Global Themes Review November 2021

A year ago, I began a series of reviews of longer-term themes which will be updated going forward on the first Monday every month. The last was on October 1st. These reviews can be found via the search bar using the term “Secular Themes Review”.

The metaverse has captured the imagination of many investors over the last month. It’s an online world that accepts real world money and is growing at an exponential rate. The value being created rests on the assumption someone will put more value on the space or bauble than you, at some point in the future. Stories of people making 1000x on their investments are not uncommon so it is understandably creating a great deal of excitement in the online community.

The fact this is occurring as an offshoot of the cryptocurrency sector is unsurprising. Bull markets find ways to continually increase leverage in the system. Binance, for example, recently limited leverage to 40 times but 100 times is still easily available. The introduction of futures-based ETFs for bitcoin and the options that trade on them has re-upped the leverage in the system. On top of that we have the money pouring into the NFP and metaverse offerings through the medium of cryptocurrencies.

Every big bull market, fuelled by a major financial innovation, opens up a pathway for money and credit to flow into new asset classes and eventually leads to an historic bubble and subsequent crash. Everything from the creation of financial futures (Tulip mania) to the limited company (South Sea bubble), private credit creation (Mississippi bubble) to margin trading (1920s), to index futures (1987), internet/disintermediation (1999) to credit default swaps/CDS (2008) has resulted in a record-breaking bull market and subsequent collapse.

Blockchains, smart contracts, distributed ledgers and new forms of fraction ownership are genuine financial innovations. They will form part of the tapestry of the global financial infrastructure of the future. At present, that infrastructure is being built, in just the same way that the 1990s boom built the internet. There is no sign this trend is over and will probably accelerate even more.

At present bitcoin is consolidating in the region of its all-time peak and ethereum is outperforming once more as it extends the move to new all-time highs.

.png)

Bitcoin is the most conspicuous success story from the decade of low interest rates. It is by no means the only one. The continued outperformance of the FANGMAN+T (Facebook, Apple, Nvidia, Google, Microsoft, Amazon, Netflix and Tesla) stocks is also an important group to monitor as a gauge of the persistence of this bull market.

When we look at the relative performance, it had a good-sized shakeout from the initial peak in August 2020 and is now retesting that level. As long as that remains the case there is no reason to question the potential for continued upside.

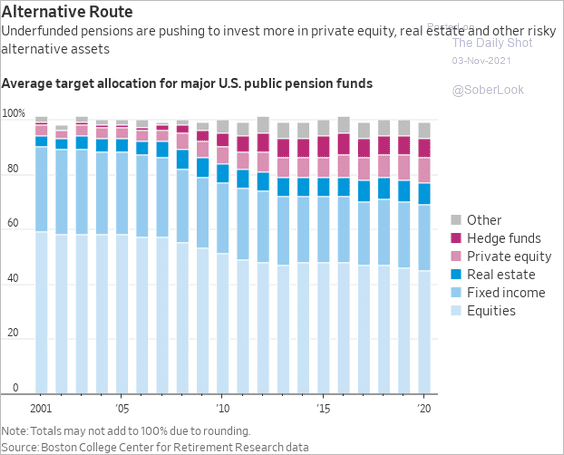

The surge of interest in the private assets sector has not been limited to the crypto sector. The success of university endowments in pioneering investment in alternative assets has been well publicized and most pension funds now follow a similar strategy. They get outsized performance and it offers a handy solution for how to deal with an extraordinarily low interest rate environment. The risk is they are substituting liquidity for performance and that exposes them to mark to market risks in a downturn. The absence of anything to challenge the trend, to date, only means the flow of funds will continue.

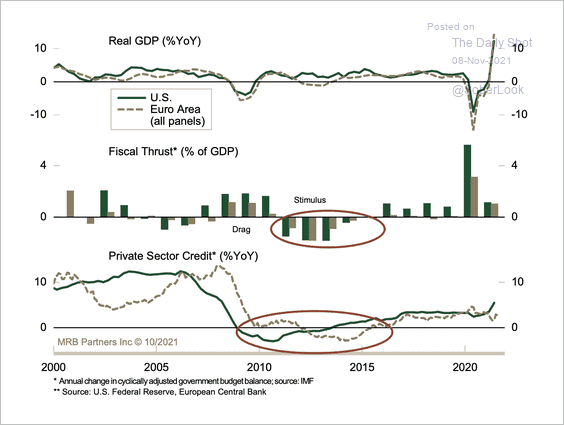

That begs the question, how do bubbles eventually end? They float higher on a tsunami of liquidity so it is when that liquidity becomes more expensive and less available that we need to be particularly vigilant. It is no coincidence that the crypto sector has boomed during an era of record low interest rates and abundant credit. Its continued success is tied to the persistence of that condition.

