Gold miners

The attraction of gold mining shares has been cannibalised by ETFs over the last decade and they did not offer the same degree of leverage to gold prices as seen in previous cycles. The failure of gold miners to respond to this situation and their subsequent inability to control costs resulted in the sector underperforming by a considerable margin for much of the last four years. By late last year the NYSE Arca Gold BUGS Index/Gold ratio had fallen back to test the 2000 lows; unwinding the entire early bull market advance in the process.

Faced with the prospect of extinction, boards reined in spending by reducing head count, slashing marketing and investor relations budgets, cancelling exploration and expansion projects and by developing a newfound respect for free cash flow. The result was that prices stabilised and now offer leverage to the gold price once more.

With gold and silver prices rallying, gold mining shares are responding positively. Among some of the more interesting chart patterns:

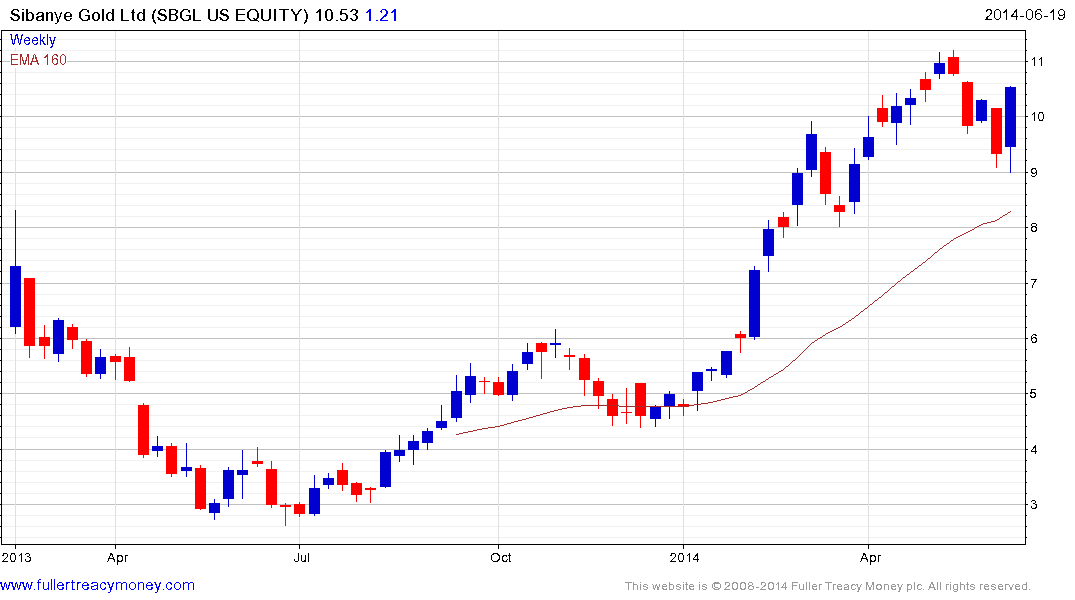

Sibanye Gold remains the sector’s relative strength leader and found support this week in the region of the 200-day MA.

.png)

Agnico Eagle broke out of a 12-month base today.

New Gold has also broken a progression of lower rally highs.

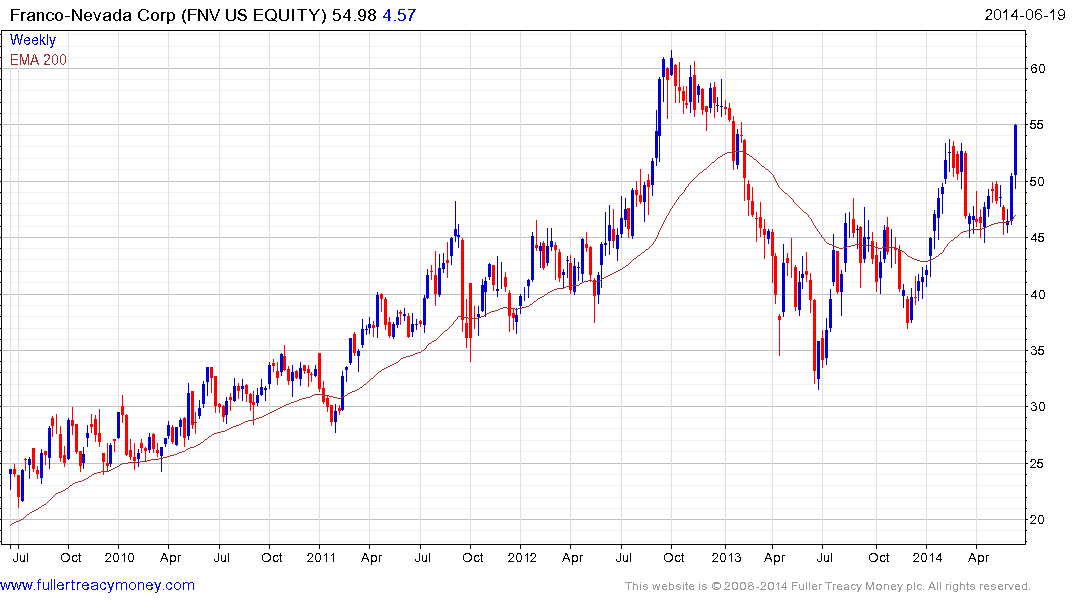

Royalty streamers such as Franco Nevada and Royal Gold are rallying from their respective 200-day MAs.

The above shares represent relative strength.

Laggards such as Companhia de Minas Buenaventura had fallen to make new lows but are now rallying to at least unwind short-term oversold conditions.

Back to top