Greenlight Presentation at Sohn Conference 2022

Thanks to a subscriber for this presentation by David Einhorn. Here is a section:

However, the Fed is limited in raising rates. Powell faces a problem that Volker didn’t have. We have $24 trillion of debt held by the public, which is over 6 times in the last 20 years.

Approximately $7 trillion has to be rolled in the next year. Every 1% increase in rates adds $70 billion to the deficit annually. So, raising rates to 4% would be an additional $280 billion, 85 would be $560 billion, and a full Volker 19% would be $1.3 trillion…and that’s just the first year.

Raising short rates will also cause a strain on the Fed’s financials, where assets are of long duration and the funding is at overnight rates $5 trillion of overnight liabilities costs an extra $50 billion per percent increase in interest the Fed will pay on reserves. I will let you figure out the rest of the math for bigger increases.

The fiscal situation has limited the Fed’s flexibility.

Here is a link to the full report.

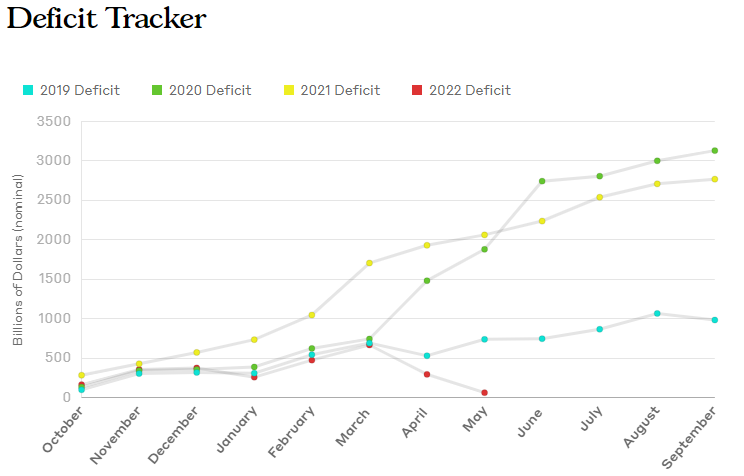

The 1.5% increase in the Fed Funds rate so far this year has increased the deficit by $105 billion. Nevertheless, the Dollar has been firm and there has been little concern about the knock-on effects of this on government finances. That is because fiscal tightening is in effect even if it is not being talked about.

The US deficit has narrowed substantially in the last couple of months. Until March it was following the 2019 trajectory but that changed in April and May as additional emergency support programs expired. The impending decision on whether to continue to extend repayments on student loans will probably be influenced by the reality of rising borrowing costs as the Fed Funds rate trends towards 3% by the end of the year.

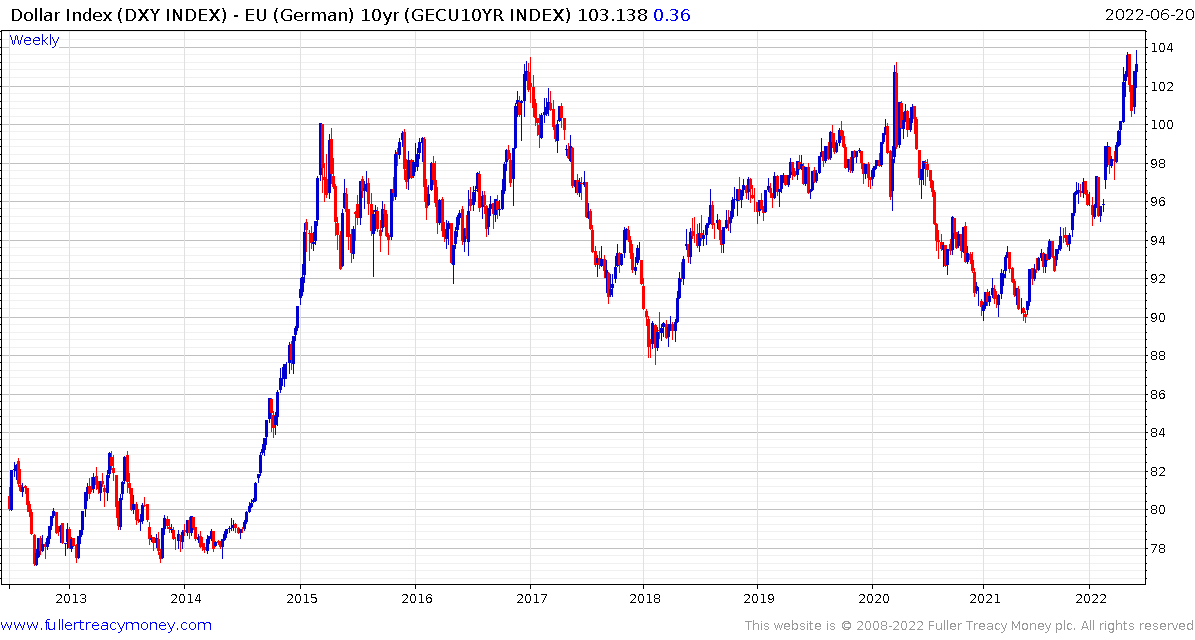

The Dollar Index continues to pause in the region of the upper side of the seven-year range. A widening interest rate differential has been supporting the currency over the last year, but that influence will wane as Europe and other regions attempt to play catch up. A break in the yearlong sequence of higher reaction lows would be required to question the consistency of the uptrend.

The Dollar Index continues to pause in the region of the upper side of the seven-year range. A widening interest rate differential has been supporting the currency over the last year, but that influence will wane as Europe and other regions attempt to play catch up. A break in the yearlong sequence of higher reaction lows would be required to question the consistency of the uptrend.