Bubbly conditions arise because of policy mistakes. That’s where we are at present. For decades central banks were worried about inflation and acted to ensure it would not take off by snuffing out liquidity provision whenever it looked like it might trend higher. That suite of policies ensured the triumph of deflationary pressures and was aided by the march of technological innovation. They are now more worried about deflation than inflation and are reluctant to inhibit inflationary pressures lest they prove transitory.

That’s the logical conclusion from all the talk of transitory inflation. They want inflation to trend and that is what is happening. Just like any other trend the initial data points are volatile. We’ve seen booms and busts in everything from lumber to iron ore and shipping rates.

The Breakwave Dry Bulk Shipping ETF experienced a sharp pullback over the last month and found at least near-term support today in the region of the trend mean.

The Breakwave Dry Bulk Shipping ETF experienced a sharp pullback over the last month and found at least near-term support today in the region of the trend mean.

Stock market valuations contracted over the last year because earnings were so strong. That was enabled by massive monetary and fiscal stimulus. It is the fuel for the breakouts currently in evidence internationally from Wall Street to Europe and Japan. It is also a result of major central banks and governments leaving financial conditions in a very lax position for a prolonged period.

That was further exaggerated last week when the Bank of England demurred from raising rates, the ECB stated they would not raise rates until 2023 and the Federal Reserve said they will not raise rates until they have full employment.

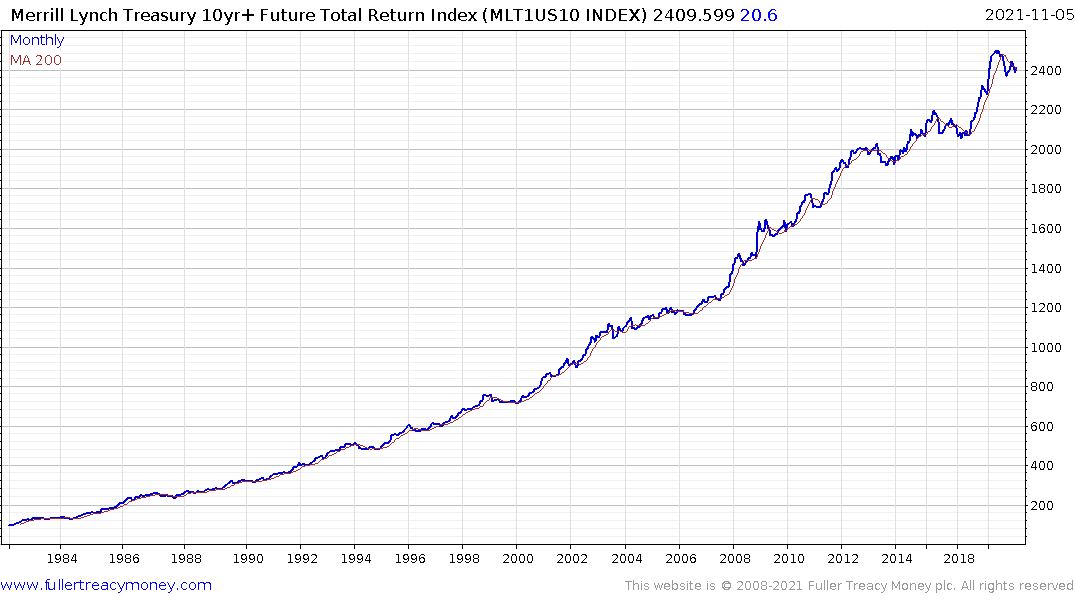

Nevertheless, government bond yields are not trending higher because investors are willing to give the benefit of the doubt to the hope inflationary pressures will moderate. The total return on a rolled US Treasury futures position has been ranging for a year but is still in an overall uptrend.

Nevertheless, government bond yields are not trending higher because investors are willing to give the benefit of the doubt to the hope inflationary pressures will moderate. The total return on a rolled US Treasury futures position has been ranging for a year but is still in an overall uptrend.

