Gold Views: In search of a new reserve currency

Thanks to a subscriber for this report from Goldman Sachs which may be of interest. Here is a section:

As a result of growing debasement risk, DM investment demand strength has continued with ETF additions in both Europe and US running high (see Exhibit 6). We see this trend persisting for some time as investment allocations into gold increase in line with allocations to inflation protected assets, similar to what happened after the financial crisis. Following the GFC, inflation fears peaked only at the end of 2011 as the bounce back in inflation ran out of steam, bringing the gold bull market to a halt. Similarly, we see inflationary concerns continuing to rise well into the economic recovery, sustaining hedging inflows into gold ETFs alongside the structural weakening of the dollar, we see gold being used as a dollar hedge by fund managers. Indeed, decomposing our gold forecast, with returns of 18% over the next 12 months, we estimate 9% of the growth is driven by 5yr real rates going to -2% over the next 12 month, (an est. elasticity of 0.1), while the second 9% comes from the 15% increase in the EM dollar GDP (an est. elasticity of 0.5) (see Exhibit 7). On top of these known flows, a large share of physical investment demand in gold is non-visible, in particular vaulted bar purchases by high net worth individuals. Looking at net Swiss imports one can see that gold stocks in Switzerland, where most of these private vaults are located, have been building at close to a record pace (see Exhibit 8). In addition, the stretched valuations in equities, low real rates and high level of economic and political uncertainty all point toward continued inflows by high net worth individuals, in our view.

Here is a link to the full report.

It is easy to conclude the USA is the world’s chief currency debaser because of the size of accommodation provided in response to increasingly frequent crises. However, every other country is actively debasing their currencies too. The only difference is in scale.

One of David’s adages was “no country wants a strong currency, but some need a weaker one more than others”. Right now, the USA needs a weak currency and they are doing everything they can to ensure the Dollar trends lower.

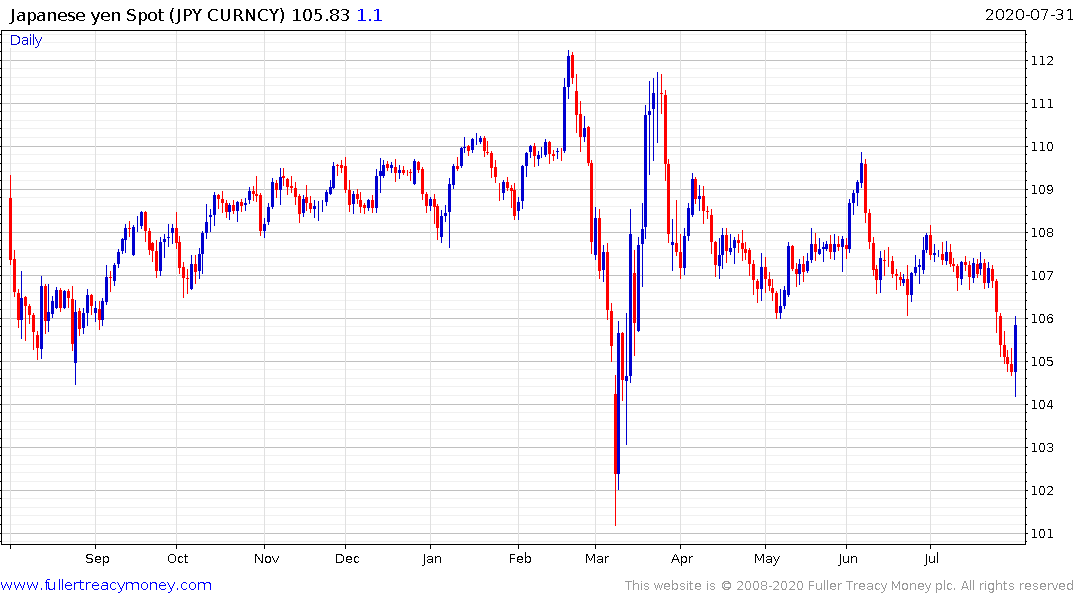

Those efforts encountered some resistance today. Both the Euro and Yen posted large downward dynamics from short-term oversold conditions. That at least suggests a period of consolidation is underway.

The Eurozone is not yet on a sustained recovery trajectory and many European countries are still heavily dependent on exports. There is some reticence at the thought of prolonged currency strength. That points towards a moderation in the trend of the advance and near-term risk of profit taking.

The Japanese Yen has base formation characteristics versus the Dollar but the last think the Japanese government wants is further currency strength. Today’s emphatic downside key day reversal suggests intervention to derail the pace of the advance.

