Gold Climbs Toward a Record as Producer Prices Drop Unexpectedly

This article from Bloomberg may be of interest. Here is a section:

“While the strong labour market trends and sticky core services inflation suggest a 25bp hike at the May FOMC, markets are increasingly looking toward the end of the hiking cycle, with cut timing also top of mind,” said Ryan McKay, a commodity strategist at TD Securities.

Core CPI ex-Shelter peaked in September and continues to trend lower; albeit at a slower pace than it advanced. That suggests there is still some way to go in putting the inflation genie back in the lamp. It might seem presumptuous at present but deflationary pressures will eventually prevail because of the long and variable lags from rising rates, negative money supply and quantitative tightening.

That’s one of the reasons gold is pushing out to new highs. The potential is growth will moderate faster than inflation and that will force the Fed to ease up. It suggests a higher inflation rate will be tolerated for longer because the alternative would be both deep deflation and high unemployment.

That’s the basis for the argument the new unstated inflation target is closer to 4% than 2%. If correct that will also enhance the negative real interest rate argument for owning gold. The times when gold does best are when the Dollar is trending lower and real interest rates are trending down.

That’s driving the Dollar lower at the same time that several countries have begun accepting renminbi for commodities. Dedollarisation is a growing theme and is a direct repercussion of confiscating Russia’s sovereign reserves following its invasion of Ukraine. Every country is now aware that is a risk, so they have a clear incentive to diversify exposure.

It seems inevitable Saudi Arabia will eventually begin accepting renminbi for oil. There has been some fringe speculation they are already accepting gold for oil, but I do not have a way of proving or disproving that claim. Open interest on the Shanghai oil contract has not changed. I believe that is a reasonable way of monitoring whether appetite for the oil settled in gold contract is gaining traction.

At present, these moves are cosmetic but what concerns investors is the direction of travel. Dedollarisation will be more serious if it acts as a limiting factor in how low yields go during a recession.

