Greece: Will this time be different?

Thanks to a subscriber for this report from Deutsche Bank. Here is a section:

Is this time different?

We are not overly optimistic, but is there are reasons to think that this time could be different? The answer is maybe, because the genie is out of the bottle. First, what the above question really means is whether Greece will manage to implement reforms and finally return to sustainable growth.

Understandably, clients tend to be very skeptical. However, recall that not too long ago several market commentators argued that Ireland and Spain could not remain within the euro area. These two countries are now among the fastest growing economies in the euro area. Before the general elections we were forecasting Greece to grow in line with Ireland and more than Spain in both 2015 and 2016.

The problem is that Greece’s challenges appear more economically, socially and politically entrenched than in the other peripherals. Syriza won the elections with a political programme that was calling for a reversal of reforms – for example in the labour market. There were pledges about reducing tax evasion and corruption – but it appears that tax receipts have fallen materially in past few months.

Indeed, since December economic prospects for Greece have deteriorated sharply.

So are we destined to experience a new Greek crisis over the next year or two? While it is difficult to be optimistic, we think something has changed.

Here is a link to the full report.

Greece has little choice but to now toe the line and implement the raft of reforms that has been imposed upon it. If the experience of Ireland and Spain is any measure it is possible to return to a growth trajectory but the intervening period will be very difficult. The big question is to what extent Greece can replicate that performance given the chasm that exists between political parties and the weight of debt the country has accumulated.

My mother is one of the most astute political observers I know. She pointed out that Yanis Varoufakis is now one of the most important people in Greece because he is the only person close to power who still has his political reputation intact. How he reacts to the possibility of a minority government and even more stringent austerity will in many respects shape how well Greece can deal with this challenge. He may decide to rest on his laurels but if he decides schism is the best option and forms another party of rebels, it could act as a rallying call to those disaffected by what they see as chicanery in the democratic process. This article from the NewStatesman, interviewing Varoufakis last week may be of interest.

With even the IMF beginning to talk about haircuts/write-downs being the only way around the debt obstacle, how well Greece’s political apparatus can navigate the negotiation and compliance process over the next few months will have a major bearing on the debt question.

Meanwhile Greek yields have returned to test the region of the progression of higher reaction lows evident since September. Bargain hunters came in at close to 20% but buyers will need an additional reason to participate at current levels.

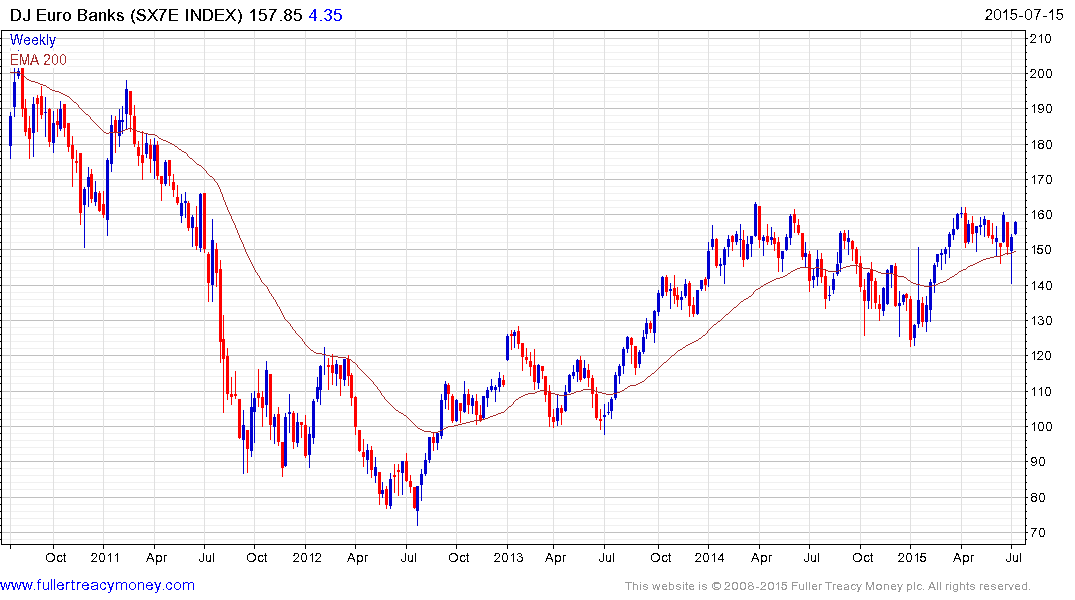

The Euro STOXX Banks Index has bounced back from last week’s decline and has returned to test the upper side of the three-month range. It is a little overbought in the very short term, having unwound an oversold condition, so there is scope for some consolidation. However a sustained move back below 150 would be required to question medium-term scope for continued higher to lateral ranging.

Back to top