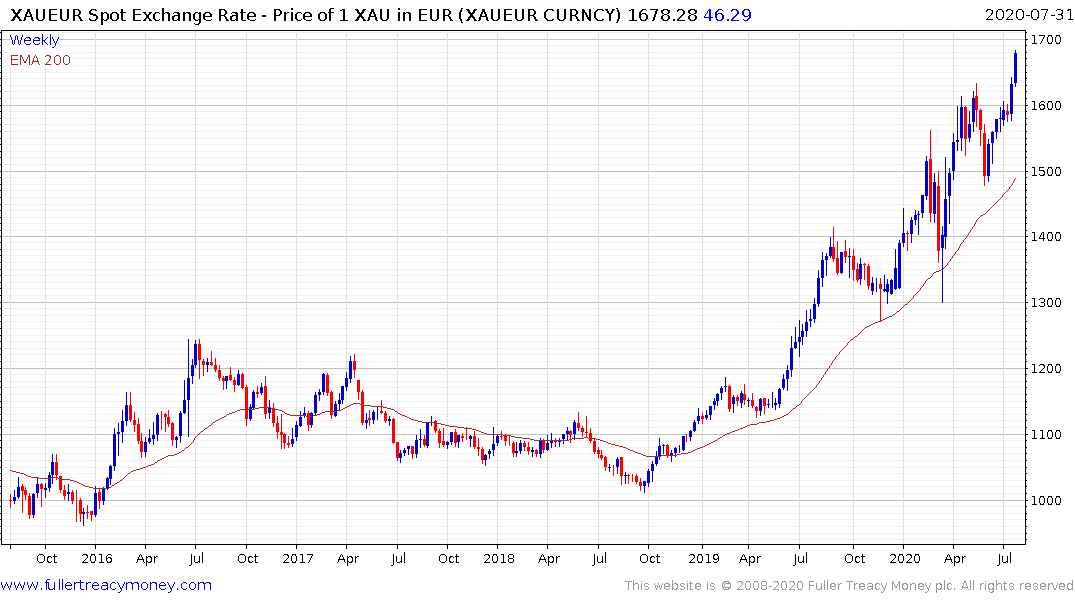

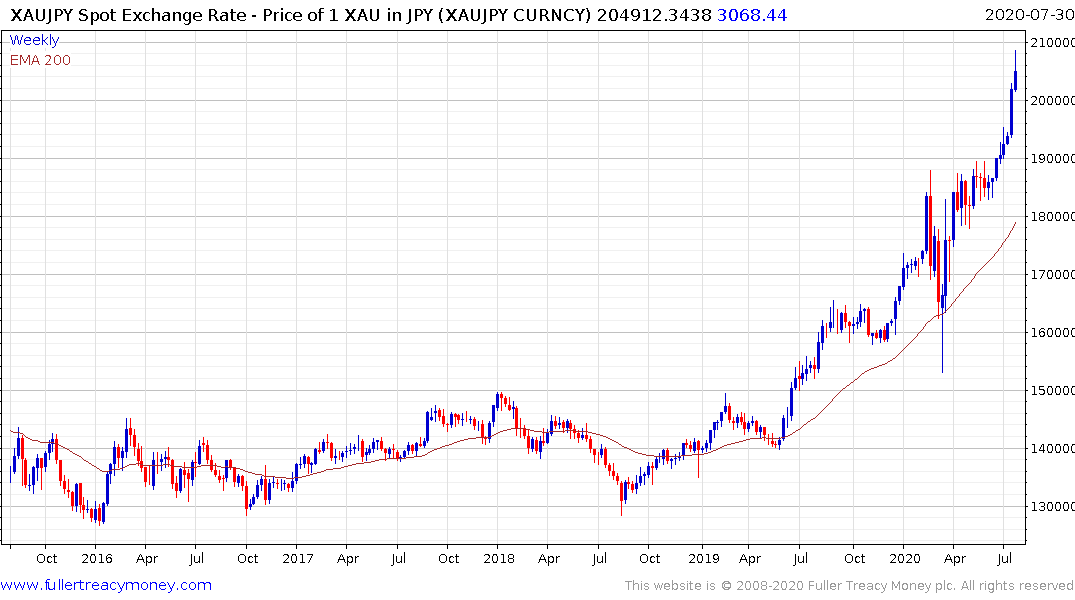

Meanwhile gold continues to firm in just about all currencies. With the supply of US Dollars continuing to increase the only way other countries can weaken their currencies against it will be to print even more. This is a competitive devaluation environment which is favourable for precious metals.

The Topix 2nd Sector Index pulled back sharply today from the region of the trend mean and continues to hold the sequence of lower highs evident for more than years. A clear upward dynamic will be required to signal a return to demand dominance.

The Euro STOXX Index also pulled back sharply over the last couple of sessions and will also need a clear upward dynamic to check the slide.

The notable correlation between currency and stock market weakness for Japanese and European markets contrasts sharply with the inverse correlation that has been evident for much of the last decade. It suggests international investors are only willing to support the markets if they do not have to hedge the currency.

Back to top