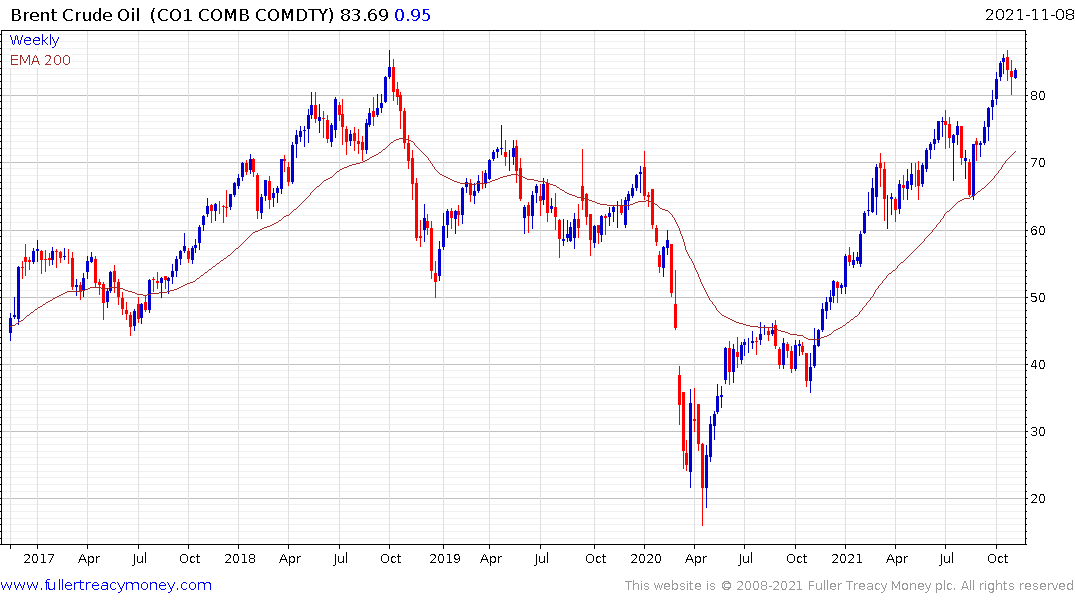

Energy prices remain strong. The twin effect of OPEC+ refusing to respond to high prices by increasing supply and the reluctance of investors to fund oil production development outside OPEC is contributing to higher prices. Concurrently, Russia is squeezing Europe in an attempt to get long-term supply contracts signed which is supporting the higher price at present. https://ig.ft.com/europes-gas-crisis-pipelines-explainer/ This sector needs to be monitored because surging energy prices cause recessions. They act as a tax on consumption. New highs on oil would be a significant lead indicator for future trouble so we are along way from that position right now.

That’s abundantly clear in the fertilizer sector where companies are having a hard time meeting production demand because of energy costs. When that is twinned with the difficulties farmers have had in sourcing migrant labour, there is potential for significant upside in agricultural product prices over the coming year.

The futures-based Invesco Agriculture Fund continues to range below $20 and is reliant on backwardations and strong trends to generate performance. Meanwhile wheat, palm oil and sugar continue to trend higher. Feeder Cattle futures have base formation completion characteristics.

The rising number of coups in Africa is at least partly to blame on rising food prices and the willingness of some countries to deal with governments that come to power through violent oppression. This is a symptom both of the deteriorating geopolitical environment and the rising cost of commodities.

As with any trend, there are periods of strong appreciation, and dips where the trend is questioned. One of the most significant trends over the last year has been the shortage of semiconductors. It’s been a major contributing factor to inflationary pressures.

The refusal of car companies to commit to long-term ordering patterns resulted in a massive supply squeeze because manufacturers were unwilling to boost supply without commitments from buyers. The pandemic resulted in outsized demand from traditional buyers and the result was a supply shortage of epic proportions.

Taiwan Semiconductor announced in July they would increase supply by 60% by the end of the year and expect the shortage to persist into 2022. Volkswagen stated in September they don’t expect to hold as much inventory of new vehicles as before but they expect to have no shortages in the 2nd half of 2022. Qualcomm stated on Friday they expect the shortages to abate by the middle of next year too. They are probably the most successful of the chip companies in managing supply chain issues but the end is in sight for this source of inflationary pressures.

![]()

The Philadelphia Semiconductors Index remains in a consistent uptrend and continues to hold the breakout to new highs.

Anyone who pays household bills is fully aware that inflationary pressures have been rising for years and are now accelerating. The two measures central banks focus on are wages and accommodation prices. The most significant repercussion of generous unemployment benefits has been to convince workers they are entitled to higher wages.