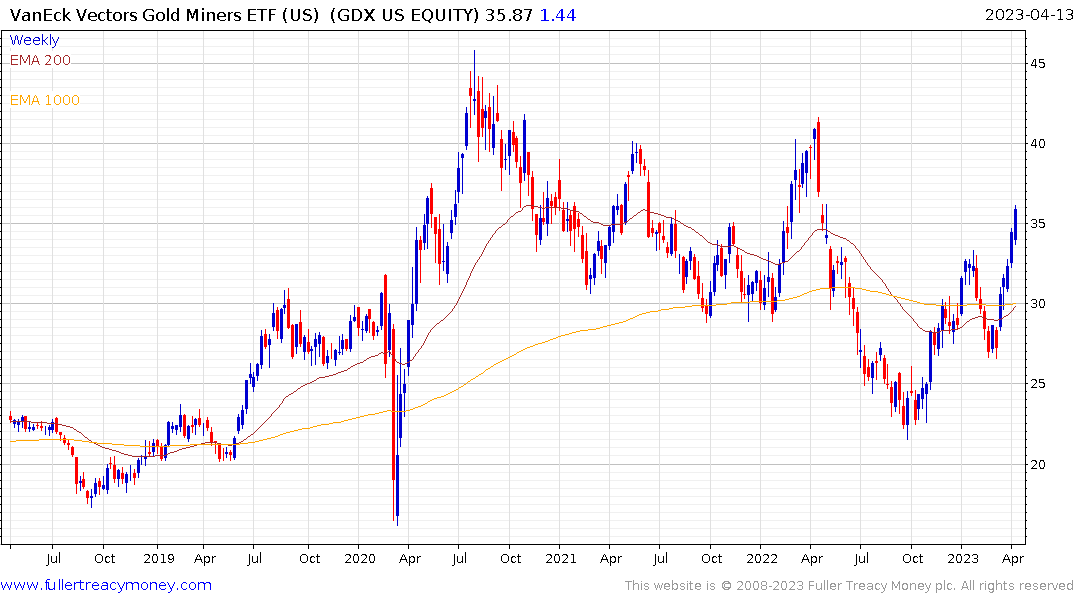

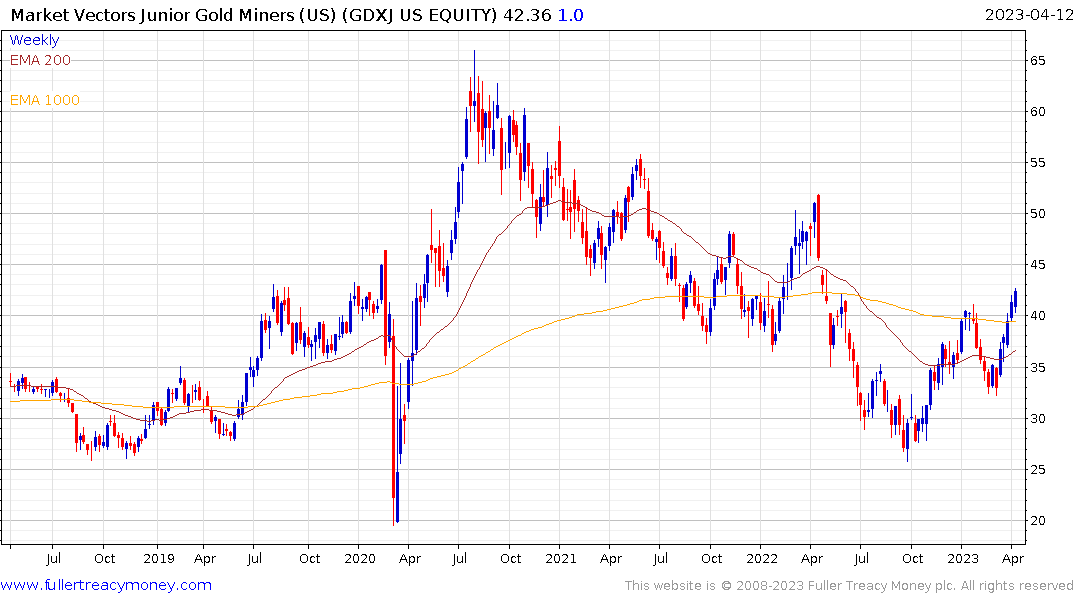

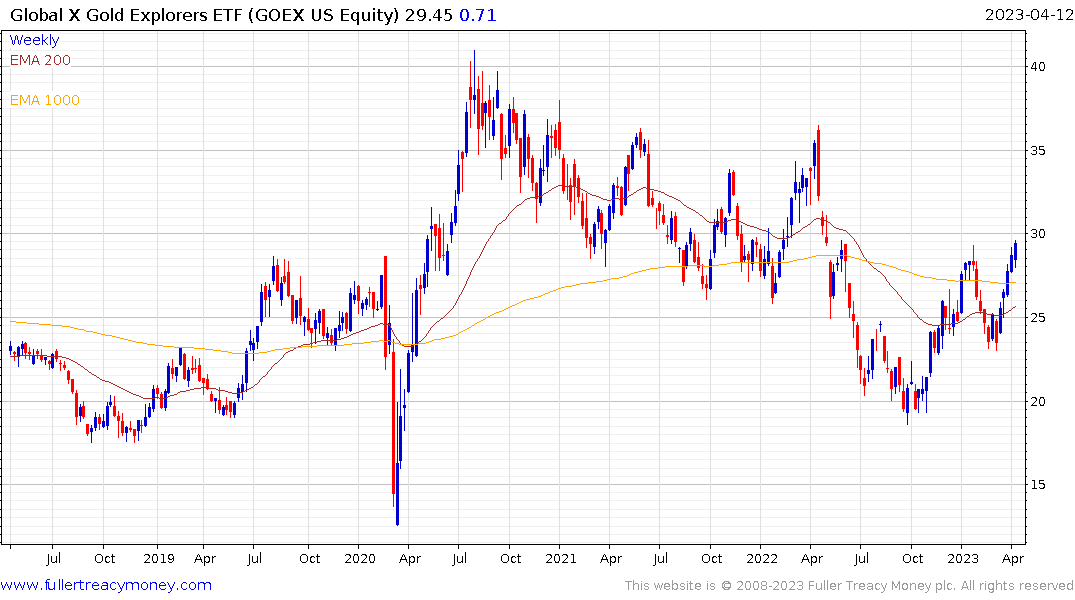

Gold shares has been ranging relative to gold for several years. The ratio is now beginning to recover which confirms investors are looking at taking on some leverage to the gold price.

In a typical gold bull run, the major, well-known names move first. The silver miners move next, then the near-term producer candidates and finally the explorers.

The VanEck Gold Miners ETF continues to surge.

The VanEck Junior gold miners ETF is rallying from a lower based but has now broken its downtrend.

The Global X Silver Miners ETF is step behind the junior gold miners ETF but is has broken its downtrend.

