Gold Investors Brace for Lower Prices on Interest-Rate Outlook

This article by Luzi Ann Javier for Bloomberg may be of interest to subscribers. Here is a section:

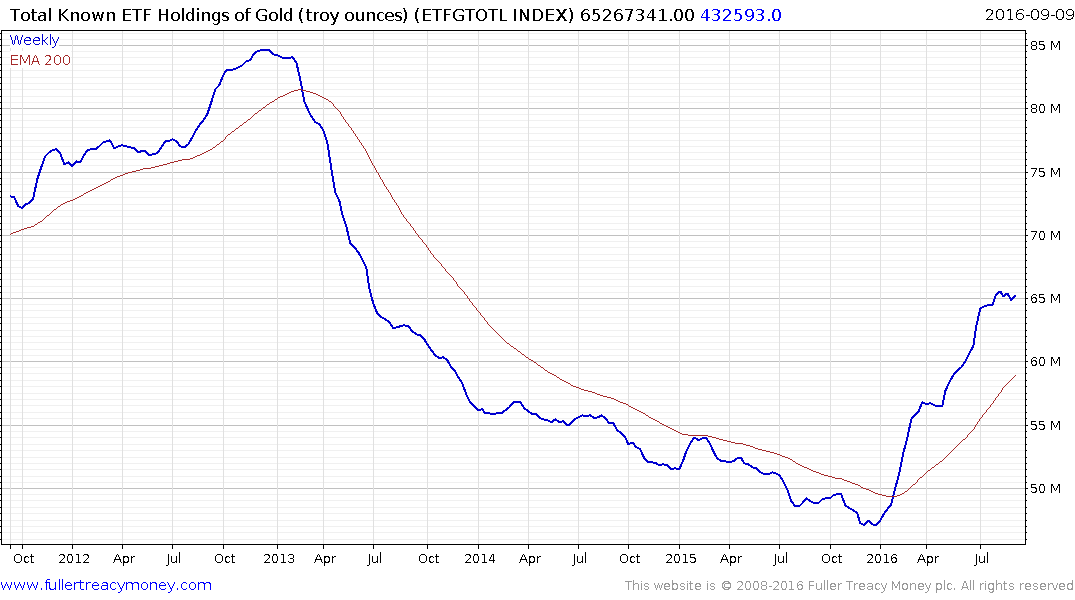

More than 2,500 lots exchanged hands Friday for a put option giving owners the right to sell October futures at $1,300 an ounce, making it the most-traded option for the second straight day. The most active contract on the Comex slipped as much as 0.6 percent to $1,334.10. Holdings in exchange-traded funds backed by gold fell for a second day on Thursday.

There’s reason to be worried. Federal Reserve Bank of Boston President Eric Rosengren, who shifted his stance in recent months in favor of monetary tightening, warned Friday that waiting too long to raise interest rates risks overheating the economy. Higher rates make bullion less competitive against interest-bearing assets. The comments come a day after the European Central Bank played down the prospect of an increase in asset purchases.

“The markets are quite nervous that an interest-rate hike might actually happen this month,” Phil Streible, a senior market strategist at RJO Futures in Chicago, said by telephone.

“Investors and traders know that gold futures have held above $1,300 and this looks like a key level of support. It’s rational for investors to be looking at protective put options at $1,300 in the event a surprise interest rate increase occurs.”

Total Known ETF Holdings of Gold have not been affected by the pullback witnessed in precious metals markets this week suggesting the action is more driven by traders than investors.

There is continued worry about the potential for an interest rate hike in September not least because the argument for raising has been so muddied by competing statements from Fed officials.

Gold remains in a ranging consolidation that is slowly but surely unwinding its overextension relative to the trend mean. It has fallen over the last three days which has just about countermanded Tuesday’s surge and a clear upward dynamic will be required to check the slide. A sustained move below $1260 would signal a deeper and potentially lengthier consolidation is unfolding.