Go Figure

Thanks to a subscriber for Howard Marks’ latest memo to Oaktree clients focusing on the outcome of the US election. Here is a section:

That brings us to the outlook for bonds. Just as the U.S. stock market has celebrated Trump’s election, the bond markets have been discouraged. Interest rates rose very rapidly last week following Trump’s election, bringing big losses to bond holders. The FT wrote the following, citing Henry Kaufman, the Solomon Brothers chief economist who correctly called the bond bear market in the 1970s:

“It’s a tectonic shift”…the end of a three-decade bond bull market, because of the likelihood of unfunded tax cuts, infrastructure spending and a radically reshaped Federal Reserve. “I would say the secular trend is going to be upwards now” he told the FT “Secular swings are hard to forecast, but the secular sweep downwards in interest rates is over, and we are about to have a gentle swing upwards”

I always feel it takes a degree of innate optimism to be a devotee of stocks (with their reliance on conjectural returns awarded by the market) as opposed to bonds (which bring contractual returns guaranteed by their issuers). Thus U.S. equity investors have exhibited an optimism regarding the Trump administration that virtually no one foresaw a week ago.

Equity investors like inflation because it pumps up profits. Bond investors dislike it because it raises interest rates, reducing the value of the bonds they hold. But the two can’t go in opposite directions forever. At some distant point, higher interest rates can cause bonds to offer stiffer competition against highly appreciated stocks.

Here is a link to the full report.

Generally speaking the stock and property markets are reasonably good hedges against inflation because both dividends and rents can increase over time and compensate the asset holder. Fixed rates bonds on the other hand do not have this advantage and are therefore one of the most interest rate sensitive sectors.

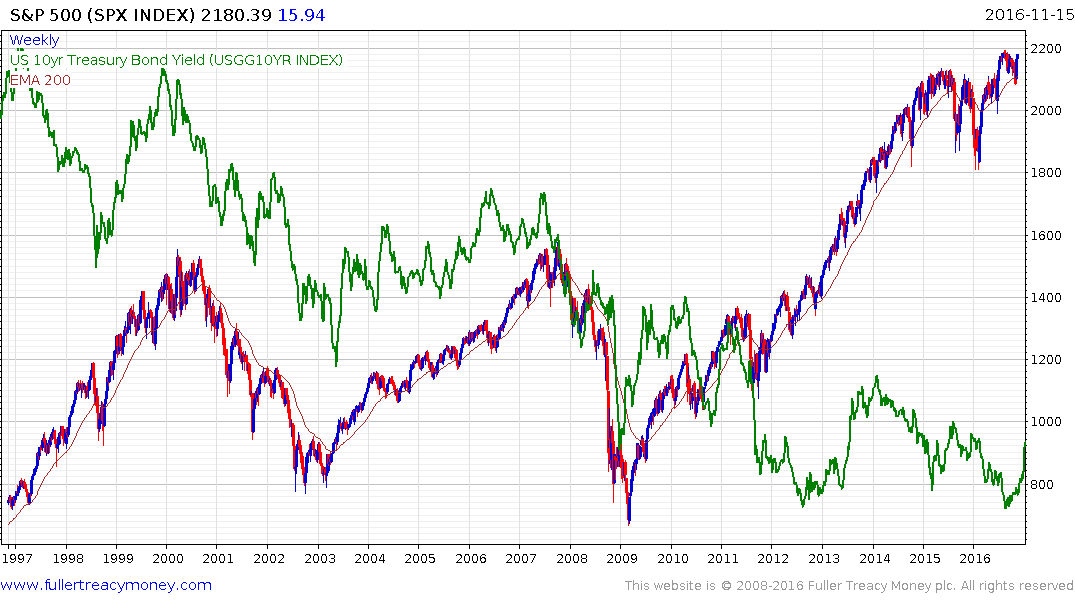

For the last five years there has been a strong inverse correlation between the stock market and bond yields because central banks have been so active in supressing yields which spurred flows into equities most particularly through buybacks. That correlation may now be returning to its more historical relationship which is when bond yields rise so do stocks and of course vice versa because the prospect of inflation is now being priced back in.

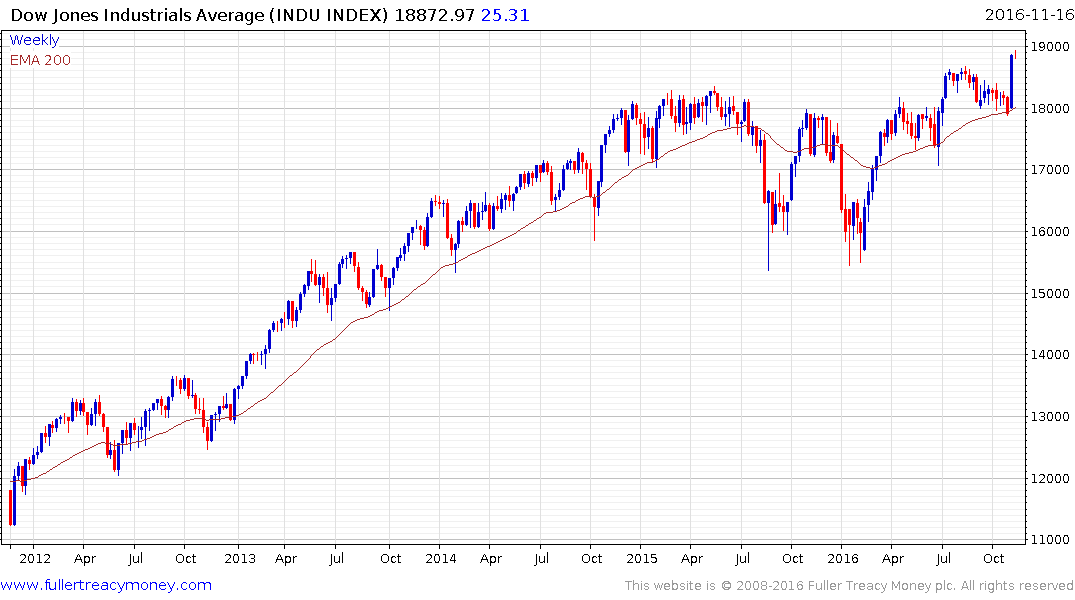

The Dow Jones Industrials Average and the Russel 2000 both moved to new all-time highs over the last week while both the S&P500 and the Nasdaq-100 are trading in the region of the trend mean.

.png)