Golden dragon

This article by Kip Keen for Mineweb may be of interest to subscribers. Here is a section:

By 2020 Barclays sees China surpassing its banner year for gold consumption (based on somewhat contested statistics, a matter it acknowledges) in 2013 by 150 tonnes. Simply put, it bases its vision on increasing personal incomes in China amid ongoing urbanisation and with gold’s dual attraction as jewellery and store of value for investment. It notes China’s saving rates were as high as 42% a few years ago with gold benefitting as a result.

Price wise Barclays sees some, albeit moderated, bargain hunting. “We believe longer term, this year and next are likely to offer sound buying opportunities with (gold) prices approaching their nadir,” writes Barclays. “It is not our base case that we will see triple digit gold prices, but in turn we are not likely to see a repeat of 2013’s buying frenzy.”

There has been a great deal of commentary centring on the ability of gold to find support at the lower side of its range, not least as the Dollar has rallied. However as the Dollar unwinds its short-term overbought condition, it is lending a tailwind to commodities generally, not least the precious metals. This pump piece, kindly forwarded by a subscriber, from Malaysia’s The Star highlights the fact Asian buyers are being encouraged into the market.

Gold continues to bounce from the region of the November and December lows near $1140 and is quickly closing the overextension relative to the 200-day MA.

Silver has rallied impressively over the last two days to break the two-month progression of lower rally highs and to demonstrate support in the region of $15.

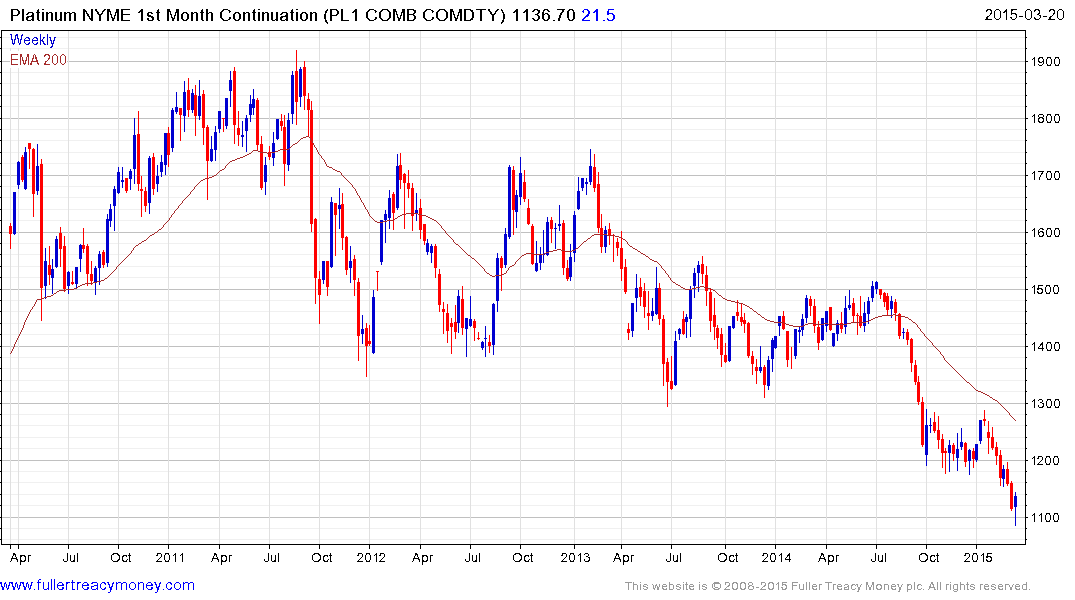

Platinum also continues to bounce as its closes its oversold condition relative to the 200-day MA.

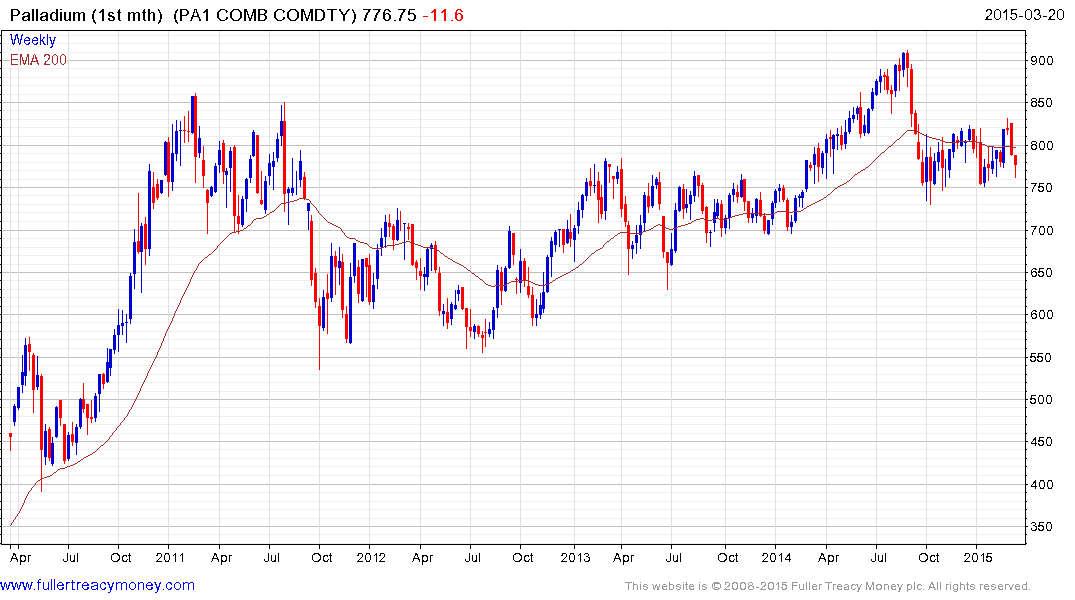

Palladium is rebounding from the lower side of its medium-term range.

Back to top