Gold Surge Looks More Flow-Based than Fundamental

This note from a blog on Bloomberg may be of interest to subscribers.

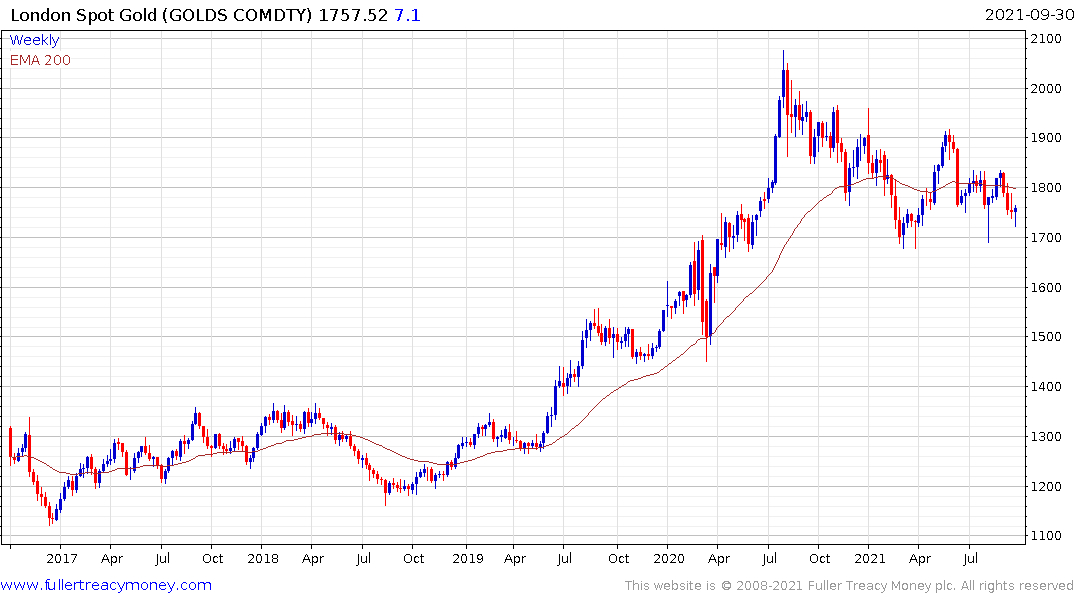

Gold is showing some mysterious strength and it’s hard to see why. The dollar has weakened, but not nearly enough to push bullion about 2% higher. Real Treasury yields are actually rising, which usually is enough to keep the yellow metal in check.

It may seem like a cop out, but the culprit here is probably quarter-end flows. The last Commitments of Traders report showed hedge funds had boosted their gold shorts to near the highest since 2019. Perhaps they’re now covering and taking profits after what has been a month to forget for bullion bulls.

The end of the month and end of the quarter is a time for reassessment for many investors. That’s particularly true on this occasion because the Biden administration’s outsized spending plans are floundering, inflationary pressures are rising and investors are questioning the wisdom of supporting the government bond market.

Gold rebounded impressively today from the region of the lower side of its range. Upside follow through tomorrow would begin to signal more than short-term support.

Gold rebounded impressively today from the region of the lower side of its range. Upside follow through tomorrow would begin to signal more than short-term support.

Silver partially unwound yesterday’s decline but has more work to do to convince traders more than temporary support has been found.

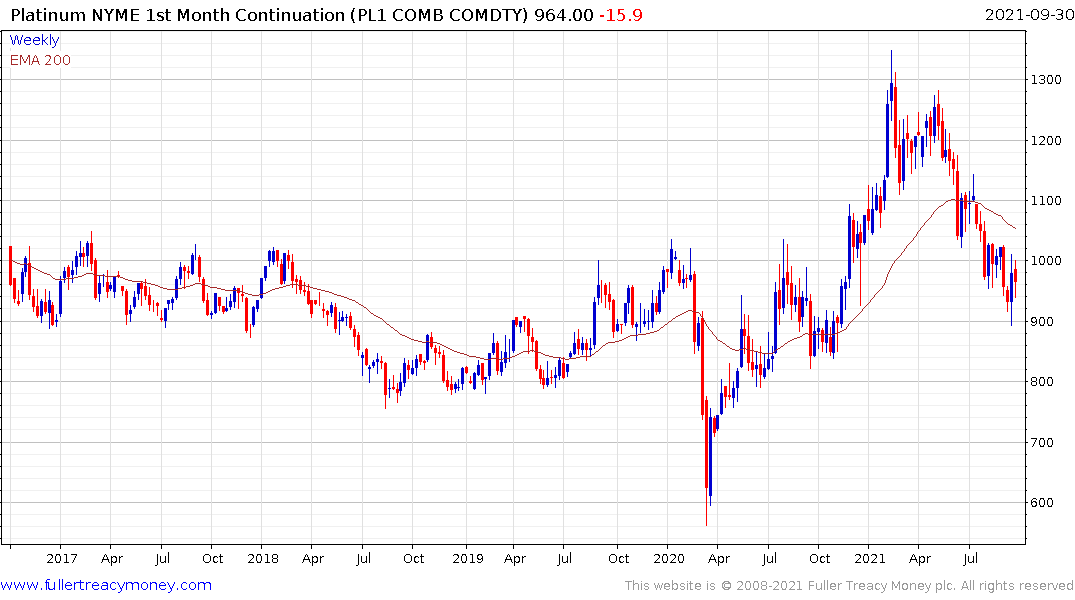

Platinum posted a large upside weekly key reversal last week. It has not yet followed through on the upside but was at least steady today. A sustained move back above the psychological $1000 level will be required to confirm a low of more than short-term significance.