Hacked in the U.S.A.: China Not-So-Hidden Infiltration Op

This article by Chris Strohm, Michael Riley and Jordan Robertson for Bloomberg may be of interest to subscribers. Here is a section:

Some investigators suspect the attacks were part of a sweeping campaign to create a database on Americans that could be used to obtain commercial and government secrets.

“China is building the Facebook of human intelligence capabilities,” said Adam Meyers, vice president of intelligence for cybersecurity company CrowdStrike Inc. “This appears to be a real maturity in the way they are using cyber to enable broader intelligence goals.”

The most serious breach of records occurred at the U.S. Office of Personnel Management, where records for every person given a government background check for the past 15 years may have been compromised. The head of the government personnel office, Katherine Archuleta, resigned Friday as lawmakers demanded to know what went wrong.

The campaign began in early 2013 with the travel records, said Laura Galante, manager of threat intelligence for FireEye Inc., a private security company that has been investigating the cyber-attacks.

This article from the Financial Times focusing on Israel’s cyber security industry and this article from the Wall Street Journal focusing on encryption highlight just how much of an issue internet security has become. This is a rapidly evolving sector. There is a need for more security as data evolves to being available exclusively online. Despite, its utility the infrastructure we use today is deeply flawed when it comes to security. The uses to which even our most mundane data can be put are also evolving not least since we are increasingly reliant on our online presence tor real world utility.

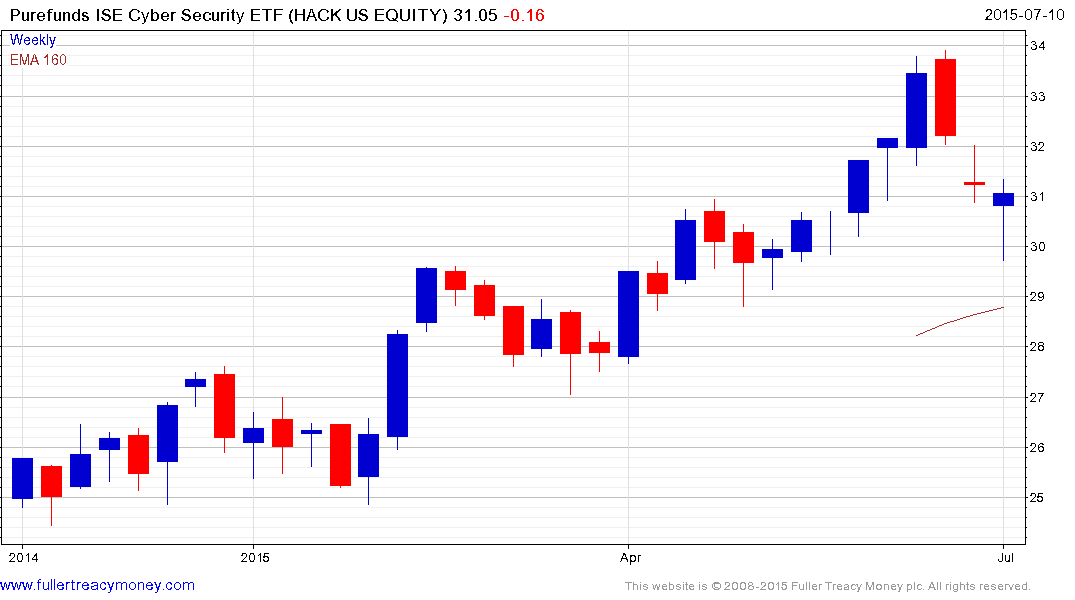

The PureFund ISE Cyber Security ETF bounced last week from the region of the 200-day MA and a sustained move below $30 would be required to question medium-term scope for additional upside.

