Gold's rate-risk, enhanced

Thanks to a subscriber for this report from Morgan Stanley which may be of interest. Here is a section:

Janet Yellen's view of the world. Last Friday at Jackson Hole, the US Federal Reserve Chair, Janet Yellen, largely re-iterated her moderately positive take on the US economy: that the impact of a soft business environment and USD crimped export demand growth is being offset by rising economic activity elsewhere, featuring robust household spending. Indeed, Ms. Yellen believes that net-growth has been sufficient to deliver almost full employment, while inflation remains sub-2%. In coming years, the Fed expects moderate real-GDP growth + tightening of the labour market + inflation lifting above 2%.

Implications for gold. Ms. Yellen delivered nothing new at this event. Her view of the current state of the US economy and its outlook could reasonably be described as balanced – confirmed by the subdued general market response to the event. Her most provocative statement regarding the cash rate itself was that the case for a hike had ‘strengthened in recent months’ – but any such move would require more economic data, and no time frame was offered. What does this all mean for the gold price? Ms. Yellen’s growth statements appear subtly more bullish, more insistent; comments on rate positioning probably less dovish – enhancing the risk of a short-term rate hike. This, in turn, constrains the short term upside of gold’s price (i.e. lifts demand for US$-assets; reduces demand for non-yielding gold).

Here is a link to the full report.

The Fed’s very gradual policy of raising interest rates, against a background where most other major central banks are still easing, or experimenting with negative rates, represents a moderate tailwind for the US Dollar. However when we consider the impact this might have on gold it is really worth considering in what currency one is denominating the metal in.

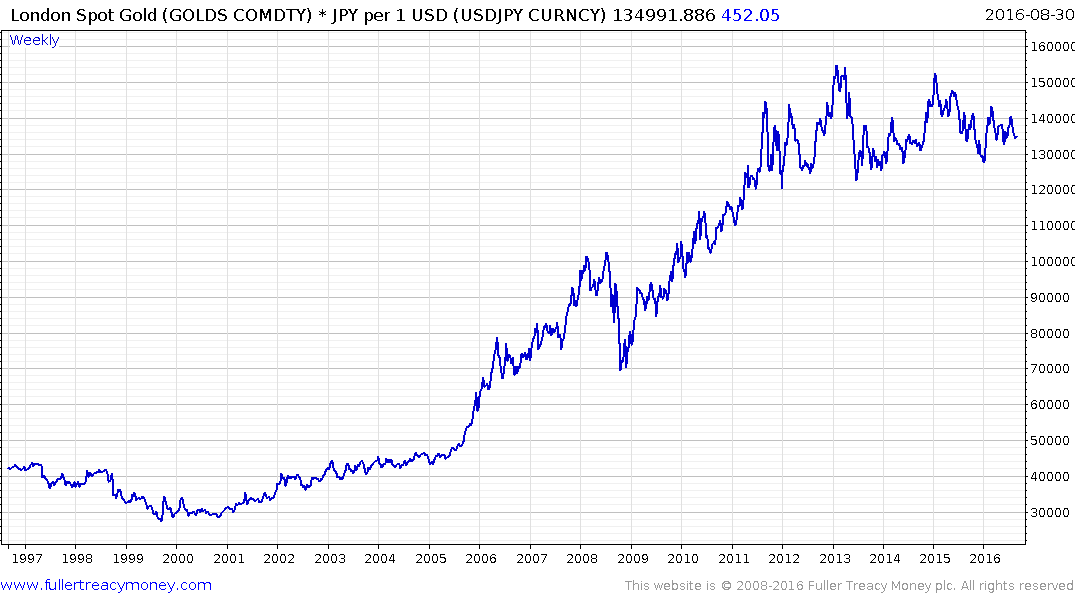

US based investors are large purchasers of gold but there are by no means the largest and Fed actions may have a positive impact on the motivations of Chinese, Indian, Japanese, European and UK investors. For example, with the Yen pulling back from the ¥100 against the Dollar, the price of gold has been much steadier for Japanese investors

.png)

The US Dollar denominated gold price trended lower for more than four years before breaking the downtrend early this year. It has held a progression of higher major reaction lows since January and bounced from the region of the trend mean in June. Another reversionary pullback is now underway and it will need to find support in the region of the trend mean, currently near $1260, if the medium-term upward bias is to be given the benefit of the doubt.

Silver has already closed most of its overextension relative to the trend mean and the first clear upward dynamic is likely to signal a low of at least near term and potentially medium-term significance.

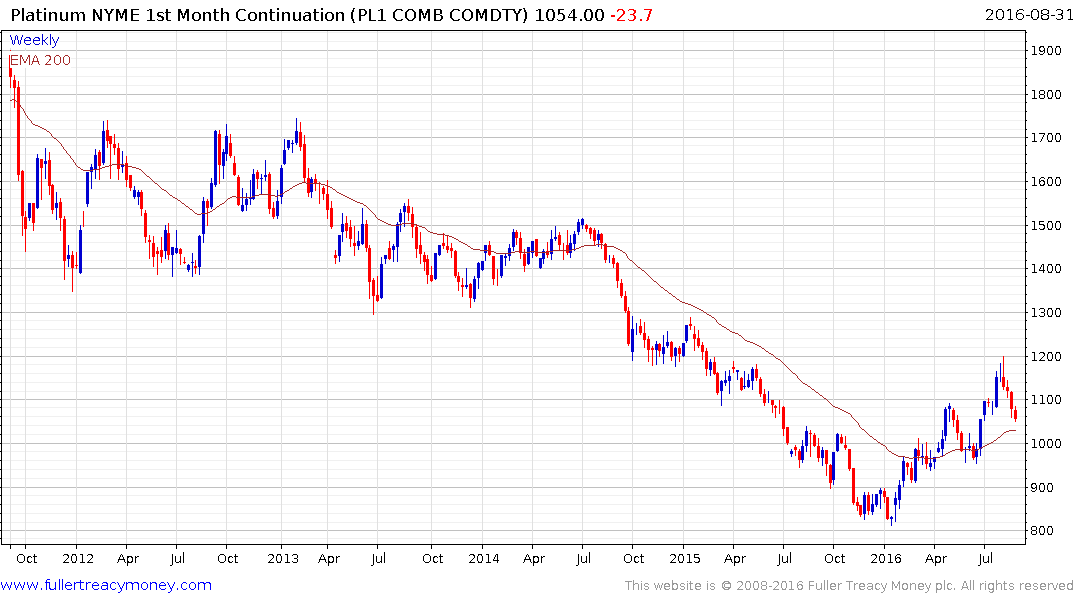

Platinum has pulled back by $150 over the last four weeks to almost completely close its overextension relative to the trend mean. A clear upward dynamic would also signal a return to demand dominance.