Gold Climbs From One-Month Low After Strong U.S. Jobs Data

This article from Bloomberg may be of interest to subscribers. Here is a section:

Gold climbed from its lowest in a month as real yields declined following a strong U.S. jobs report that underlined inflationary pressures in the economy.

ADP Research Institute data indicated higher wages are helping fill a near-record number of vacancies in America, potentially stoking price pressures. Market-based measures of inflation expectations climbed after the report, trimming real bond yields and supporting gold.

The Federal Reserve’s increasingly aggressive approach to curbing inflation is still weighing on the non-interest bearing precious metal. Philadelphia Fed Bank President Patrick Harker said Tuesday that he expects a series of “deliberate, methodical” rate increases this year, but is open to a half-point move in May if inflation accelerates.

The yield curve inverted during yesterday’s trading session. That started the clock on the beginning of the next recession. It’s a reliable lead indicator for future trouble with anything from a six to eighteen-month timeframe.

The tightening of financial conditions suggests the maximum amount of tightening possible is equal to or less than 200 basis points. The futures market has already priced that tightening into rates for this year. Nevertheless, big open questions remain unanswered. Is the Federal Reserve going to blink and favour asset price stability over killing off inflationary pressures?

Gold is rebounding on the conclusion the Fed is going to run into issues well before it has raised rates by 200 basis points. The price has been consolidating between the all-time and the upper side of the underlying range for the last month. This looks like little more than a pause before higher levels are sustained.

The US Dollar is also unwinding its short-term overbought condition as the Dollar Index fails back from testing the psychological 100 level. The primary support for the Dollar is the prospect of a wider interest rate differential and lower supply as quantitative tightening begins. Anything that questions those factors takes the impetus from its rally.

Silver firmed from the region of the 200-day MA yesterday and the upper side of the underlying short-term range.

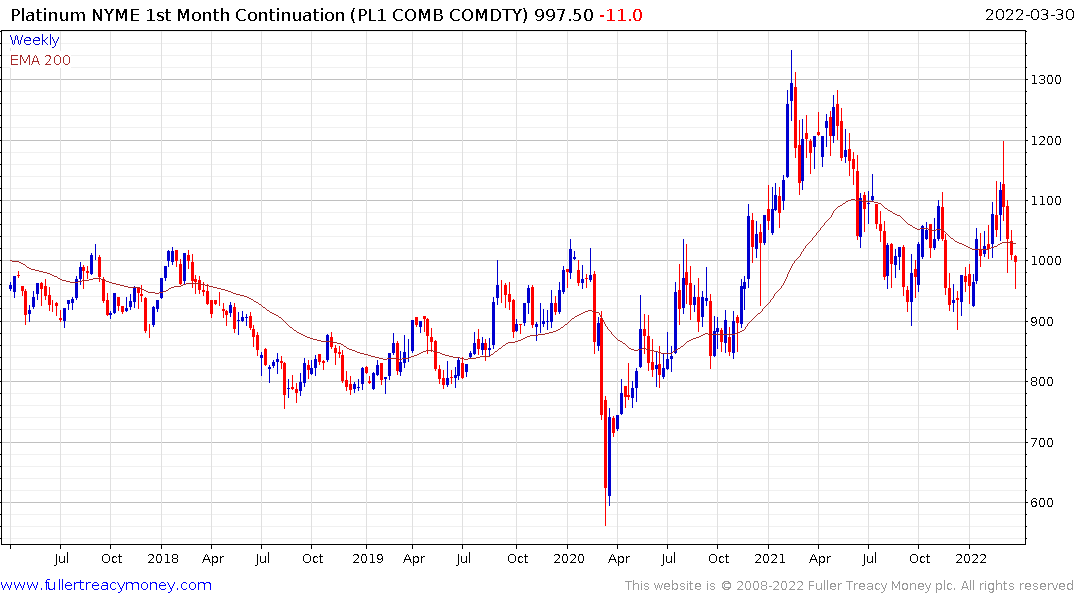

Platinum is also firming in the region of the psychological $1000 area.

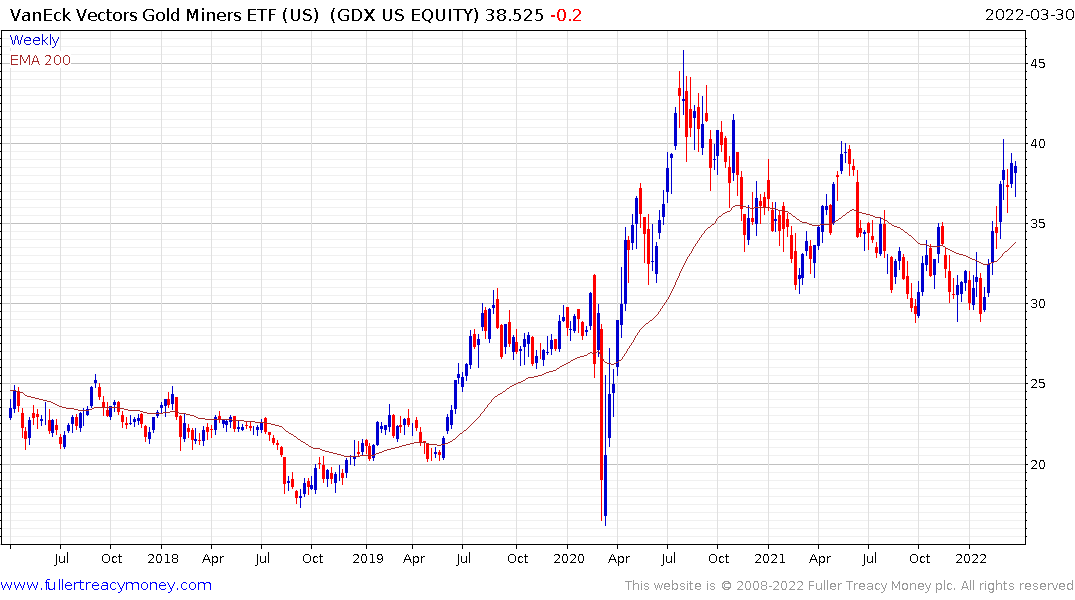

The VanEck Gold Miners ETF is back testing its May 2021 highs.

