Gold Falls on Equity Rally as Silver Slumps to Four-Year Low

This article by Debarati Roy and Nicholas Larkin for Bloomberg may be of interest to subscribers. Here is a section:

Holdings in exchange-traded funds backed by gold slumped to a five-year low as price volatility plunged to the lowest since 2010. The metal has dropped 13 percent from this year’s high as theU.S. economy gained traction amid prospects for rising interest rates and muted inflation.

“We are seeing a rush for equities,” Tom Winmill, who helps manage about $220 million of assets in Walpole, New Hampshire, for Midas Funds, said in a telephone interview. “Many investors don’t see the need for a safe haven as the dollar has gained strength.”

There has been understandable speculation about where the money would come from to fund the Alibaba IPO and the conspicuous declines in precious metal markets, coinciding with the shares launch, represent a tempting candidate. However, the recent strength of the Dollar, improving governance in India where desire of a safe haven is easing and slower Chinese economic growth are all also factors in the recent weakness of precious metals.

Silver broke downwards to a new four-year today, having fallen for 10 consecutive weeks. A deep short-term oversold condition is evident, not least following today’s acceleration. However, a clear upward dynamic will be required to check momentum and pressure shorts.

Gold has fallen back to test the lower side of its 15-month range and a similar upward dynamic to those posted in 2013 from this area will be required to confirm the return of demand.

Platinum has a similar pattern and is equally short-term oversold as it tests the 2013 lows near $1300.

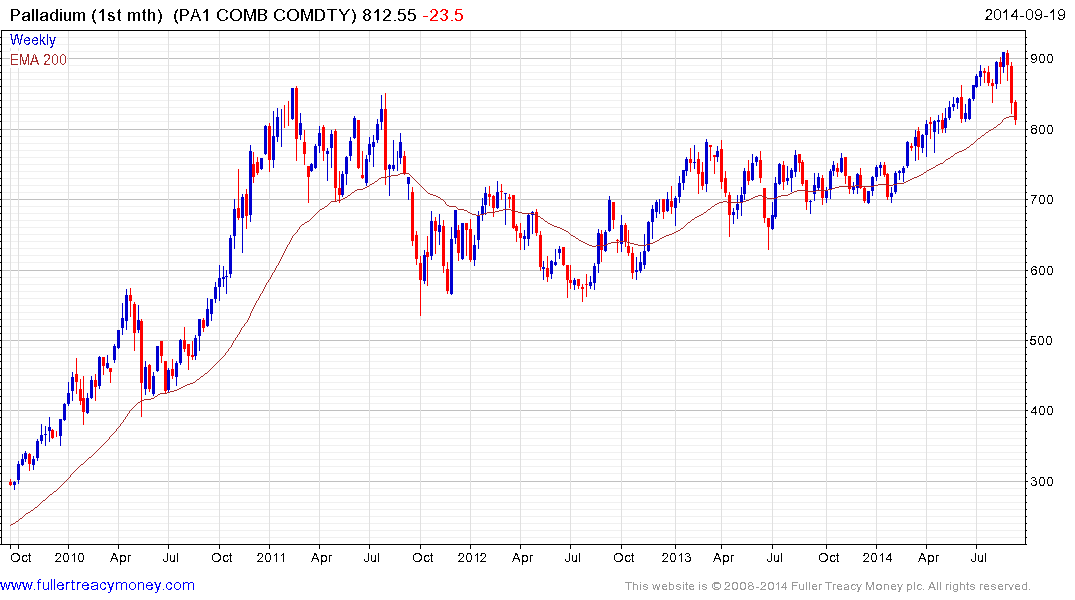

Palladium has posted its largest reaction in more than a year, since failing to hold the $900 level. It will need to find support in the current area if medium-term scope for continued higher to lateral ranging is to be given the benefit of the doubt.