The Global X Silver Miners ETF is step behind the junior gold miners ETF but is has broken its downtrend.

The Global X Gold Explorers ETF is rallying towards the upper side of a decade-long base formation.

The Global X Gold Explorers ETF is rallying towards the upper side of a decade-long base formation.

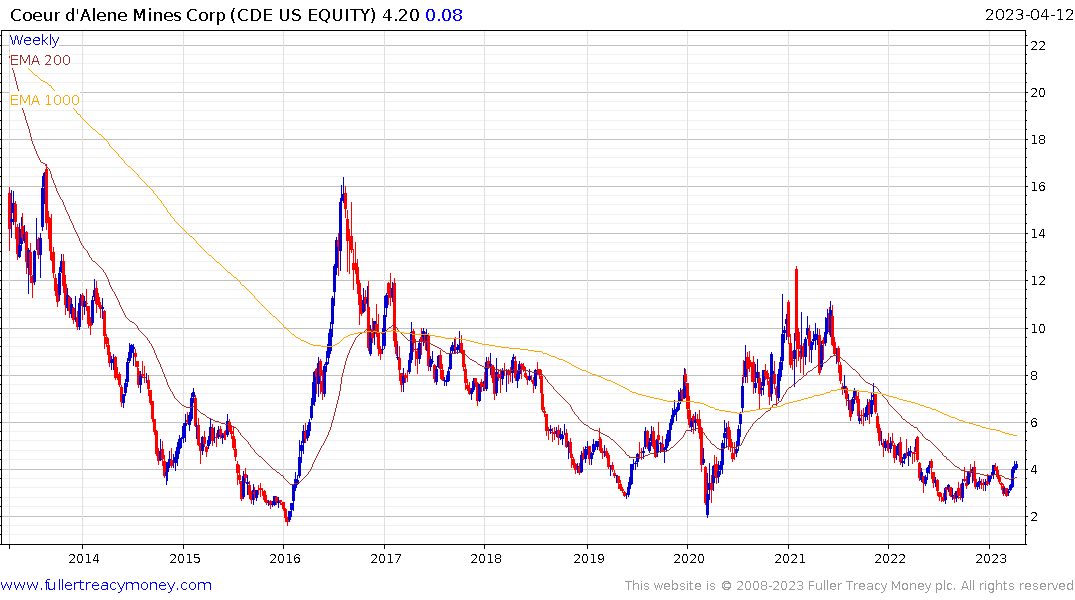

Coeur Mining is a top-10 silver producer with North American only exposure. The share is only just beginning to rebound from the lower side of its base formation.

Coeur Mining is a top-10 silver producer with North American only exposure. The share is only just beginning to rebound from the lower side of its base formation.