Gold Climbs to Highest Since August as Inflation Misses Estimate

This article from Bloomberg may be of interest to subscribers. Here is a section:

The Personal Consumption Expenditure Deflator, a measure of inflation based on changes in personal consumption, rose 0.3% in October from the month before, below economists’ median forecast. It follows two other inflation gauges that indicated price pressures were easing, boosting bets on a slowdown in monetary tightening.

Rate hikes to curb inflation have weighed on non-interest bearing gold throughout the year by pushing up bond yields and the dollar. Bets on a slowdown and China’s Covid loosening saw bullion rise 8% in November as the greenback retreated the most since 2009.

Other data showed the jobs market gradually cooling, a welcome sign for the Fed as it tries to tame inflation. Wage gains driven by labor tightness have been a major driver of price increases.

The swift pace of Fed tightening was a major tailwind for the US Dollar. Now that the Fed is slowing the pace of hiking it reduces that tailwind and the Dollar is now trending lower. That’s a significant tailwind for gold.

The two complementary conditions for a bull market in gold are negative real interest rates and a weak dollar. The prevailing interest rate has been below the inflation rate for much of the last decade but the Dollar has gone through some major swings.

Whenever the Dollar declines, it lends support to gold. The price rallied up through the 200-day MA today to confirm a failed downside break. The next area of potential resistance is the upper side of the range near $2050.

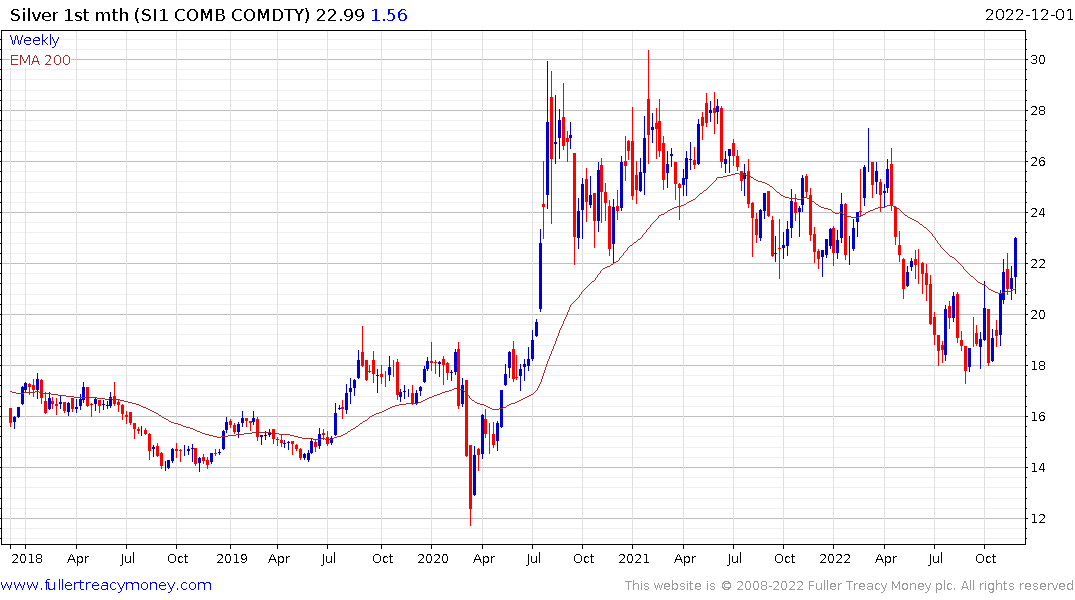

Silver broke out of a three-month base formation today to also confirm a failed downside break below $20. This helps to confirm the two-year range between $20 and $30 is a first step above the base.

