Goldman Analysts' Bearish China Bank View Draws Fresh Rebuke

This article from Bloomberg may be of interest. Here is a section:

At stake was a report published by Goldman analysts including Shuo Yang last Tuesday, which highlighted margin risks and potential credit losses from banks’ exposure to local government debt. Yang, a former official at the China banking regulator, estimated that the “implied loss ratio of credit portfolio in debt investment book” could reach 25% for Merchants Bank, compared with 6% on average for lenders under its coverage.

A representative for Goldman declined to comment.

Shares of Merchants Bank have lost 12% in Hong Kong since Goldman cut its target price for the second time in three months with a neutral rating. The US bank now has one of the lowest target prices for the Chinese lender, according to data compiled by Bloomberg.

Merchants Bank argued that Goldman’s report is “illogical” in the way it calculates the potential losses, “lacks basic common sense,” and also overestimates its exposure to the local government financing vehicles.

The Chinese banking sector is independent in name only. The government has no qualms about using the sector’s resources to further its long-term development goals. When that means supporting infrastructure development to industrialise the economy, banks were forthcoming with loans and earned strong margins. Now that government priorities have changed, bank liquidity is constrained and asset quality is deteriorating.

Thanks to a subscriber for sending through the report referenced in the above article.

The primary thrust of their argument is dividends are threatened by the deteriorating economic conditions. The challenge for China-based analysts is any negative commentary will be deemed an attack on the government and new anti-defamation laws have a very broad remit. Yang Shuo must feel very comfortable in his position to write that report.

The FTSE/Xinhua A600 Banks Index is barely steady in the region of its 2023 lows. The big outstanding question is whether this discussion of the pressure on the banking sector amid the wider deflationary environment will act as a catalyst for additional official stimulative action.

The FTSE/Xinhua A600 Banks Index is barely steady in the region of its 2023 lows. The big outstanding question is whether this discussion of the pressure on the banking sector amid the wider deflationary environment will act as a catalyst for additional official stimulative action.

Government bond yields continue to compress which suggests investors are unwilling to bet on outsized stimulus. There are good reasons for thinking the government will not repeat past splurges since assets are already overpriced and the local government reliance on land sales is a problem that needs to be fixed eventually.

Negative sentiment towards China’s economic growth potential is weighing on the Australian market. The ASX 200 continues to revert towards the 1000-day MA and to test the sequence of higher reaction lows.

Negative sentiment towards China’s economic growth potential is weighing on the Australian market. The ASX 200 continues to revert towards the 1000-day MA and to test the sequence of higher reaction lows.

Vietnam’s market hit a new recovery high today as it extends the move above its trend means. Vietnam is one of the primary beneficiaries of the desire to have a China+ strategy.

Vietnam’s market hit a new recovery high today as it extends the move above its trend means. Vietnam is one of the primary beneficiaries of the desire to have a China+ strategy.

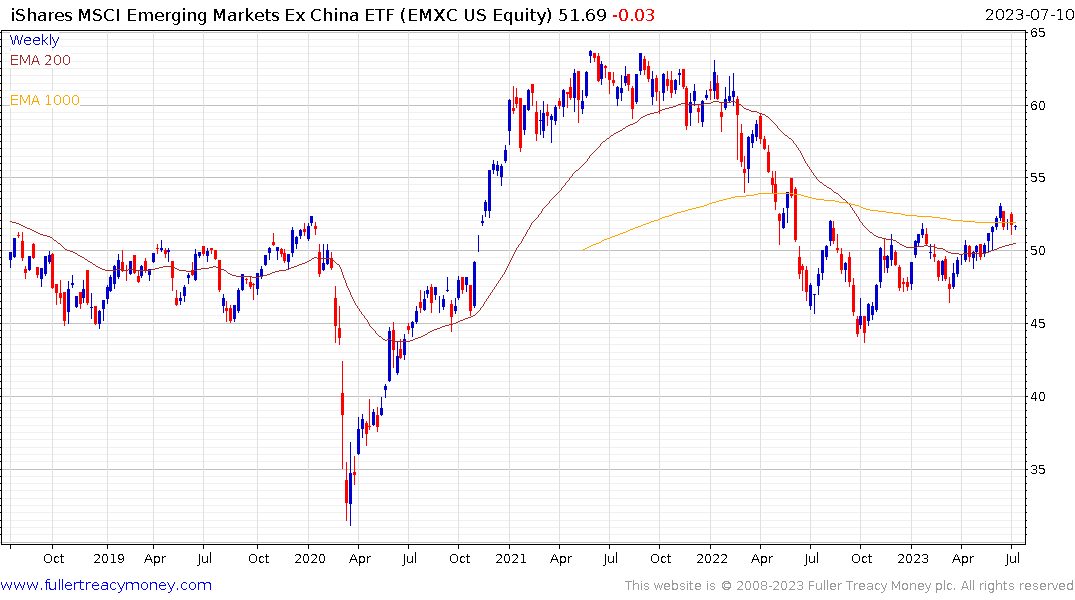

The iShares EM Ex-China ETF continues to grow its assets. The price is about the same as when the fund listed in nominal terms. When compared to the MSCI Emerging Markets Index on a total return basis the ex-China version has an annual return of 3.47% versus 0.35% for the version including China. While neither is impressive versus the performance of the US market over the last five years, the 300-basis point pick up by excluding China is a something asset allocators will be conscious of.

The iShares EM Ex-China ETF continues to grow its assets. The price is about the same as when the fund listed in nominal terms. When compared to the MSCI Emerging Markets Index on a total return basis the ex-China version has an annual return of 3.47% versus 0.35% for the version including China. While neither is impressive versus the performance of the US market over the last five years, the 300-basis point pick up by excluding China is a something asset allocators will be conscious of.