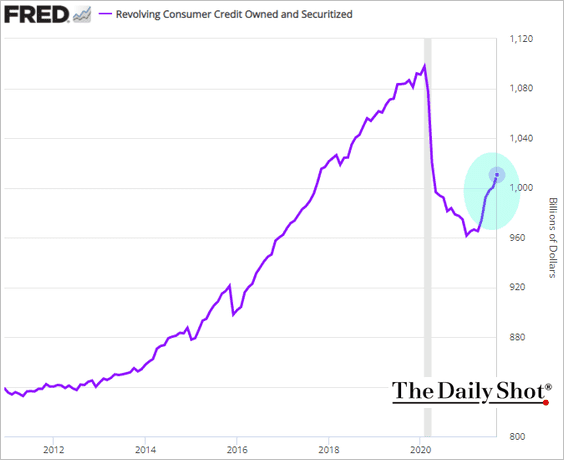

Higher savings and strong equity market performance have allowed workers to stay outside the workforce and they are unlikely to come back until their money runs out. In that vein, credit usage is starting to pick back up which suggests more demand from credit instead of paying with cash. As that trend reaccelerates it will encourage more people to take jobs. They will still demand higher wages and more benefits but there is likely to be a significant uptake of vacant positions as savings run down.

All of this points to very lumpy inflationary data. Within the next six-nine months there is going to be a very heated argument about whether interest rate hikes are justifiable. There will be arguments both for and against with energy and asset prices being the clearest reasons for raising rates. The fact it is not a straight forward answer is likely to continue to support asset prices.

The Nasdaq-100 has one of the most consistent trends of any major index. As long as it sustains the currently breakout and continues to range and trend, the benefit of the doubt can continue to be given to the upside even as bubble risk grows.

The Nasdaq-100 has one of the most consistent trends of any major index. As long as it sustains the currently breakout and continues to range and trend, the benefit of the doubt can continue to be given to the upside even as bubble risk grows.

Financial conditions are still very supportive, high yields spreads are extremely tight and the yield curve spread is only beginning to contract. All that points to a continued bull market because liquidity is still very abundant.

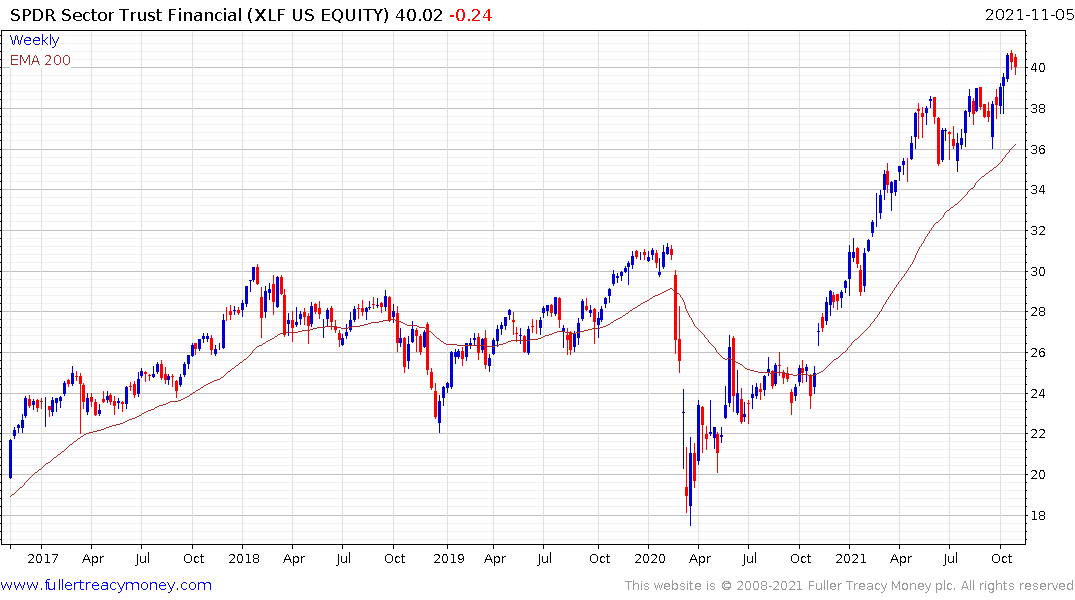

The Financial SPDR remains in a consistent medium-term uptrend.