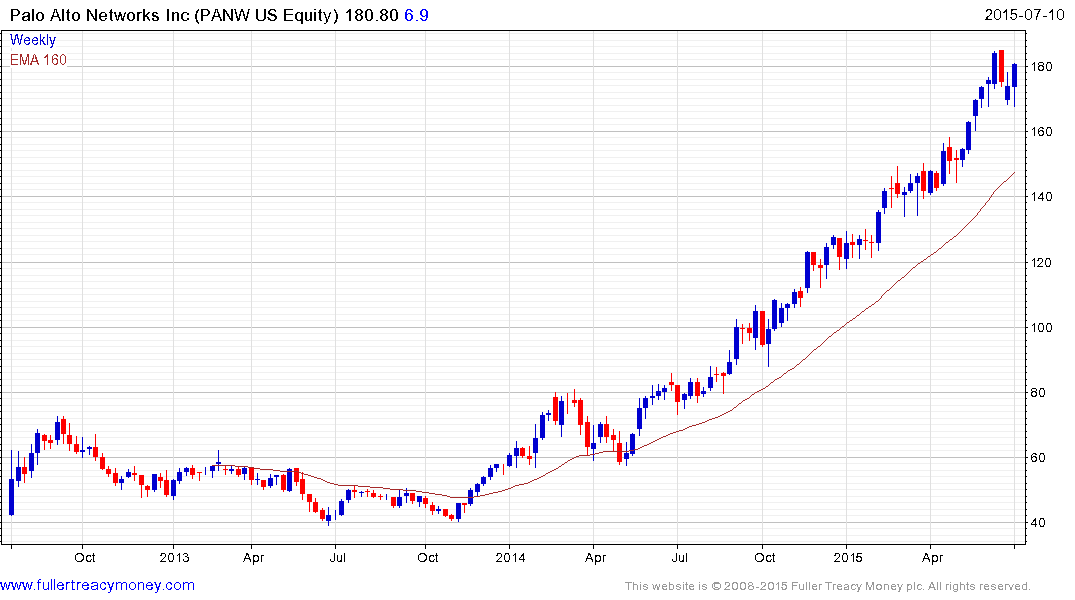

The vast majority of shares are bouncing from the region of their respective 200-day MAs, Palo Alto Networks remains the clear leader and continues to hold a progression of higher reaction lows. It is now quite overextended relative to the trend mean so there is potential for some consolidation.

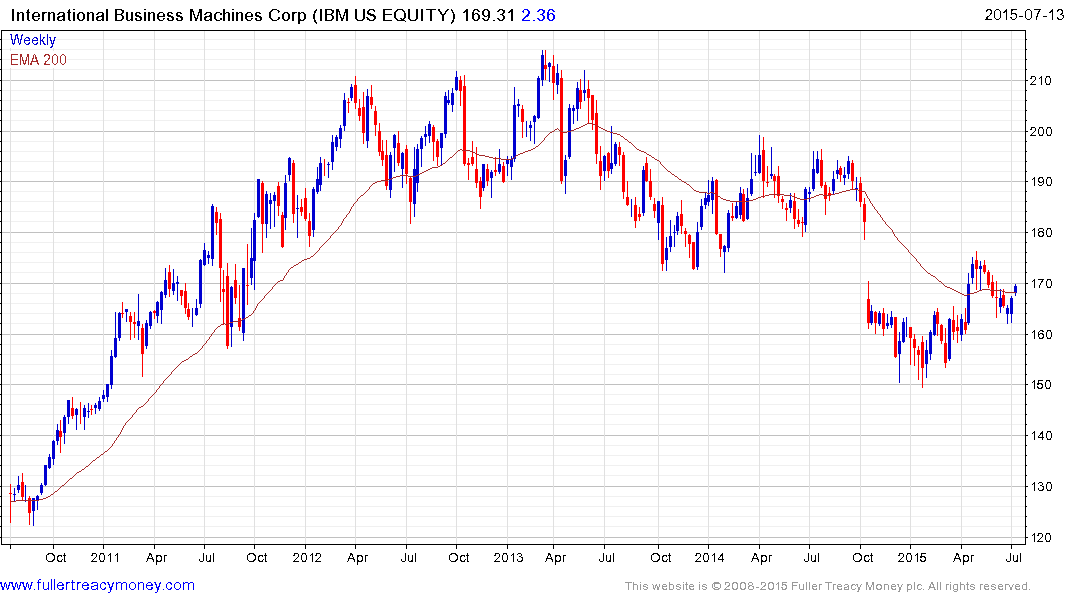

IBM with its continued aggressive buyback program, found support last week in the region of $160 and rallied today to break the short-term progression of lower rally highs. A sustained move below last week’s low would be required to question current scope for additional upside.

On the hand Intel broke down to new reaction lows last week and will need to sustain move above $30 to begin to suggest a failed downside break.