Gold Hits One-Month High as Dollar Slide Brings in Fresh Buying

This article from Bloomberg may be of interest to subscribers. Here is a section:

“A million ounces of gold was bought in under two minutes moving the price nearly a percent - this suggests fresh buying,” said Tai Wong, a senior trader at Heraeus Precious Metals in New York. “Gold holding above the 50-day moving average for the first time since August added to the positive sentiment.”

Aggressive Federal Reserve monetary tightening aimed at cooling inflation has weighed on metal prices this year by driving up the greenback and hurting demand prospects. Higher interest rates tend to diminish the investor appeal of commodities, which bear no interest.

Traders are eyeing the upcoming US inflation reading due Thursday, after the core consumer price index rose more than forecast to a 40-year high in September. Another hot print could further curb hopes of an impending slowdown in the Fed’s monetary tightening.

It is often said that the only hard fundamental in currency markets is the interest rate differential. In raw terms, the interest rate differential between the USA and the Eurozone exceeded 250 basis points in the late 1990s. Since then, spread peaked at 250 basis points in 2006 and 2019 and is now testing the 200 basis point level. It is reasonable to question whether it is likely move much beyond the current band in this cycle as the ECB plays catch up with tightening policy.

The European energy crisis has decreased to a low rumble rather than the screaming panic buying of the summer month. Meanwhile the Euro’s decline has been a major contributor to imported inflation. A stronger currency is one of the easiest ways to bring down supply-led inflation because it will make imports uncompetitive and reduce the burden of imported commodities prices.

The European energy crisis has decreased to a low rumble rather than the screaming panic buying of the summer month. Meanwhile the Euro’s decline has been a major contributor to imported inflation. A stronger currency is one of the easiest ways to bring down supply-led inflation because it will make imports uncompetitive and reduce the burden of imported commodities prices.

This is an issue many countries are facing and the spending down of Dollar reserves, as pointed out in yesterday’s commentary, is aimed at both supporting domestic currencies and reducing exposure to the USA’s deficit spending.

Gold popped on the upside on Friday and followed through today to close above $1700. The internal dynamics of the six-week range suggest support building may be reaching completion. If gold sustains a move above $1750, a failed downside break will have been confirmed and that will greatly enhance scope for a retest of the peaks below $2100.

Silver closed back above the 200-day and 1000-day MAs today and has resumed its outperformance relative to gold by breaking the relative downtrend.

Silver closed back above the 200-day and 1000-day MAs today and has resumed its outperformance relative to gold by breaking the relative downtrend.

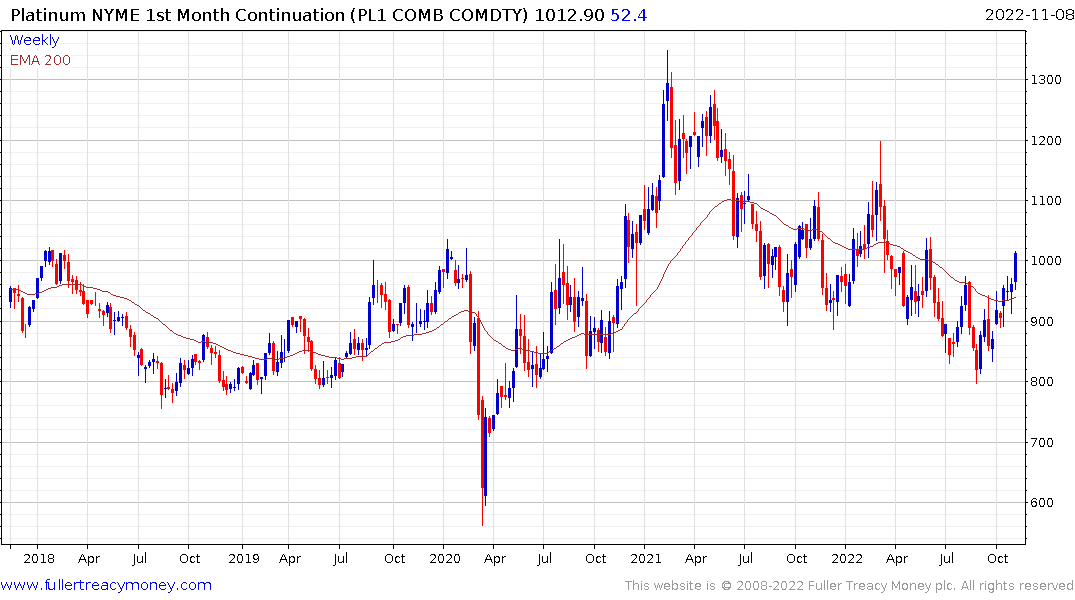

Platinum is trading back above the psychological $1000 level and has broken the sequence of lower rally highs.

Platinum is trading back above the psychological $1000 level and has broken the sequence of lower rally highs.

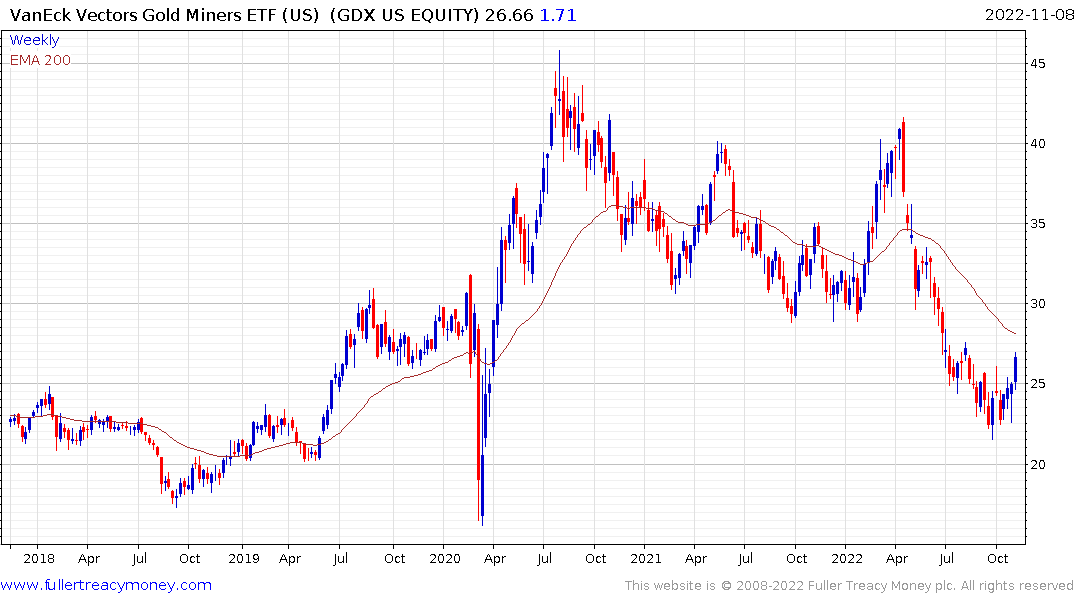

The VanEck Gold Miners ETF extended its rebound today to break the sequence of lower rally highs.

The VanEck Gold Miners ETF extended its rebound today to break the sequence of lower rally highs.