The Financial SPDR remains in a consistent medium-term uptrend.

Central banks are inhibited from raising rates because they are worried inflationary will not be transitory, that the recovery is not self-sustaining and that any increase in rates would cause undue fiscal stress of governments. That’s a particular risk for the USA because of the short duration of outstanding debt and for countries with elevated property prices where floating rate mortgages proliferate.

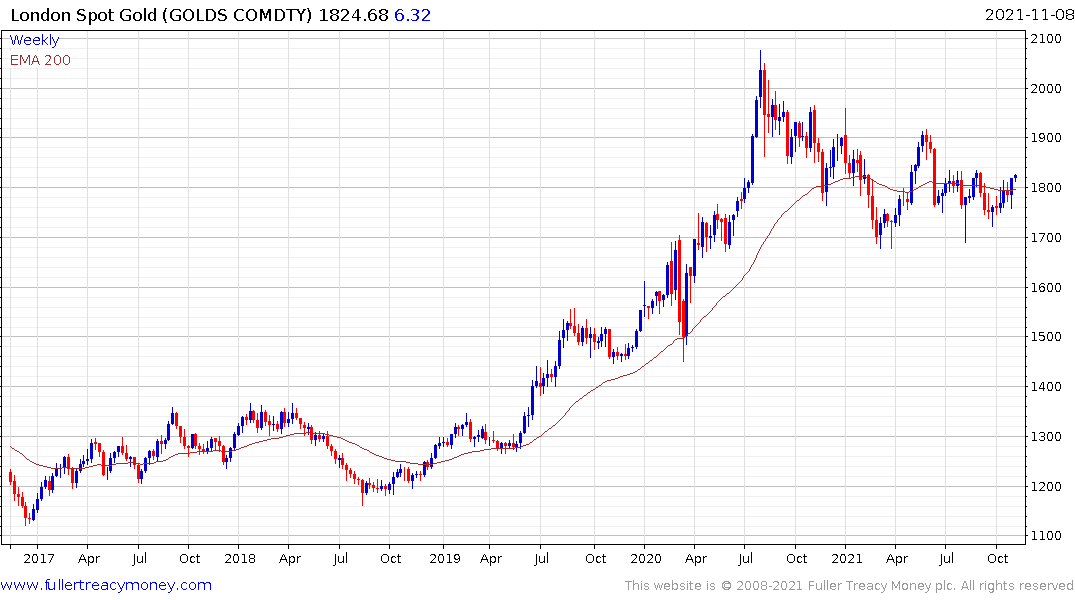

That’s creating a very bullish backdrop for gold. With inflationary pressures trending higher in a jerky manner and central banks impeded from normalising policy, gold store of value characteristics are burnished. It is not at all unusual for gold prices to range for more than a year at a time and the price has been developing a triangular pattern for the last six months. That suggests the breakout, when it comes, will be particularly emphatic and the subsequent explosive move will be surprising in its ferocity.

