Gold in correction mode

Thanks to a subscriber for this report from Commerzbank which may be of interest. Here is a section:

Precious metals: Gold has dropped to a 2½-week low of $1,315 per troy ounce this morning amid increased risk appetite among market participants. Gold in euro terms is trading at only around €1,100 per troy ounce. The Dow Jones Industrial Average and S&P 500 indices in the US had both climbed to new record highs on Friday. The rise in stock markets is continuing in the Asian region today. What is more, bond yields in the US have increased significantly of late, which makes gold less attractive as an alternative investment.

Presumably this is also why Friday saw the second consecutive daily outflow from gold ETFs. Portugal’s credit rating was upgraded on Friday evening by the ratings agency S&P, achieving an investment grade rating again for the first time since January 2012. Ireland was also upgraded, this time by the ratings agency Moody’s. Wednesday could see further volatility on the gold market, as this is when the US Federal Reserve meeting will take place.

If the market’s currently low rate hike expectations increase as a result of the meeting, this is likely to weigh on the gold price. According to the CFTC’s statistics, speculative financial investors further expanded their net long positions in gold in the week to 12 September, putting them at 253,500 contracts now. This was already the ninth weekly increase in a row.

The price rise to a 13-month high of just shy of $1,360 was thus driven largely by speculation. Given that the gold price is now trading considerably lower, positions have presumably been squared in the meantime

Here is a link to the full report.

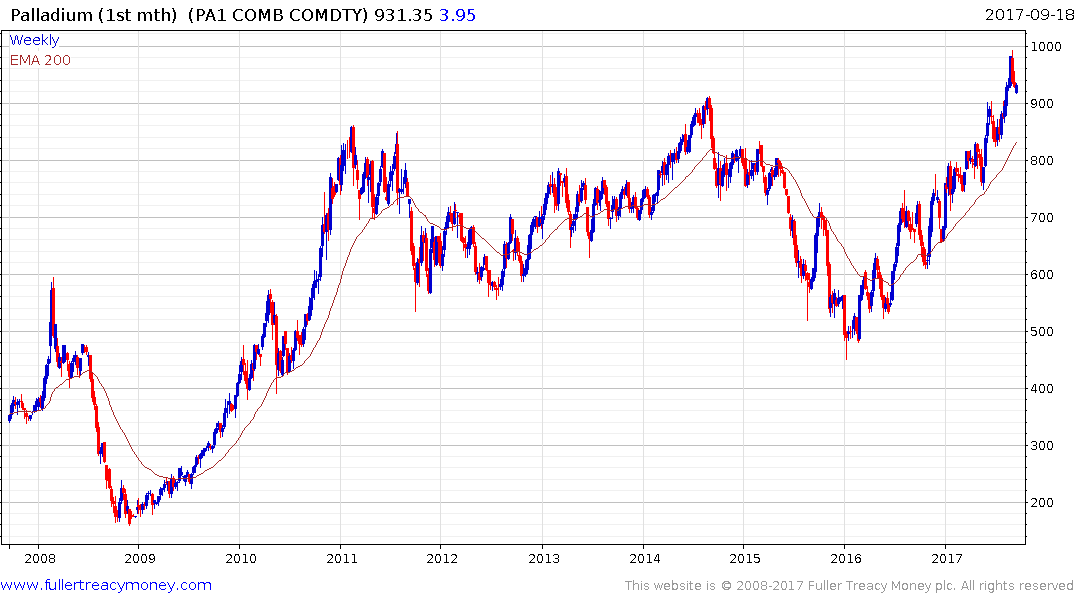

We are in a period of synchronised global economic expansion where central banks are only just beginning to turn the corner towards tightening; with the USA’s Federal Reserve in the lead. Commodities no longer share the trending commonality evident at the dawn of the commodity boom in the early 2000s. Industrial resources including palladium are recovering while energy and agricultural prices have been subject to a great deal of volatility.

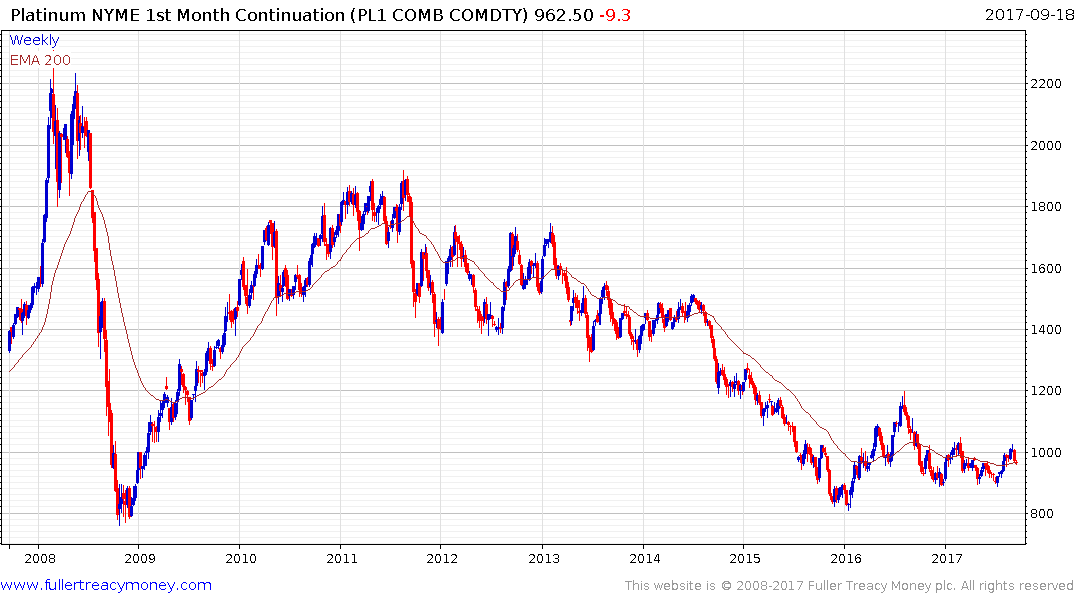

Against that background gold, silver and platinum prices have been ranging for more than a year and are currently pulling back towards their respective means.

Gold does best when inflation outpaces the rate at which central banks are raising interest rates. That is not the case right now with inflation figures still reasonably modest while interest rates are rising moderately.

.png)

US 10-year TIPS yields have been ranging between 0% and 0.75% since 2013 and more recently between about 0.25% and 0.75%. The yield is bouncing right now but this inert period of ranging suggests a sanguine attitude towards mounting inflationary pressures. Like every range it will be completed by an emphatic breakout and since the 10-year chart has Type-2 bottom characteristics with right hand extension, as taught at The Chart Seminar, that eventual move is likely to be upwards. I contend that a breakout for TIPS yields would be bullish for the precious metals.

Since the end of quantitative easing represents a major unknown factor on the horizon there is an argument for having a position in precious metals if for no other reason than to act as a hedge against an unruly outcome.

In the meantime, the gold price is pulling back from the region of the 2016 peak. If a generally consistent advance is to be sustained it will ideally find support somewhere between $1300 and the trend mean which is currently at $1264. Of course, this being gold, there is ample potential for it to overshoot. It is worth remembering that, in a rehash of the early days of the commodities boom, precious metals are best bought following corrections.