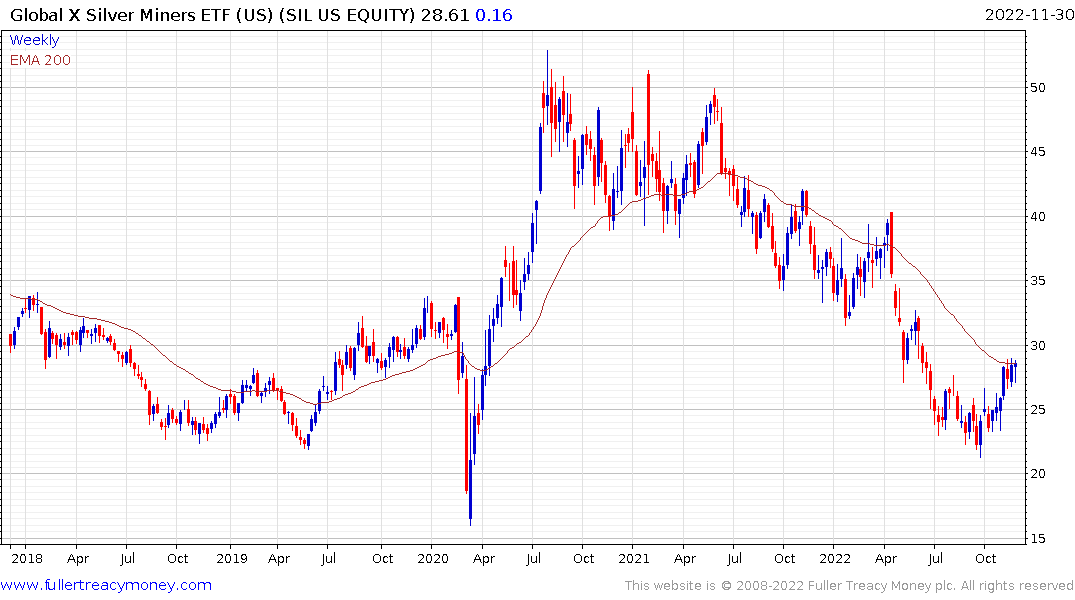

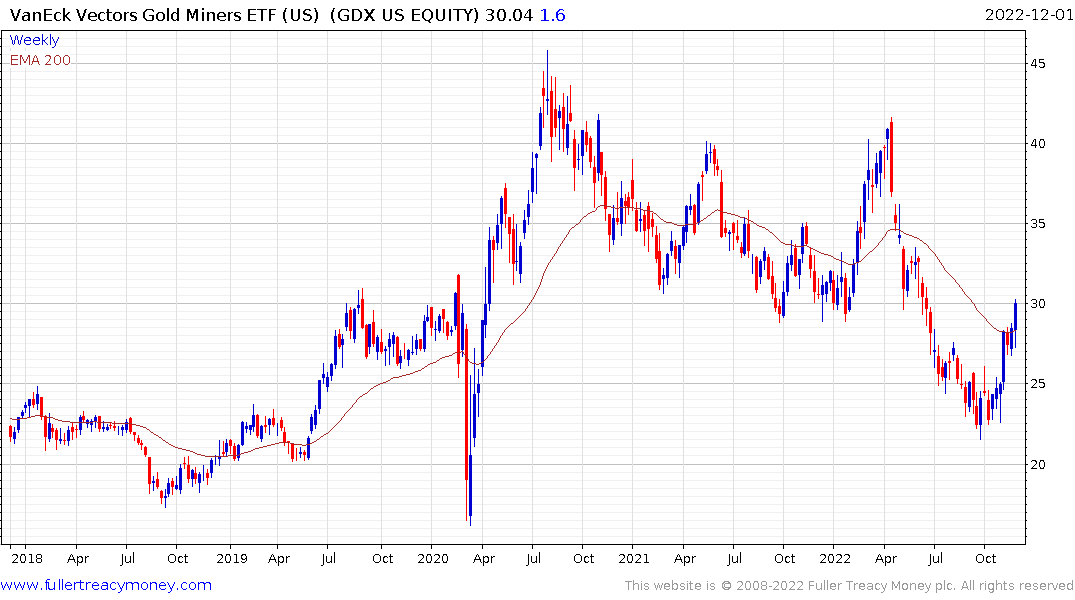

The Silver Miners ETF also crossed back above the 200-day MA today. The Gold Miners ETF (GDX) is back testing the psychological $30 area which is an important area of near-term resistance. A sustained move above it would confirm a return to medium-term demand dominance.