GMO Quarterly Letter

Thanks to a subscriber for this instalment of Jeremy Grantham’s report which may be of interest to subscribers. Here is a section:

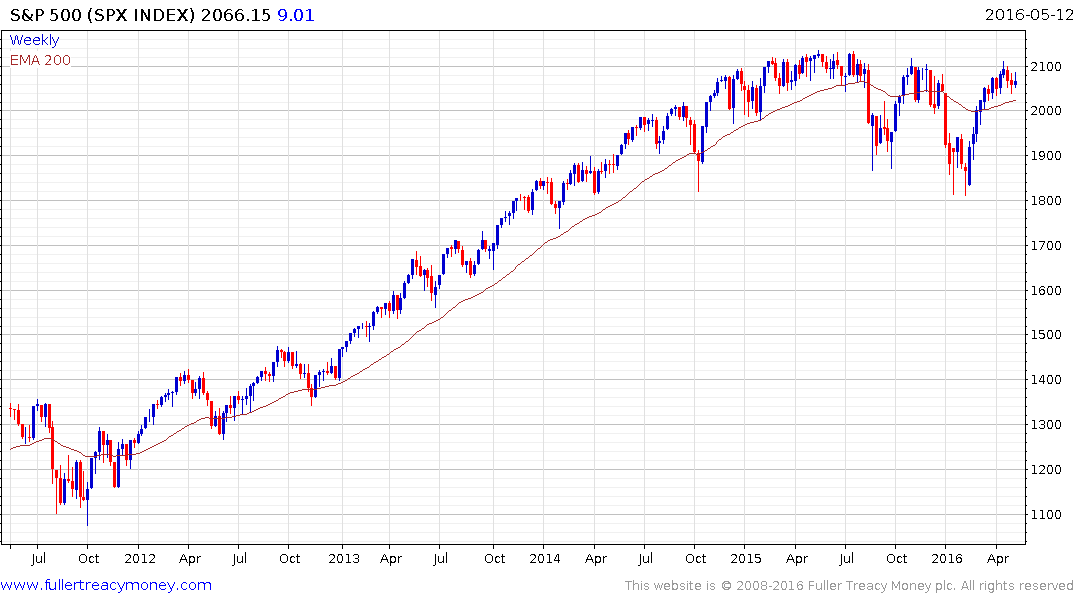

This relative optimism was an unusual position for me and the snapback in these markets has validated, to a modest degree, my thinking at the time. I still believe the following: 1) that we did not then, and do not today, have the necessary conditions to say that today’s world has a bubble in any of the most important asset classes; 2) that we are unlikely, given the beliefs and practices of the U.S. Fed, to end this cycle without a bubble in the U.S. equity market or, perish the thought, in a repeat of the U.S. housing bubble; 3) the threshold for a bubble level for the U.S. market is about 2300 on the S&P 500, about 10% above current levels, and would normally require a substantially more bullish tone on the part of both individual and institutional investors; 4) it continues to seem unlikely to me that this current equity cycle will top out before the election and perhaps it will last considerably longer; and 5) the U.S. housing market, although well below 2006 highs, is nonetheless approaching a one and one half-sigma level based on its previous history. Given the intensity of the pain we felt so recently, we might expect that such a bubble would be psychologically impossible, but the data in Exhibit 1 speaks for itself. This is a classic echo bubble – i.e., driven partly by the feeling that the substantially higher prices in 2006 (with its three-sigma bubble) somehow justify today’s merely one and one-half-sigma prices. Prices have been rising rapidly recently and at this rate will reach one and three-quarters sigma this summer. Thus, unlikely as it may sound, in 12 to 24 months U.S. house prices – much more dangerous than inflated stock prices in my opinion – might beat the U.S. equity market in the race to cause the next financial crisis.

Here is a link to the full report.

The Fed is a serial bubble blower and it is hard for them not to be. They are almost compelled to wait for evidence that conditions are overheating before acting and then have to play catch-up by tightening. Eventually policy becomes restrictive enough to prick the bubble but not before truly eye-watering valuations have been achieved.

It needn’t be this way but the political capital and force of will required to run truly counter cyclical policies has not been in evidence since Paul Volcker was Fed chair. In addition politicians do not appear to have the appetite for the coincident fiscal policy required to ensure a positive outcome. Therefore we cannot discount the potential this bull market will eventually climax in a bubble.

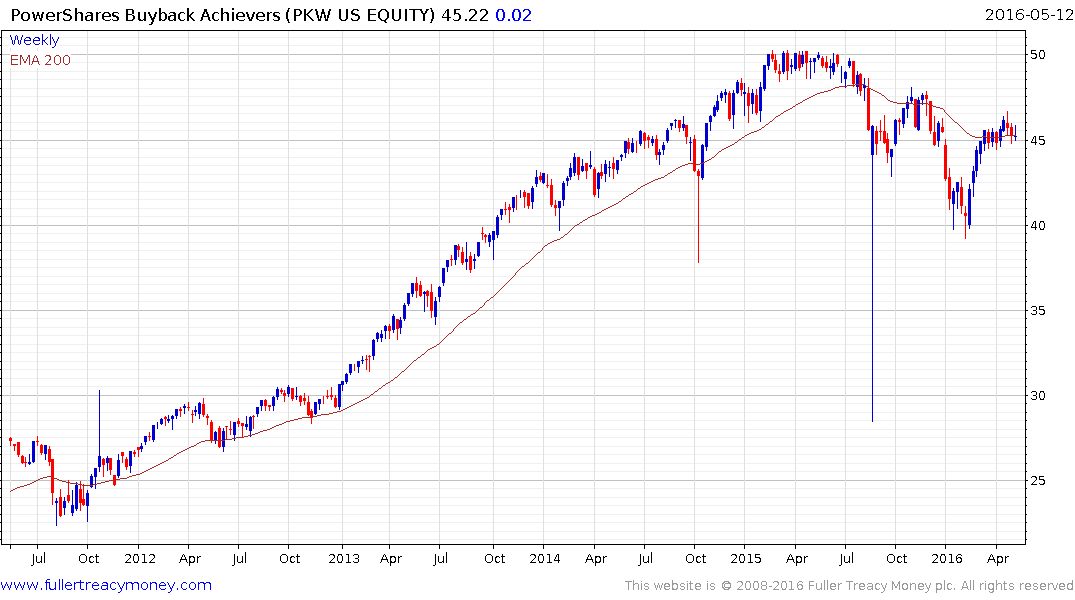

Right now valuations are not cheap but it would be hard to argue they are at bubble levels. The only question I have that would throw doubt on that conclusion regards the role of buybacks in flattering EPS, not least because it is so seldom discussed. Trillions of Dollars in shares have been taken out of the market over the last seven years. Their absence represents a significant influence on valuations. I would be very interested to know if subscribers have any insights into what P/Es would be like without the influence of buybacks. My hunch is that buybacks have represented the primary artery for liquidity to support the stock market during what has been a very impressive bull market to date. .

The PowerShares Buyback Achievers ETF outperformed the wider market until early last year and has been trending lower for a year. It is currently trading in the region of the trend mean and will need to sustain a move above $47.50 to question medium-term supply dominance.

The larger range evident over the last 18 months on the S&P500 tells us supply and demand have come back into relative balance. A sustained breakout to new highs is therefore required to signal a return to medium-term demand dominance. The developing bubble hypothesis would be bolstered by such an outcome if it occurs without a meaningful uptick in corporate profits.