Guide to the Markets Australia

Thanks to a subscriber for this chartbook from JPMorgan which may be of interest.

Here is a link to the full report.

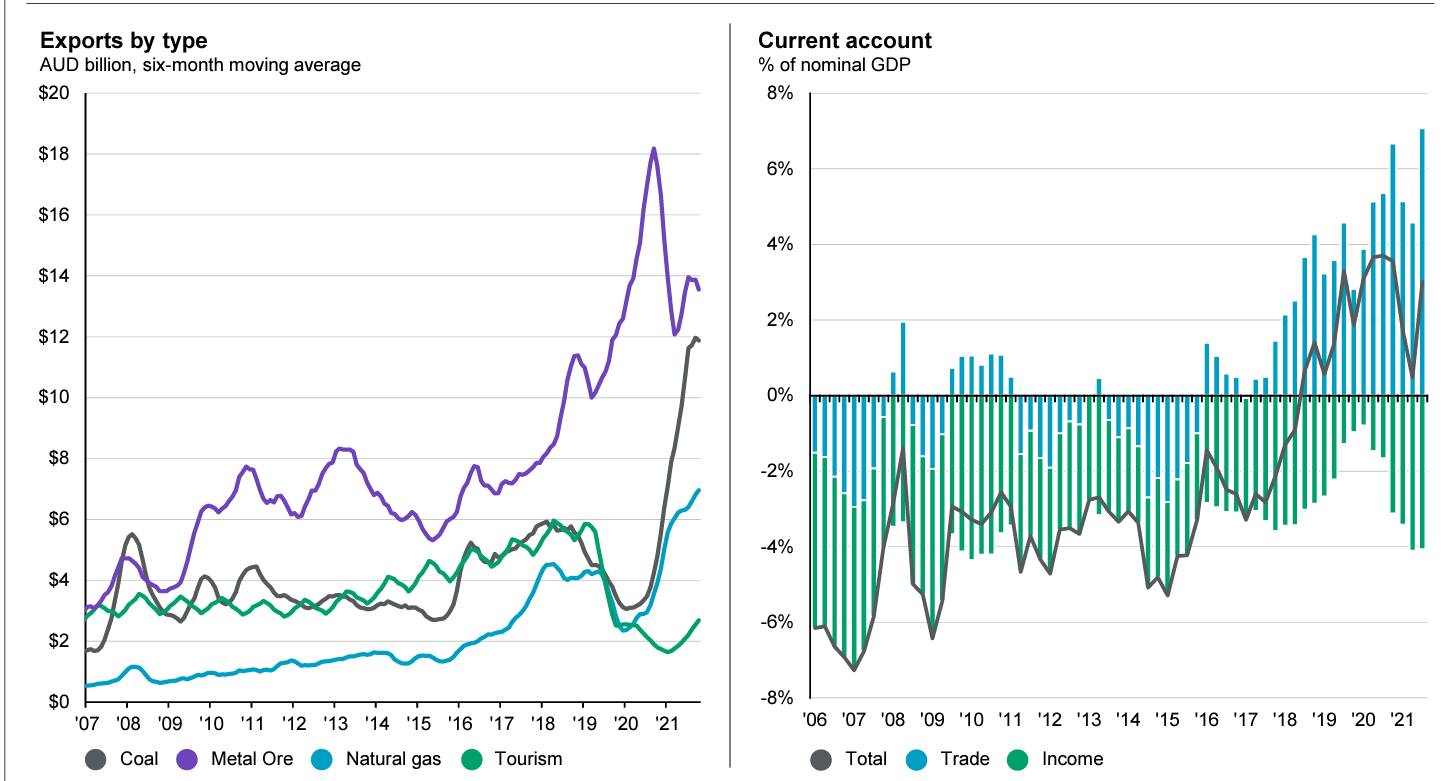

Australia benefitted both from the global low interest rate environment and booming Chinese demand for materials over much of the last 15 years. That seeded an impressive domestic technology/growth sector and significant growth in demand for iron-ore, coal and natural gas as well as other commodities.

The Wallumbilla day ahead price for natural gas has followed the same trajectory as European prices and fallen back significantly from the spike highs posted in July. It is reasonable to expect significant volatility but a repeat of the spike is unlikely.