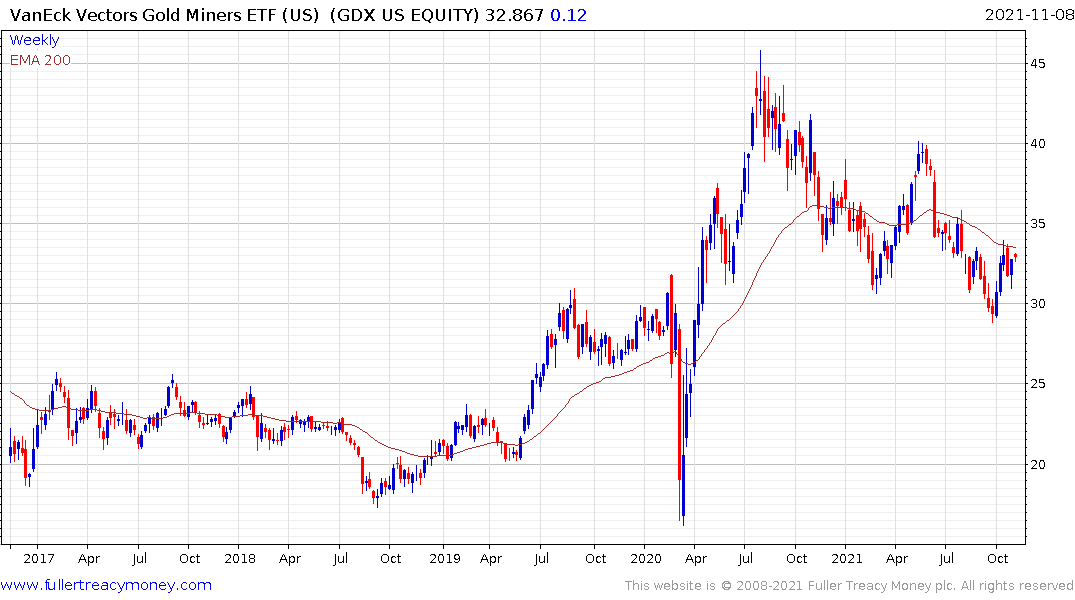

Gold shares has sold off aggressively over the last six months. Investors have been worried about the role of higher energy costs in curtailing profitability. They also fret about the need to invest in additional new supply considering there have been no new major discoveries for four years.

The good news is gold miners are much more disciplined about costs today than at any time in recent memory. The all-in sustaining costs metric, imposed during the bear market, ensures investors have a conservative estimate for the cost of production. That means gold miners can offer leverage to the gold price in this cycle.

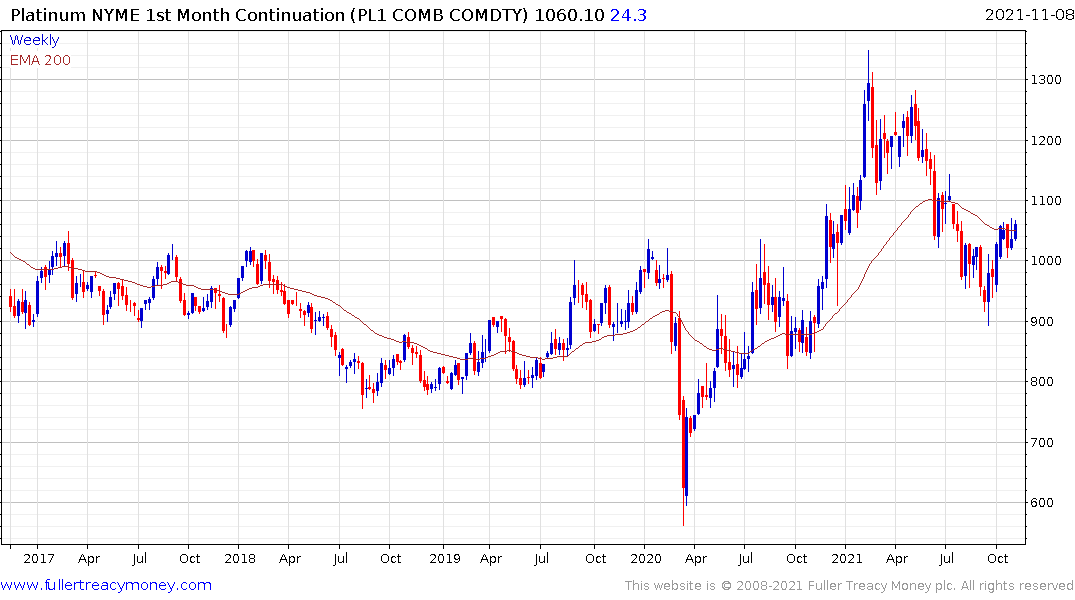

Silver and platinum both have first step above the base characteristics.

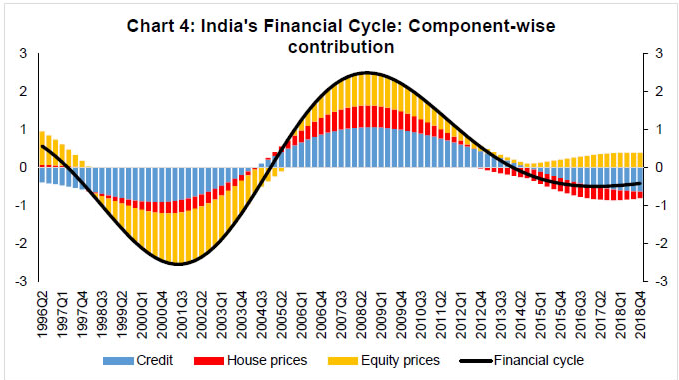

With inflationary pressures rising, the relative attraction of emerging markets is also burnished. They tend to have higher growth rates and have more recent experience of dealing with inflation so they have scope for outperformance. That’s especially true of India because the RBI has identified the beginning of a new credit cycle.

