Have we entered the final crisis of the Euro?

This article by Charles Gave (original in French) for the Institute of Liberties may be of interest to subscribers. Here is a section:

Let's do a little rule of three.

Debt service is now at about three percent of GDP per year and the ECB can no longer manipulate Italy's rates downward, to keep Italy's head above water, since the US is raising its rates.

On today's growth figures (which will fall), and with interest rates rising over the next five years, debt servicing will rise to six percent of GDP, which means that the standard of living of every individual will fall by at least three percent, which is impossible.

And there is no solution as long as Italy remains in the Euro, and everyone in Italy knows this.

And Italy can easily get out because it has a primary budget surplus and a trade surplus. It does not need the financial markets to make ends meet, unlike France.

In any case, make no mistake: the Italian elections are about one thing and one thing only: the euro. "Always think about it, never talk about it" seems to be the watchword in Italy.

And so, the more "right-wingers" are elected, the higher the probability that Italy will abandon the euro.

Here is a link to the full article

Yield curve control is the topic of the moment. The UK has just introduced it, so the logical question is which jurisdiction will deploy it next. In this regard, Japan’s refusal to abandon its program looks particularly inspired. Another way to frame this question is what will Germany do to ensure everyone continues to use the Euro? So far, the answer has been whatever is necessary.

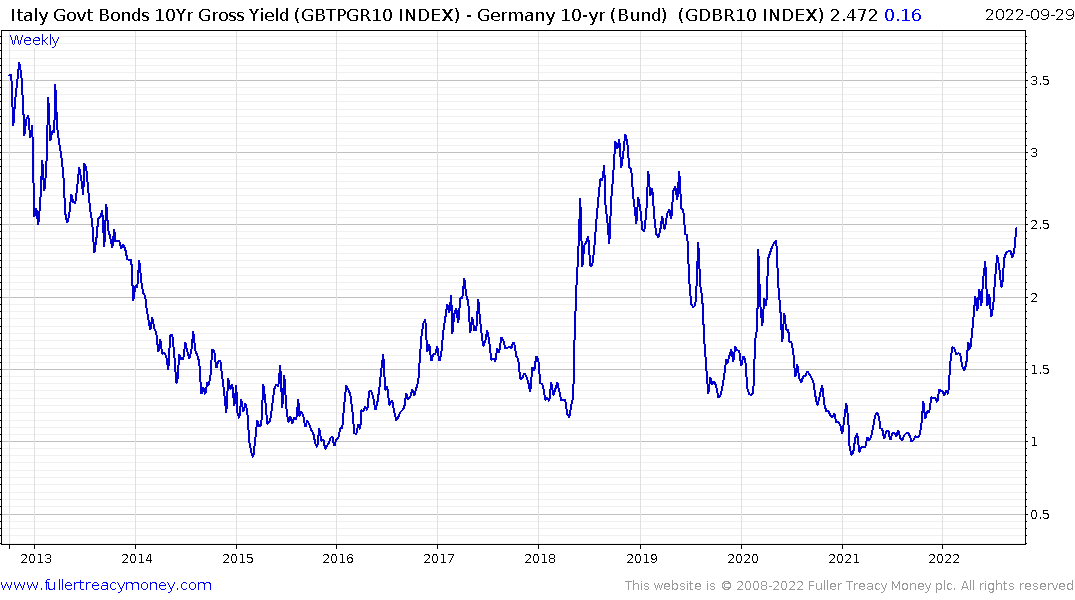

Italian debt is currently trading at 250 basis points over the German benchmark. Every time the spread has become problematic the ECB has intervened. With Brent crude oil in Euro still in the region of the 2008 and 2012/13 peaks and natural gas at a multiple of its previous peaks, the sensitivity of the Italian economy to interest rates is probably higher than in the past.

Italian debt is currently trading at 250 basis points over the German benchmark. Every time the spread has become problematic the ECB has intervened. With Brent crude oil in Euro still in the region of the 2008 and 2012/13 peaks and natural gas at a multiple of its previous peaks, the sensitivity of the Italian economy to interest rates is probably higher than in the past.

The Euro is following through on the upside following yesterday’s upside key day reversal. The first area of potential resistance is parity with the Dollar. Measures to contain widening sovereign spreads could easily be a catalyst for future weakness.

The Euro is following through on the upside following yesterday’s upside key day reversal. The first area of potential resistance is parity with the Dollar. Measures to contain widening sovereign spreads could easily be a catalyst for future weakness.

It is very easy to be enamoured by Giorgia Meloni’s rhetoric championing family values as they appear to be assailed on all sides by the progressive left. However, as this article from Foreign Policy highlights, it is no easy matter to get around Italy’s entrenched bureaucracy. Here is a section:

Fioramonti rapidly discovered what happens to idealism in the Italian political establishment. Over the first weeks of government, he gradually became aware of a vast and entrenched technocratic civil servantry, mediated through an elaborate web of veteran chiefs of staff assigned to inexperienced new ministers. He watched helplessly as, slowly but surely, the bureaucrats overtook him, assuming direct responsibility for his own ambitious mandate. Each of his attempts to enact flagship policies was quietly amended, stalled, or killed.

“They knew how to get things done—and we didn’t,” Fioramonti recalled. “They would be the ones writing the laws, changing the laws—they were the real doers.” He began to perceive this malign influence as a manina, or “little hand,” that would act under the auspices of his ministry without his own say. “There were bills and norms that were written that we were not even aware of,” he said. In the end, he was able to enact precisely none of the policies the party had campaigned on. He quit within four months.

Additionally, the President, who was elected to a second seven-year term in June, is unlikely to allow Italy to leave the Euro. That suggests, like it or not, Italy and the Euro are inextricably linked.

Back to top