The Wallumbilla day ahead price for natural gas has followed the same trajectory as European prices and fallen back significantly from the spike highs posted in July. It is reasonable to expect significant volatility but a repeat of the spike is unlikely.

European storage is full so the period of desperate buying with no regard for prices is over. Significant investments in both storage and regasification units will begin to come online within the next three months. That will increase the ability to store more, create additional demand and provide a stabilizing effect potentially at a higher for longer price point.

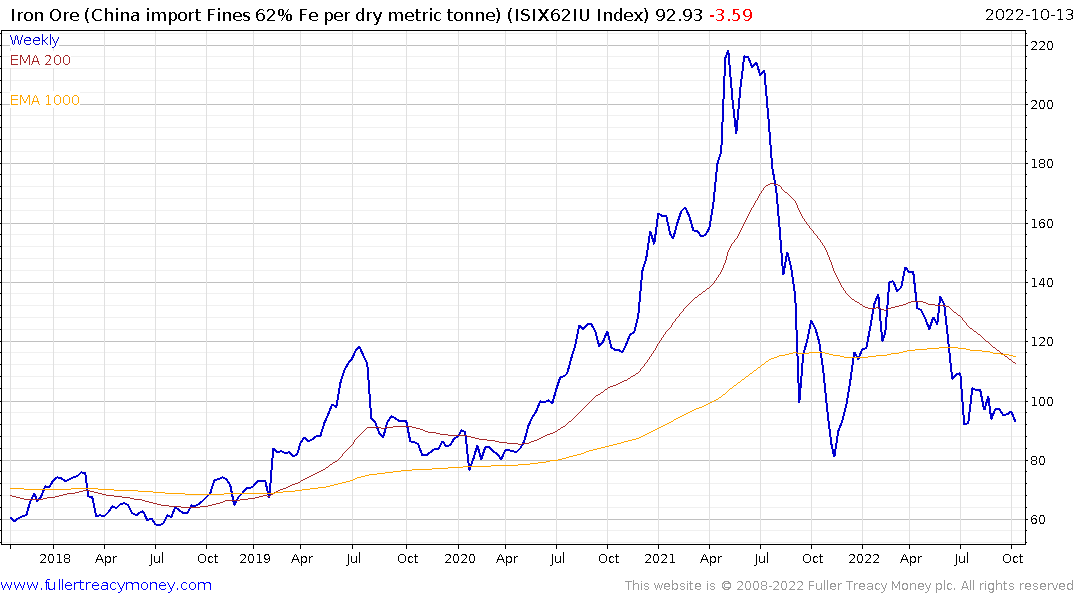

Iron-ore prices are back to where they were before the pandemic. Newcastle coal futures has Type-1 top with righthand extension characteristics. Chinese steel production is falling which is negative for both iron-ore and metallurgical coal. Meanwhile, less urgency in natural gas demand reduces urgency to buy coal too.

Copper is distributing below the 1000-day MA and remains in a downtrend. This weakness in the commodities most sensitive to Chinese economic activity suggests the COVID-zero policies are extracting a heavy toll.

Copper is distributing below the 1000-day MA and remains in a downtrend. This weakness in the commodities most sensitive to Chinese economic activity suggests the COVID-zero policies are extracting a heavy toll.

The future of mining is clouded in doubt. On the one hand, there is the promise of a bountiful future where the world joins in comradery to eschew the use of fossil fuels. On the other is the reality of significant price volatility, surprise tax hikes, smothering regulations and NIMBY on a scale never before encountered.

Anyone doubting the extreme views of climate “warriors” need only read the rationale of the protestors who threw soup on a Van Gogh over the weekend in London. My first reaction was to think Singapore’s caning policy deserves a second look as a model to deal with spoiled brats. However, the broader picture is a vocal group that wants action on climate but has no conception of what is required to get there.

The S&P/ASX Materials Index is holding in the region of the 2008 highs and has been ranging between the 200-day and 1000-day MAs for the last three months. This pause will result in a significant breakout and at present the trajectory of resources prices suggests the break will be on the downside even if prices have been steady over the last couple of weeks.