Gold miners in trouble Hambro/Raw

This article by Lawrence Williams for Mineweb may be of interest to subscribers. Here is a section:

One has to add though that the previous speaker, Peter Boockvar of the US’s Lindsey Group, was more positive on current prospects for the gold price pointing to the continuing scale of central bank money printing, despite the US Fed’s withdrawal; the Fed’s worries about dollar strength impacting the US economy; the symbolism of the Swiss gold referendum, despite the ultimate low vote, the loosening of import restrictions by the Indian government and with his comment that demand for physical gold is off the charts. He predicted that the gold price has bottomed – but warned that he also said that a year ago too!

But back to Evy Hambro’s update since his last Mines & Money presentation two years ago. He commented that the gold mining sector faces huge challenges with cash flows for most having fallen dramatically, which means that there are ongoing strictures on the sector in repaying the vast debt levels built up when they were being pushed into, in retrospect, debilitating hugely expensive new mine developments and expansion programmes. They also dropped grades which was part of the reason for the ever ongoing cost pressures they found themselves under when the gold price started falling three years ago.

Some of the cost pressures have indeed been addressed and there have been non-core asset sales to try and mitigate some of the debt problems, although given that some have been at low valuations which may provide some great opportunities for perhaps more flexible junior and mid-tier purchasers, they will probably not have helped much in terms of debt reductions.

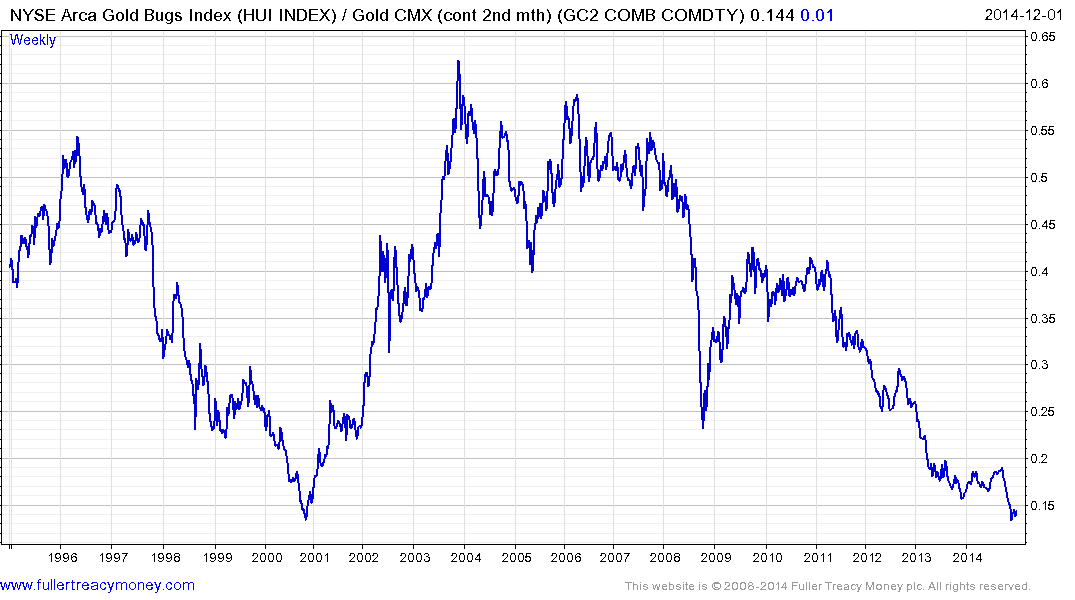

Gold miners have been underperforming the gold price and the wider market for years as a result of the issues outlined in the above paragraphs. Declining ore grades, a dearth of new discoveries and rising costs have all taken their toll while the advent of ETFs has sapped a major source of demand for gold shares.

The NYSE Arca Gold BUGS Index fell to a new low relative to the gold price in November, emphasising just how deep the crisis is for the sector.