.png)

The Aberdeen New India Investment Trust remains in a consistent medium-term uptrend.

India is also enjoying an additional tailwind because it is being relied on to act as a counterweight to China’s dominance of the Asian region. That suggests India will be provided with whatever it needs to ensure it is an economic success.

![]()

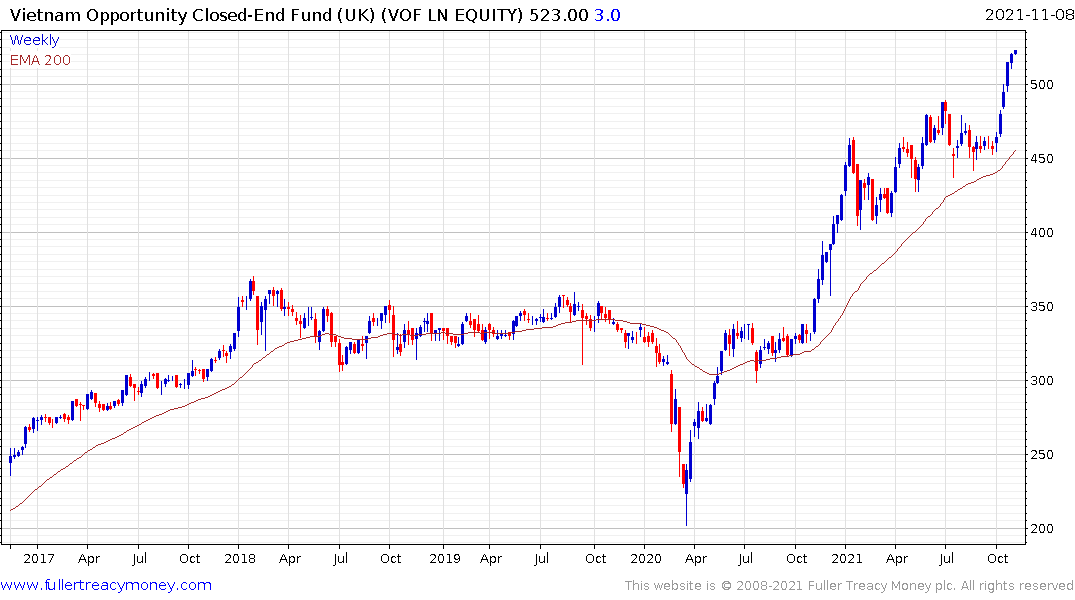

That also supports the outlook for Mexico, Vietnam and Indonesia.

Meanwhile the impending formal announcement of Xi’s historical resolution is designed to allow him rule for life and will encode his though process into how the country is managed. That suggests common prosperity is not only a jingoistic phrase but will elevate the ideals of communism to a position where a market economy will only be tolerated in so far as it serves the common weal.

The excising of the tutoring sector from the economy, ensuring it is now a non-profit, with adult training courses the only opportunity for gain, is a perfect example of that trend. The extent to which social media will be tolerated is yet to be determined. Meanwhile, the desire to become fully independent of global supply chains it does not have full control over remains a central theme.

The big outstanding question is centred on whether China’s rulers have concluded property price inflation is creating a systemic risk to single party rule. The practice of creating off balance sheet vehicles to allow property developers to fund the purchase of land sales has created a liability of unknown proportions for the central government. Efforts are underway to quantify exactly how big the debts are but the most conservative estimate is China’s total debt to GDP has doubled in the last decade.

The CSI Real Estate Index is barely steady in the region of the lows 2015.

Meanwhile, copper remains in a secular bull market where new sources of demand are outweighing the threat of slowing Chinese economic growth. With COP26 concluding soon, momentum for investments in renewable energy infrastructure is baked into plans for future expenditure.

The solar ETF popped on the upside over the last couple of weeks to confirm support in the region of $80. The wind ETF has so far failed to rebound. The challenge for both these sectors is the reliance of low interest rates to fund growth and the intermittency of revenue streams subsequently.

