Gloom Descends on Luxury-Goods Industry

This article by Corinne Gretler and Thomas Buckley for Bloomberg may be of interest to subscribers. Here is a section:

Shares of both companies slid, dragging other luxury stocks down with them. The industry is grappling with another year of waning demand as China’s campaign against extravagant spending is compounded by a drop in tourism after terrorist attacks in France and Belgium, a situation Rupert characterized as a “fiasco.” Richemont’s revenue slid 13 percent, excluding currency shifts, in the five months through August, missing analysts’ estimates.

“The warnings show that macro and geopolitical uncertainties put near-term volume growth in question,” said Zuzanna Pusz, an analyst at Berenberg. “The challenges facing the luxury industry are not over yet.”

While in Hong Kong for a day earlier this year I was surprised by the willingness of luxury brands to bargain on price with discounts of over 10% readily available. At least part of the reason for this was because despite the fact there were large numbers of mainland Chinese tour groups milling around few appeared to be carrying shopping bags. The continued “anti-corruption” drive coupled with slowing economic activity have acted to curtail conspicuous consumption at home but terrorist attacks all over Europe are an additional headwind.

When one clicks through the constituents of the luxury goods section of the Chart Library a great deal of variability in performance is evident. With today’s pullback Hermes has closed an overextension relative to the trend mean but a clear upward dynamic will be required to confirm the return of demand in this area.

Meanwhile Prada has at least stabilised near HK$20 and a sustained move above the trend mean would break the three-year downtrend.

Tiffany bounced this week from the region of the trend mean and will need to hold the low near $66 if potential for additional higher to lateral ranging is to be given the benefit of the doubt.

While Chinese tourists have become a major source of revenue for the luxury goods sector, they are even more important to the gambling sector. Following a lengthy period of underperformance there is now evidence of base formation completion among a number of casino stocks.

Wynn Resorts is now testing the upper side of a first step above the Type-2 base.

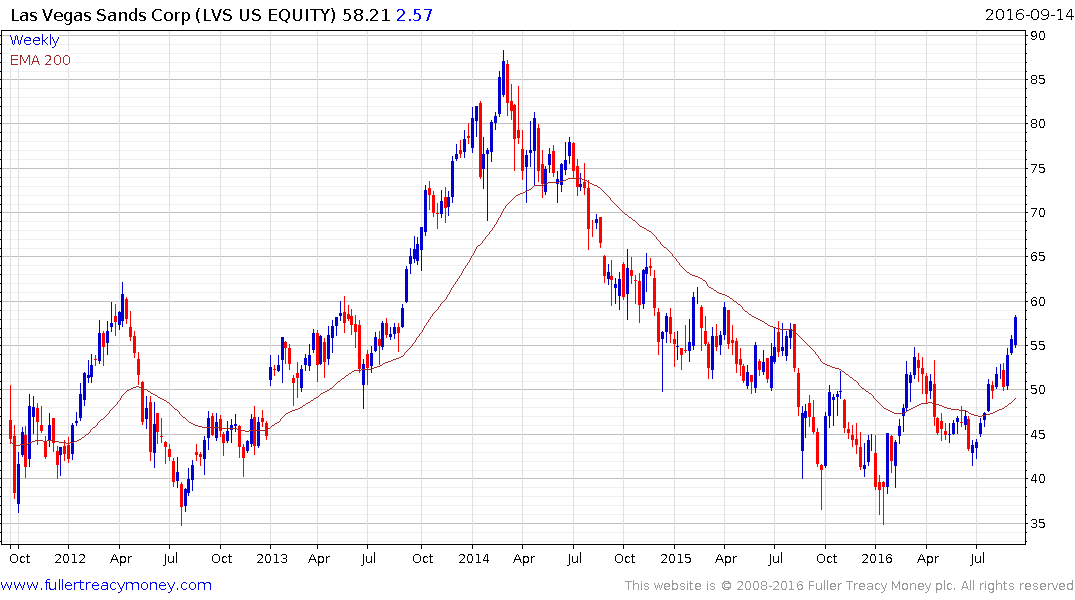

Las Vegas Sands broke to a new recovery high last week and a downward dynamic would be required to check momentum.

.png)

Melco Crown Entertainment rallied this week to break a more than two-year progression of lower rally highs.