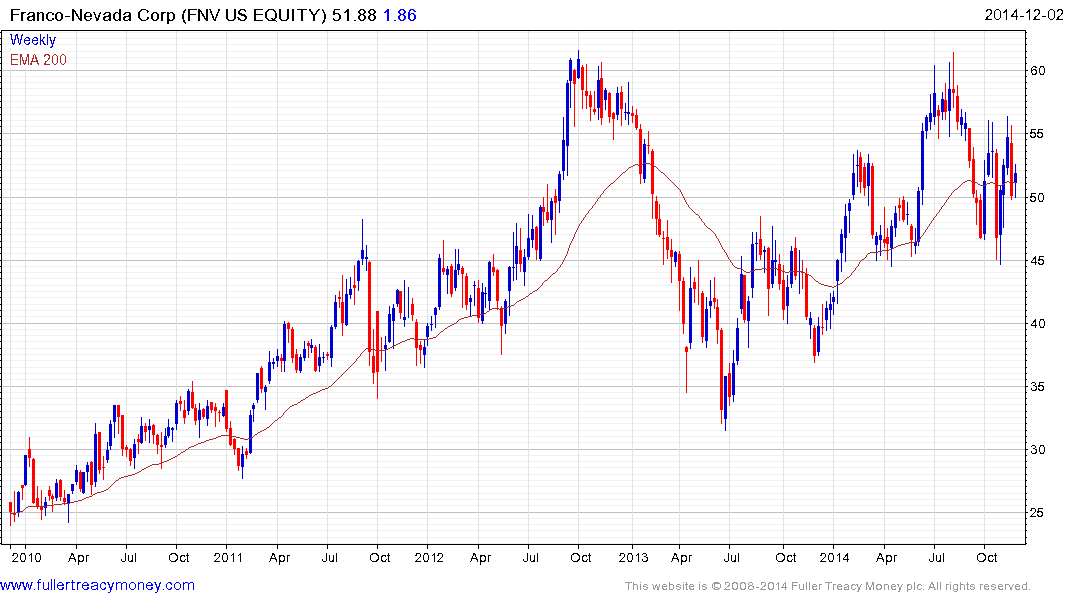

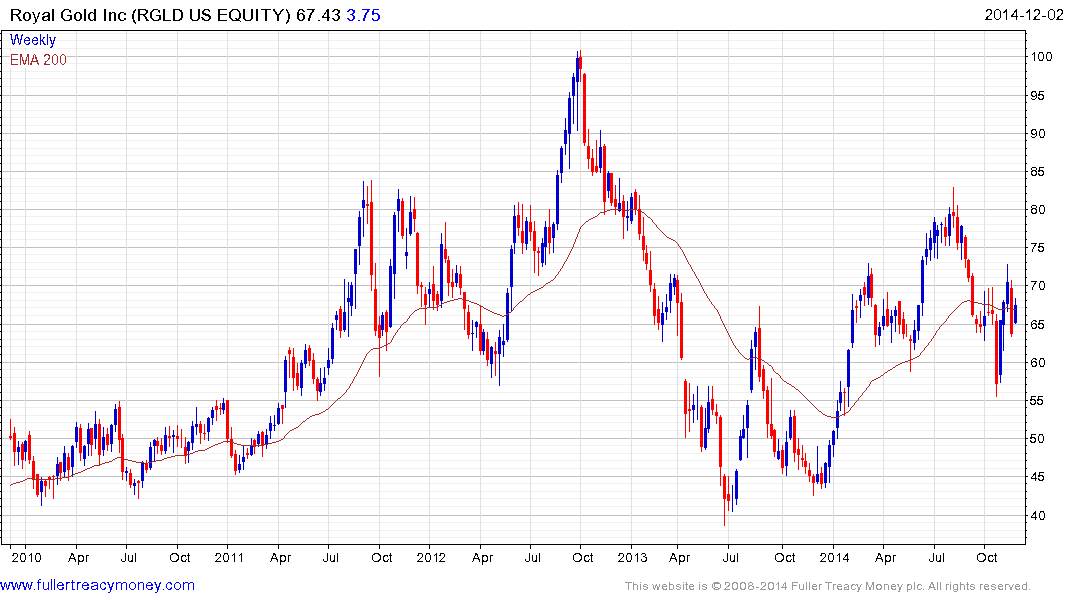

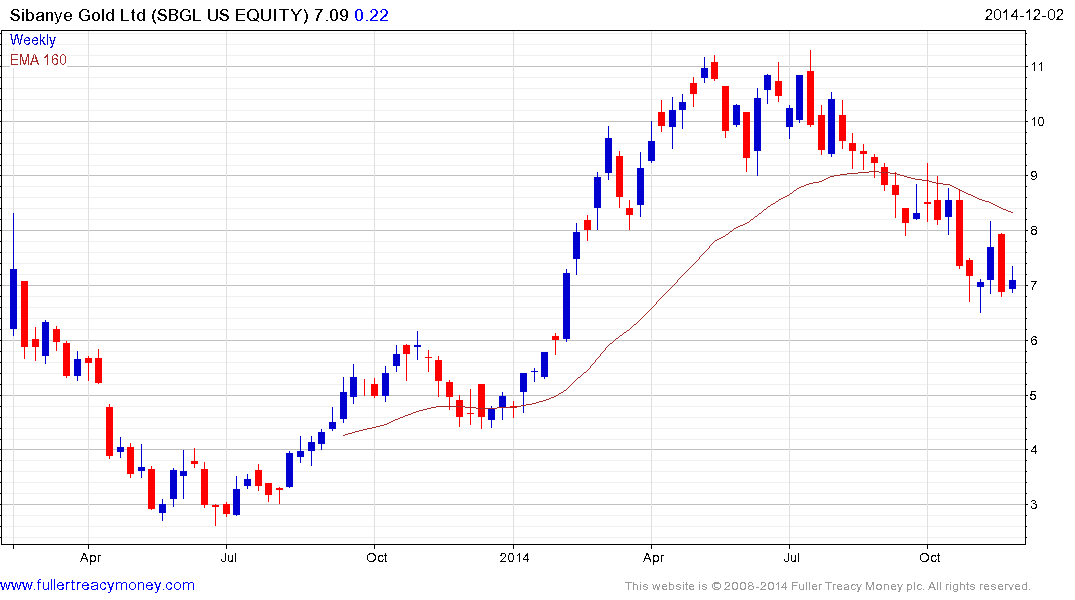

However not all companies that are engaged in gold mining have the same issues. Royalty streamers and those that pay reasonable dividends continue to outperform.

Franco Nevada (DY 1.55%) continues to hold a progression of higher reaction lows.

Royal Gold (DY 1.31%) is rebounding from its October lows.

Sibanye Gold currently yields 2.68% following this year’s earlier advance and has at least paused in the region of $7.

Hong Kong listed Zijin Mining yields 4.82% and has held a progression of higher reaction lows for more than a year.

Among the most oversold gold miners Yamana Gold is still approximately 40% overextended relative to the 200-day MA and has steadied below $4.

Back to top