Gold Edges Higher With Lower Yields as Traders Eye US Rate Path

This article from Bloomberg may be of interest to subscribers. Here is a section:

Gold inched higher as Treasury yields pared their recent surge, with traders temporarily looking beyond the Federal Reserve’s aggressive interest-rate hike path.

Bullion rose as much as 0.8%, rebounding from the worst daily loss in two weeks in the previous session. On Friday, a stronger-than-expected US jobs report added to the case for more Fed monetary tightening, pushing up the dollar and bond yields while crushing gold since it pays no interest and is priced in the greenback.

Still, a bigger rate hike isn’t a done deal, and investors are now waiting for a US inflation report later this week to gauge how hawkish the Fed may be at its September meeting. That allowed a pause for Treasury yields and the dollar, lifting gold prices on Monday.

A hike of 75 basis points at next month’s Fed policy meeting “is far from locked in,” TD Securities commodity strategists led by Bart Melek said in a note. For now, “the yellow metal has been able to hold firm.”

The precious metal has rallied for the last three weeks, as concerns over a global recession and heightened US-China tensions boosted demand for the haven asset.

Holdings of bullion in exchange-traded funds have remained under pressure, however, falling for an eighth straight week.

Spot gold rose 0.7% to $1,788.34 an ounce as of 10:49 a.m. in New York. The Bloomberg Dollar Spot Index and the 10-year Treasury yield edged lower. Silver, palladium and platinum all advanced.

I spent a lot of time thinking about gold over the weekend. I’m not happy with how my trading of the metal has gone over the last year. Despite significantly offsetting my loss with success in other trades, I still feel the pang of failure in gold more acutely than with other instruments. This is the 2nd time in four years I have sold at the wrong time, so I am resolved to do better in future.

.png)

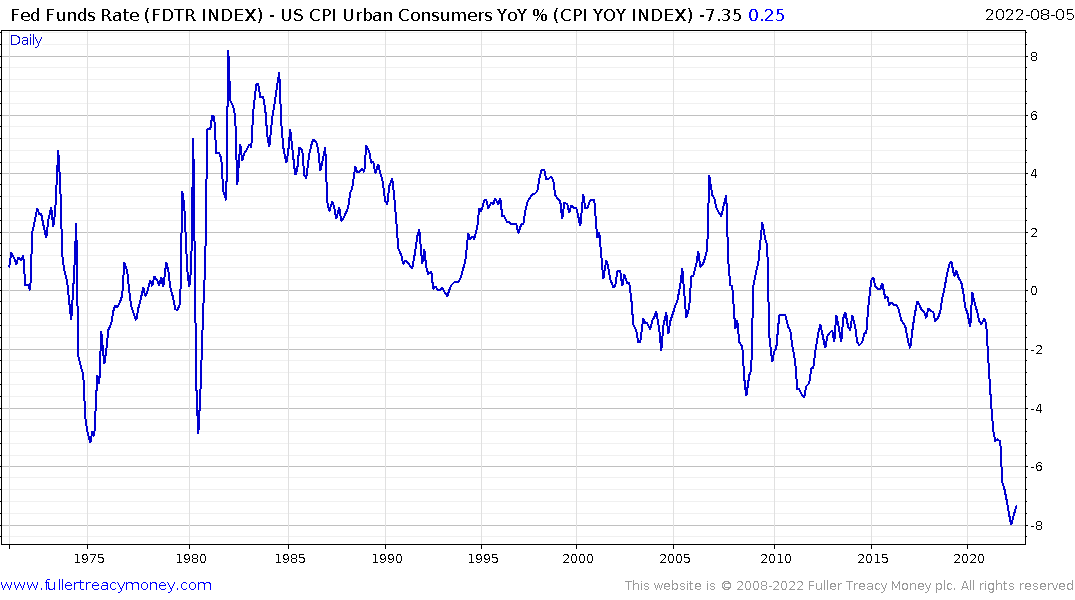

This chart of the Fed Fund Rate spread over CPI is the most basic measure of whether we have negative real interest rates. It has the advantage of going back to the late 1960s so we can see how it has performed over at least two cycles.

I prefer it to TIPS yields because it has more back history and The Fed owns about a quarter of the TIPS market so it has clear scope to offer a distorted figure.

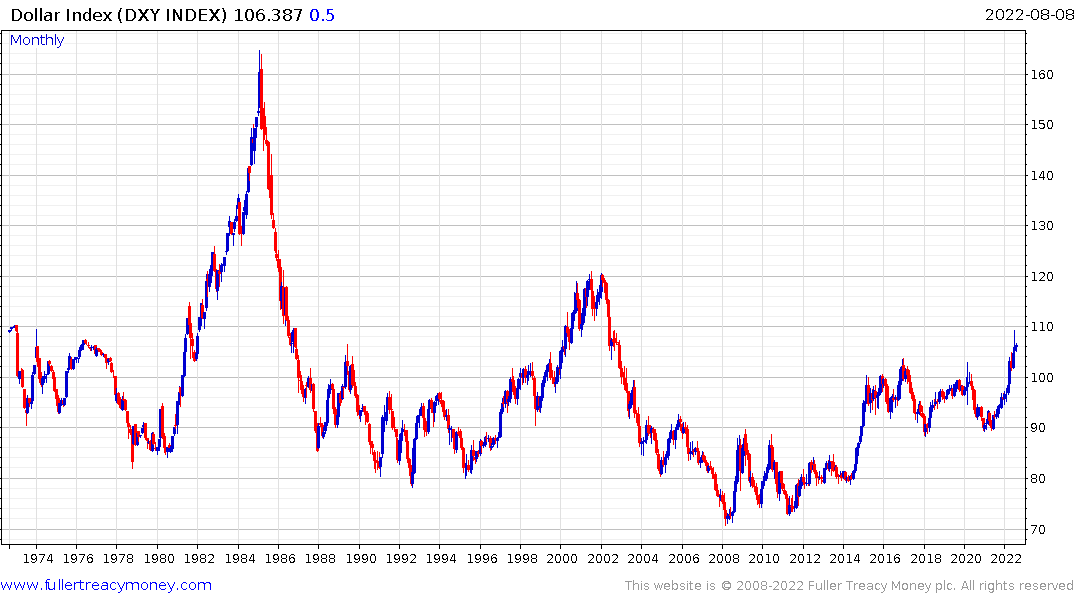

The Dollar Index also has the benefit of lengthy history.

The Dollar Index also has the benefit of lengthy history.

When I look at these charts, the big bull markets in gold have coincided with periods of negative real interest rates and chronic weakness for the Dollar.

Negative real interest rates have been present for most of the last decade. That preserved most of gold’s bull market gains but it was when the Dollar Index declined that gold truly outperformed.

Gold and the Dollar Index have been moving in lock step over the last month. Therefore, a sustained move above $1800 for gold and below 105 for the Dollar Index will be required to signal the beginning of a change of trend.