cut in May when the Fed was on the verge of shrinking its balance sheet, and announced further cuts this month even after the process had started.

And

It is also predictable that a shrinking budget deficit would mitigate the impact of quantitative tightening because the Fed is trying to cool a hot economy that is bringing in more tax revenue, said Mr. Simons of Jefferies.

Many US states have also seen budgets swell as post pandemic spending has flattered tax receipts. Here is a section from an Pew Research article:

During fiscal 2021 alone, states grew their collective rainy day funds by $37.7 billion, or an increase of roughly 50% from a year earlier—driving the total held among all states to a record high of $114.6 billion. Moreover, amid widespread budget surpluses, states reported the largest annual increase in leftover general fund budget dollars (known as ending balances) in at least the past 21 years.

The USA’s Federal Budget as a % of GDP was -18% in Q1 2021. Today it is at -3.86 which is on par with where it was in 2018. That continued improvement is both a sign of overheating economic activity and is a primary driver for the relative strength of the dollar.

The Dollar Index extended its rebound today to test the upper side of the short-term range. It remains in a consistent medium-term uptrend.

The Dollar Index extended its rebound today to test the upper side of the short-term range. It remains in a consistent medium-term uptrend.