Global Top 100 companies by market capitalisation

This report from PWC was dated March 31st but only crossed my desk this week and I thought it still worth highlighting not least because of the buyback figures for 2016 and 2017 which have been superseded this year. Here is a section:

Apple distributed $31bn to shareholders in dividends and share repurchases in 2017 - an increase from the $29bn distributed in 2016.

A total of $704bn has been distributed to shareholders by the Top 100 companies.

US companies, representing 54 of the Top 100 companies, accounted for $476bn of the total value distribution.

Unchanged from last year, companies in the Financial sector continued to return the highest total amount of $183bn (2016: $153bn) to shareholders, followed by companies in the Technology sector which returned a total of $121bn (2016: $110bn).

Share buybacks boosted the 2.2% dividend yield to an overall of 3.5% by reference to market capitalisation.

The relative attraction of cash with interest rates at 2%, and soon to be 2.25%, is now better than the dividend yield on the S&P500 which is 1.79%. However, since so many companies are buying back their shares it is arguable whether this is a fair comparison. The total return on the stock market compared to a rolled yield on money market funds highlights how much of a spread in return there is between the two asset classes and the premium investors pay for safety outside of crises.

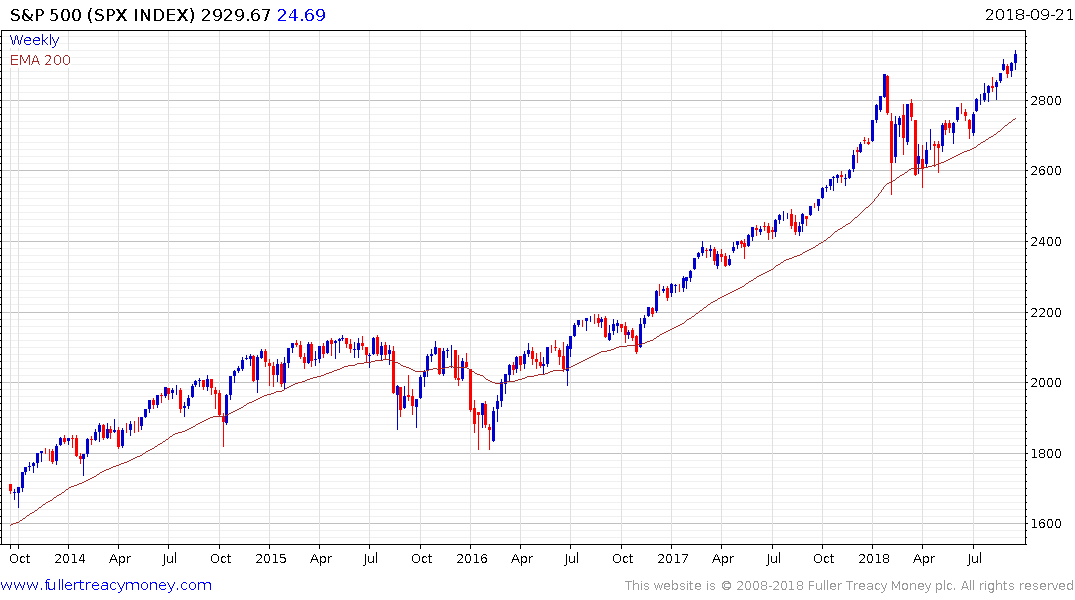

The S&P500 hit a medium-term low in February, spent seven months ranging with an upward bias and broke out to new highs in August. It reasserted on the upside this week and a break in the sequence of the higher reaction lows would be required to question medium-term scope for continued upside.