Gundlach to Summers Side With Bond Market Against Fed Rate Path

This article by Susanne Walker Barton for Bloomberg may be of interest to subscribers. Here is a section:

Traders are pricing in about a 39 percent chance the Fed will raise interest rates at or before its March meeting, down from 51 percent at the end of last year. The probability is based on the assumption that the effective Fed funds rate will trade at the middle of the new Federal Open Market Committee target range after the next increase.

“We could be looking at a really ugly situation during the first quarter of 2016,” Gundlach said during a market outlook webcast Tuesday. “It’s particularly more likely to happen if the Fed keeps banging this drum of raising interest rates against falling inflation.”And

Policy makers this week have offered conflicting views about the central bank’s rate path amid tumbling oil prices and global market volatility. Boston Fed President Eric Rosengren said Wednesday that estimates for U.S. economic growth are falling, putting the central bank’s projected path for rate increases at risk.

By contrast, Richmond Fed President Jeffery Lacker said Tuesday that the U.S. and China’s economies are linked "less than you would think" and the Fed is likely to need at least four rate rises this year.

Dallas Fed President Robert Kaplan said he "would have a bias to want to move toward normalization” in an interview with Bloomberg TV on Wednesday. "It comes with some risk,” he said.

“Every time we increase the federal funds rate, we’re going to have to watch and see what the impact is.”

In very simple terms the Fed altered the status quo by choosing to raise interest rates and market participants are still pricing in the effect rising interest rates will have on leverage, buybacks, position sizing and the relative performance of various asset classes.

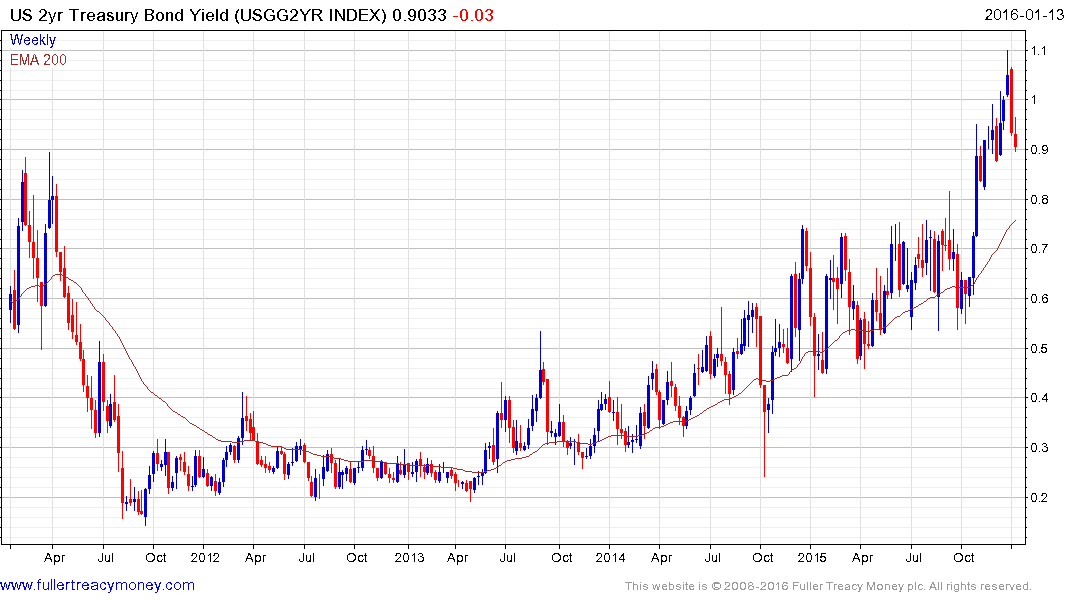

2-year yields are rapidly unwinding the short-term oversold condition but a sustained move below the trend mean, currently near 75 basis points would be required to question medium-term supply dominance.

The S&P500 Index trended consistently higher between 2012 and 2014 before losing momentum. The August pullback represented a massive reaction against the prevailing uptrend, or Type-2 top characteristic, and the subsequent failure to move to and hold a new high is indicative of right hand extension. While a short-term oversold condition is increasingly evident a sustained move above the trend mean, which has now turned lower, will be required to question the medium-term downward bias.

The Russell 2000 Index broke down from a Type-3 top today and while a short-term oversold condition is evident technical damage has been endured and a sustained move above 12,000 will be required to begin to restore confidence.

The Dow Jones Transports Average has been leading the market lower and is now accelerating. A clear upward dynamic will be required to pressure shorts and check momentum beyond a brief pause.

.png)

Gold found support today in the region of the upper side of the underlying short-term range and a sustained move below $1050 would be required to question current scope for additional upside.