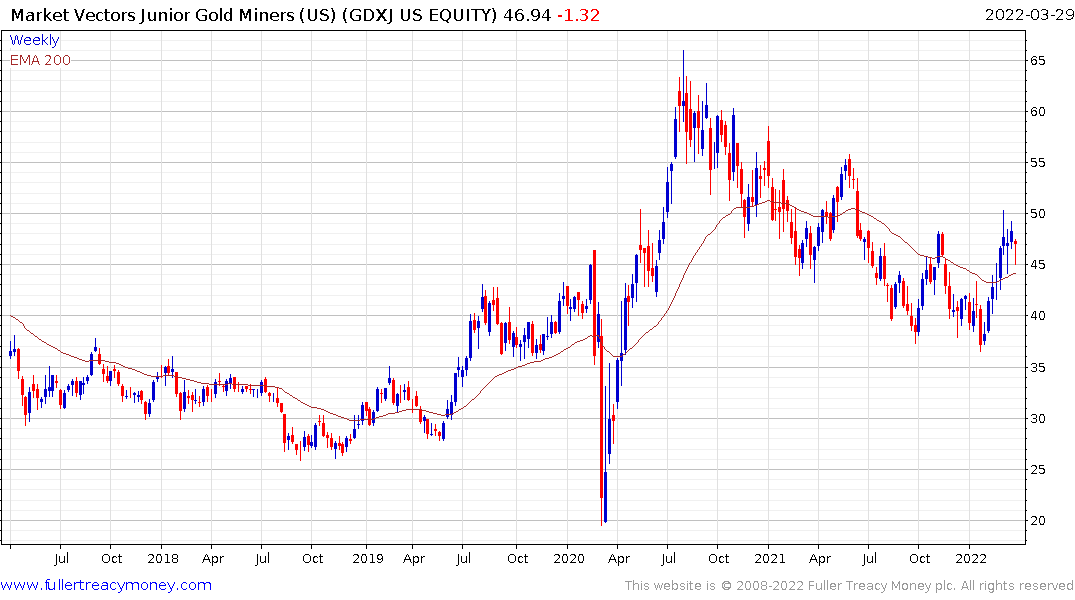

The VanEck Junior Gold Miners ETF has rallied to break the 18-month sequence of lower rally highs and is firming from the region of the 200-day MA.

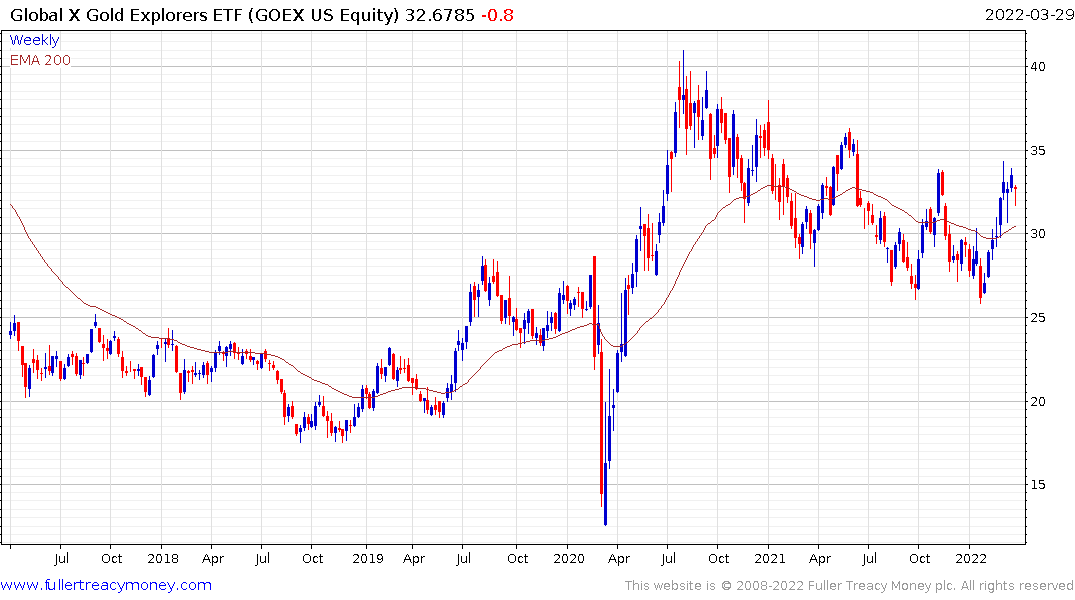

The Global X Gold Explorers ETF is also firming and is now testing its medium-term sequence of lower rally highs.

Gold shares continue to outperform the gold price. While the ratio is looking a little overbought, the rationale for gold miners to outperform, given their production costs and reluctance to spend on expansion, should support medium-term outperformance.