Gold Gets a Second Look as Equities Reel and Inflation Cools

This article by Marvin G. Perez for Bloomberg may be of interest to subscribers.

Gold may have finally snapped out of its inertia.

Prices headed for their biggest gain since March 2017 as of 10:51 a.m. in New York after a slump in global equity markets and data showing slower-than-expected U.S. inflation stoked demand for the metal as a store of value. Futures were set for a third straight gain, the longest rally since Aug. 22.

Bullion, which touched a six-week-high $1,218.60 an ounce on Thursday, has traded near $1,200 since late August as traders weighed geopolitical risks that could boost the metal’s allure as a haven against rising interest rates that dampen its appeal.The inflation data may spur the Federal Reserve “to pump the brakes on further hikes,” Phil Streible, a senior commodity broker at RJO Futures, said in a telephone interview. The slump in global equities is also luring investors to “safe-haven” assets, he said.

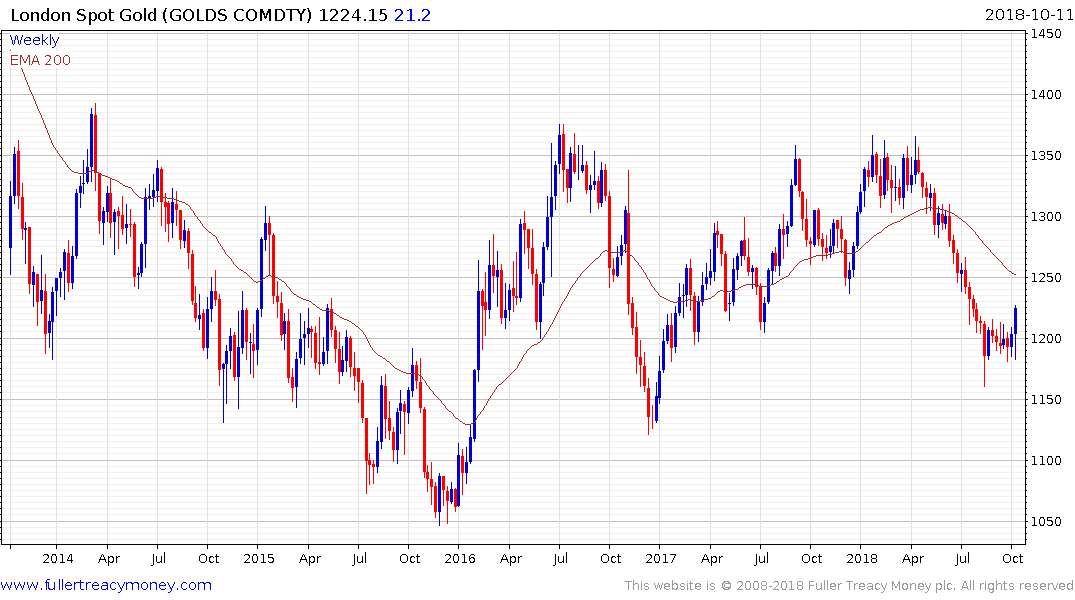

Gold has been trading in an inert manner for more than a month following a persistent decline from this year’s peak near $1350. To pause in such a narrow band is not characteristic for such a volatile instrument, and gold finally broke up and out to new recovery highs today.

Today’s move breaks the sequence of lower rally highs and is the first clear sign of a return to demand dominance beyond short-term steadying we have seen since early this year.

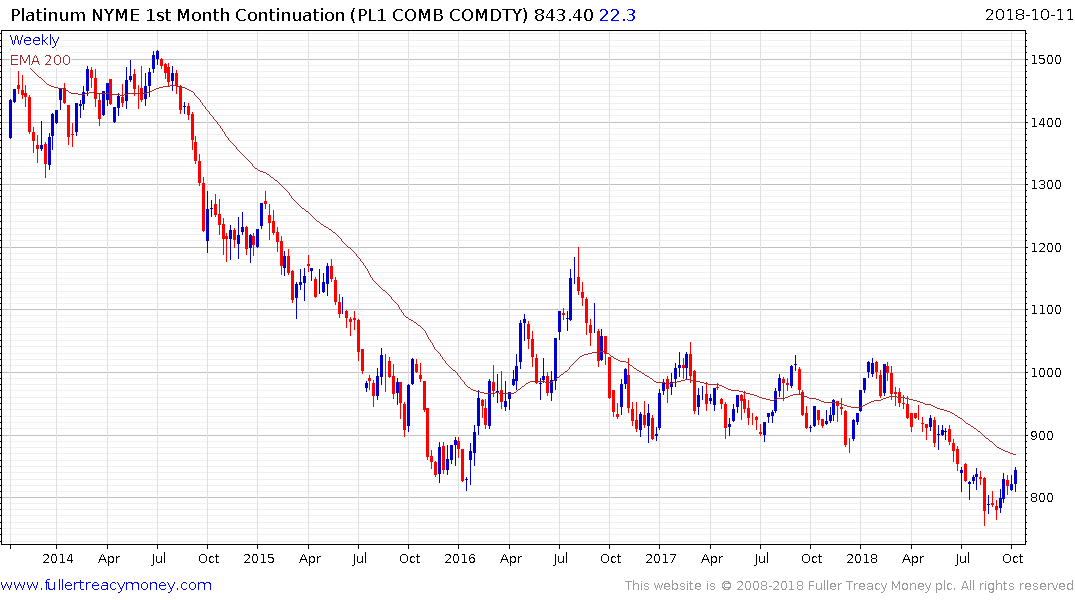

Gold has been led higher by platinum and silver to a lesser extent.

Platinum pushed back up into its overhead trading range last month to trigger a midpoint danger line stop and broke upwards today to test the $850 area. A clear downward dynamic would now be required to question medium-term scope for continued upside.

Silver also rallied to testing the upper side of its overhead trading range but then pulled back to test the most recent short-term low near $14.25. It bounced today but needs to sustain a move above $15 to confirm a return to demand dominance.

The VanEck Vectors Gold Miners ETF rallied today, hitting a new recovery high, which increases potential for a reversion back towards the mean.