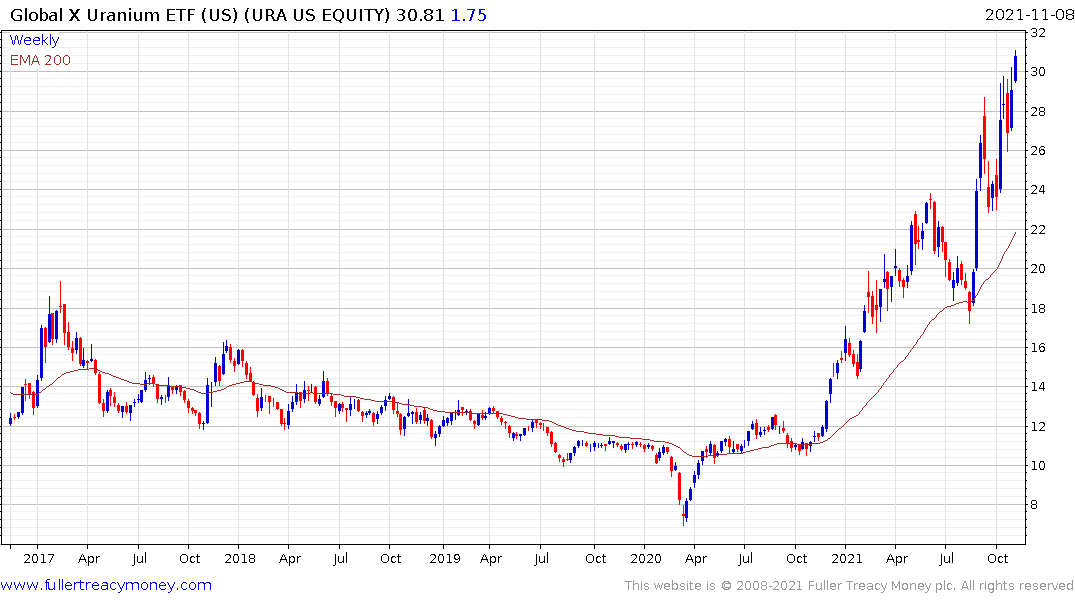

The uranium sector remains a significant new demand growth sector because it is carbon free and provides base load electricity irrespective of climate conditions.

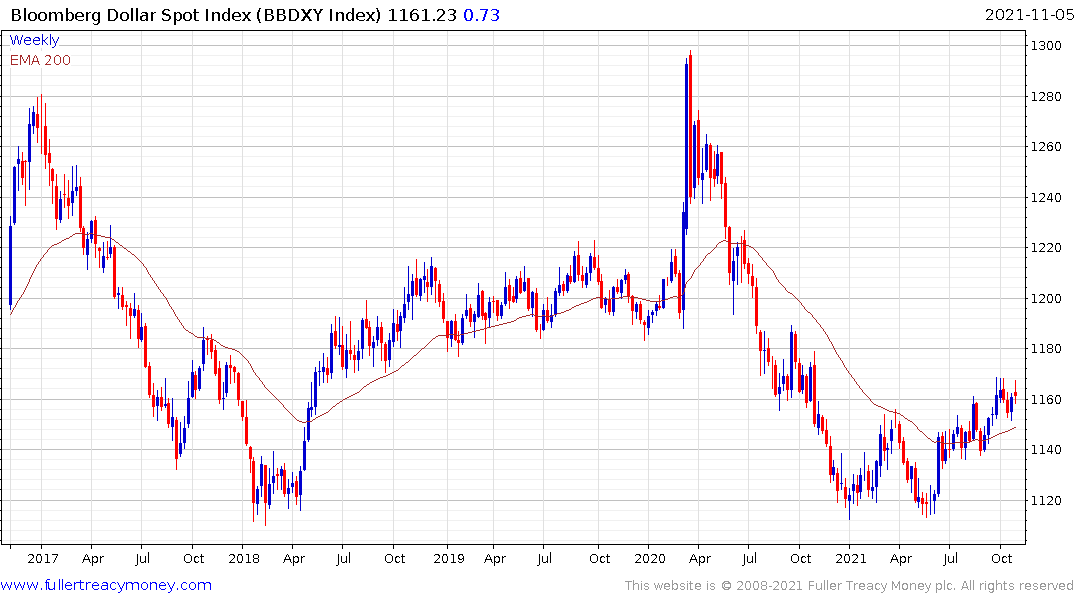

The big question for the dominance of resources/emerging markets over the stretched valuations in the tech heavy Wall Street indices is when will the Dollar roll over. With so much uncertainty about China and the potential they will be forced to devalue the Renminbi, the Bloomberg Dollar Index remains quite firm. That suggests developed markets will remain magnets for capital until some occurs to damage the safe haven credentials of the Dollar.