Greece Faces Deadline Next Week as ECB Eyes Haircut Option

This article by Nikos Chrysoloras and Ian Wishart for Bloomberg may be of interest to subscribers. Here is a section:

Most members of the ECB’s Governing Council, led by President Mario Draghi, argued Wednesday that it would be unfair to restrict access to liquidity before the outcome is clear from Monday’s meeting of euro-area finance ministers, one of the people said. For now, governors are content to keep Greek banks’ liquidity for as long as they are solvent and have adequate collateral, according to a so-called “terms of reference” unofficial document read to Bloomberg News.

“In the interest of all parties involved, one shouldn’t expect spectacular results on Monday,” German Finance Minister Wolfgang Schaeuble told reporters in Berlin. Handing aid to Greece without reforms in the country is a “bottomless pit that doesn’t make sense,” he said.

While the current focus of attention is on how Greece will manoeuvre through what is a difficult few weeks, there are some additional considerations that are also coming to bear. For traders, the funding mechanism for trades and the fact that bonds trade on a relative value basis are important right now.

The combination of the Euro’s decline, the ECB’s newly found expansionary zeal and ultra-low interest rates created the conditions for a powerful carry trade from May 2014. As the Euro declined the inverse relationship with the stock market evolved and bond prices surged.

As the Euro unwound its oversold condition relative to the 200-day MA it put pressure on shorts and the trades they used borrowed Euro to participate in. Chief among these are German Bunds which found support in the region of the 200-day MA today.

A bond’s value is determined by how much of a return you can get over and above that received from a benchmark like Bunds.

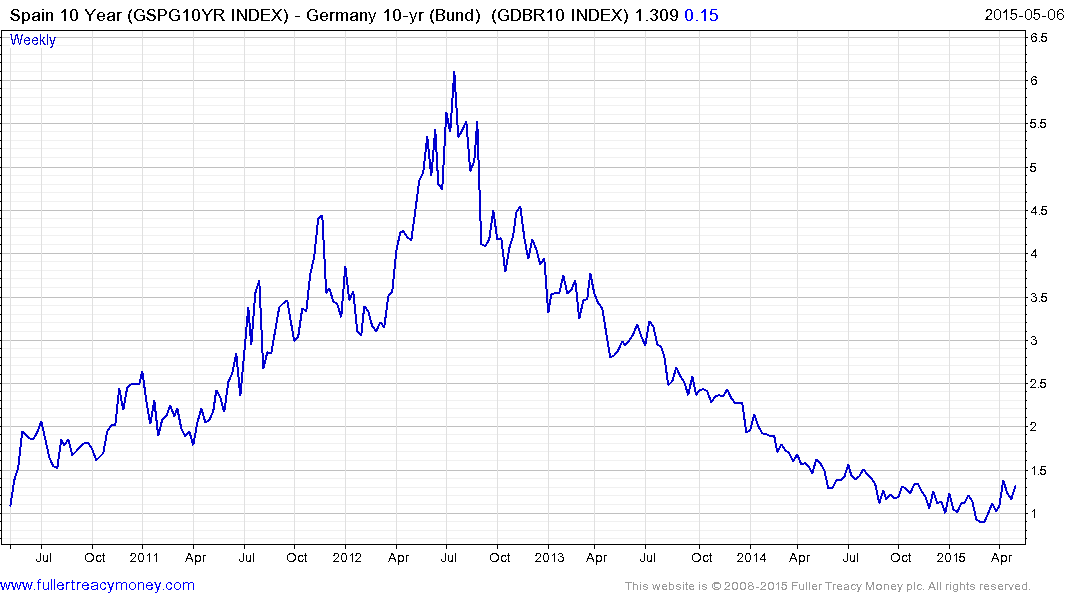

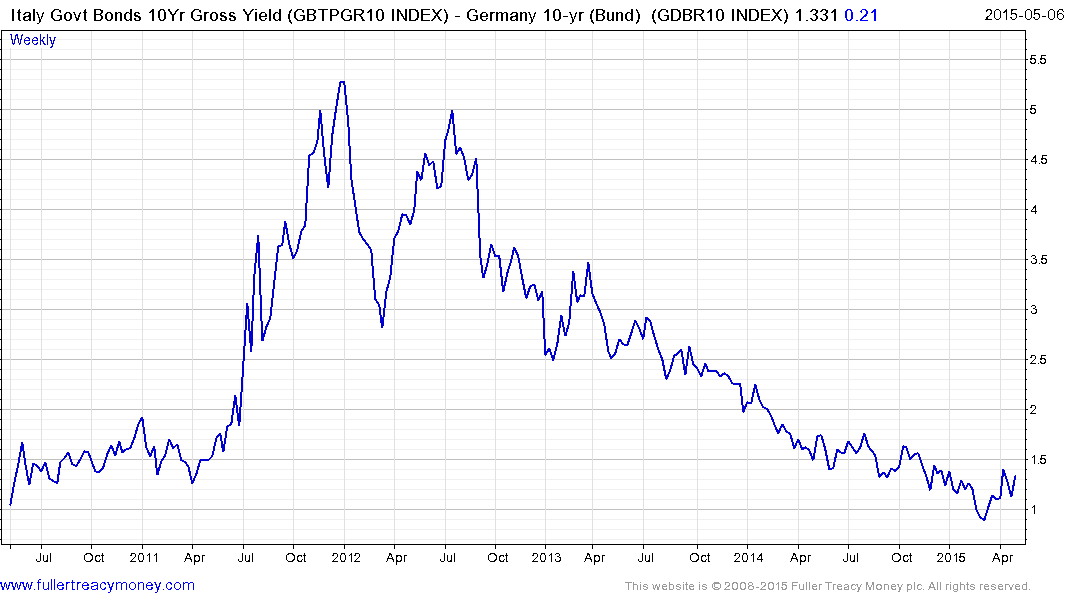

As Bund yields jumped to unwind the overextension relative to the trend mean, Italian and Spanish spreads rallied to break almost three-year progressions of lower rally highs. This suggests that 100 basis points over Bunds represents the limit of what bond investors are willing to accept for holding the 10-year debt of these countries.

.png)

(1).png)

In absolute terms they have both paused in the region of 2% which is also the level of the trend mean represented by the 200-day MA.

Returning to the Greek issue, it obviously represents an uncertainty. With the best will in the world Greece’s Eurozone partners feel they can only lend assistance if Greece is willing to meet them half way in terms of the reforms necessary to meet its obligations. The bond markets continue to express scepticism about their ability to comply. Greek yields have been trading above the 200-day MA since October and bounced from that region again this week. A sustained move below 10% would be required to signal a return to demand dominance beyond the short term.