Gold Sags in Longest Slump Since June as Demand Ebbs on Dollar

This article by Joe Deaux for Bloomberg may be of interest to subscribers. Here is a section:

“You have rising expectations that there is the possibility of a rate increase this year,” Mike Dragosits, a senior commodity strategist at TD Securities in Toronto, said in a telephone interview. “A December rate hike is a distinct possibility that’s hurting the gold market.”

Gold futures for December delivery fell 0.1 percent to settle at $1,323.70 an ounce at 1:44 p.m. on the Comex in New York. The losing streak is the longest since June 23.

Precious-metals traders have been in thrall to contrasting comments from Fed officials before the Fed’s policy meeting next week. Boston Fed President Eric Rosengren said Friday that the economy may overheat if the bank waits too long.

Gold does best when people are most worried about the integrity of their respective currency; when it is being eroded by negative interest rates in response to deflation or purchasing power is being destroyed by inflation. However between those extremes gold needs an additional catalyst to rally and if the Fed is going to gradually raise interest rates that represents a headwind.

Gold prices remains in a ranging consolidation which is slowly but surely succeeding in unwinding an overextension relative to the trend mean, which is currently near $1266. A break in the short-term progression of lower rally highs, currently near $1350, will be required to confirm a return to demand dominance.

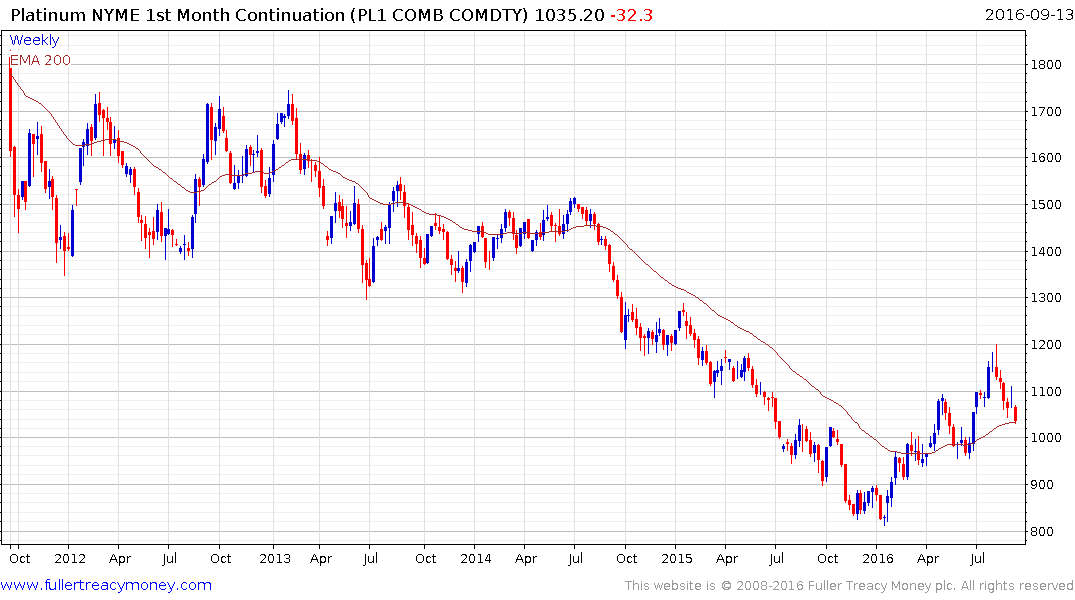

With today’s decline platinum has now closed its overextension, but a clear upward dynamic sustained for more than a session or two is going to be needed to signal a return to demand dominance in this area.

Silver hasn’t quite unwound all of its overextension and, while it has not yet moved to a new reaction low, it will need to sustain a move above $20 to reaffirm medium-term demand dominance.

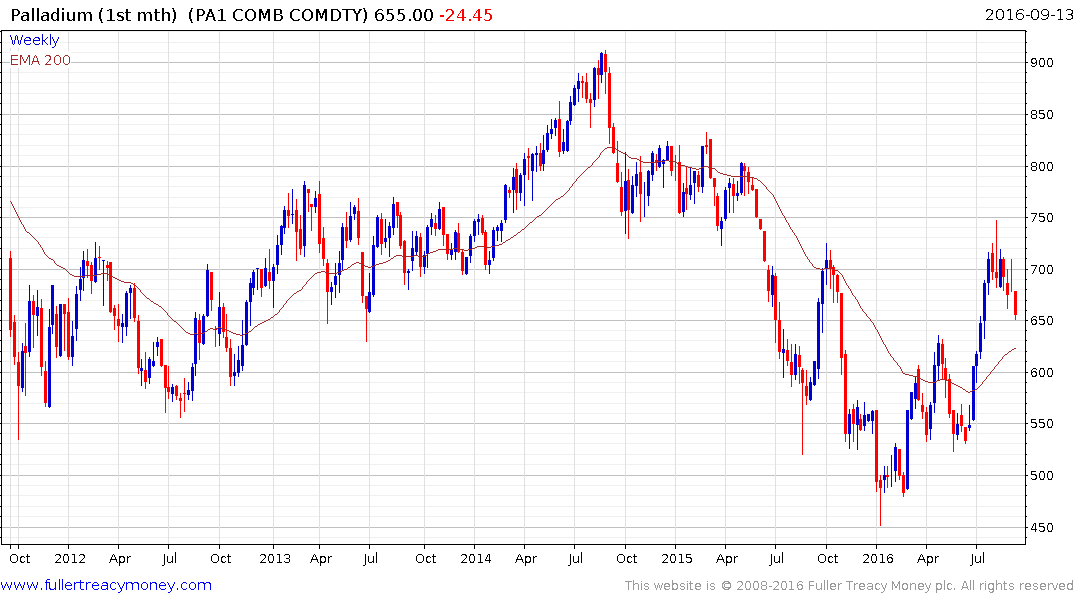

Palladium was short-term overbought when it encountered resistance near $750 and is now also engaged in a process of mean reversion.

Since I opened longs in gold, silver and platinum late last week I’m feeling a bit sheepish right. While I am not willing to hold onto these positions indefinitely I am going to persevere for the present in the hope they will bounce from their region of their respective means.