Global Thematic Diary June 12th 2020

Thanks to Iain Little for this edition of his investment note. Here is a section:

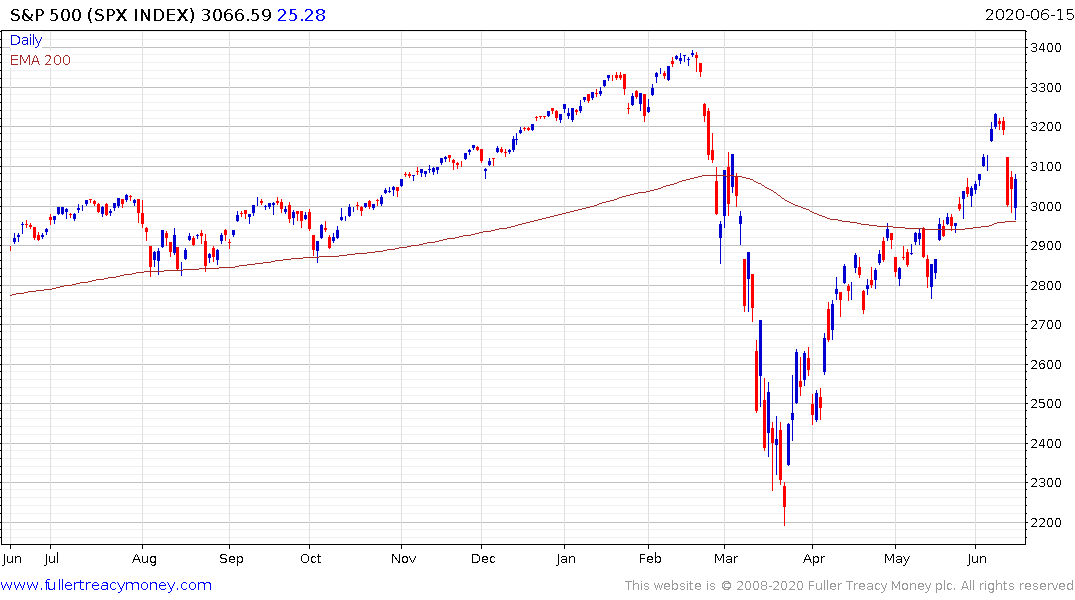

After the recovery from the 23rd March lows (supreme irony: the very date that many countries went into social and economic “lockdown”) and the -6% mini-crash last Thursday, we see stock markets as being in a redistribution phase as “shareholder regret” kicks in. Nervous Nellies who regret holding equities will either exit altogether (“phew, I’m out!”), or switch money into “cheaper”, lagging sectors like banks, oils, real estate, airlines. Optimists will do something similar except that they’ll be more inclined to hold onto the quality (tech, healthcare, FMCG) that has stood them in good stead. These bulls will regret not holding lower quality sectors if their relative outperformance starts to slip. So lower quality could out-perform higher quality for a while. But….Caution!

A man-made Frankenstein (Modern Monetary Theory, which means hiring monetary policy to do the job of fiscal policy) is ringing an early bell for “stagflation” (low growth plus inflation). There may not be enough global demand or monetary velocity to revive stagflation…..yet. But survivors of the 1970s know what this implies for portfolios at the end of the day: inflation-proof growth equities, index linked bonds, real assets and……gold.

Here is a link to the full note:

We are at a very interesting point in the market. There are completely different ways of looking at the market. For those who are long, the clearest rationale is $10 trillion has been thrown into the global market and more is on the way. One way or another that is going to inflate asset prices.

For those still sitting on the side lines the calculus is more complicated. The more cautious approach is to rationalise that following an historic decline, it is reasonable to expect a snap back in the opposite direction following the peak of fear. However, the big question is what happens afterwards? That is the primary reason for caution.

There is solid evidence that COVID-19 amounts to little more than a bad flu in terms of fatalities. The primary challenge is how quickly it spreads, which threatens the ability of healthcare systems to function. There are continued rising cases in areas which had previously been spared high infection rates such as Arizona, Florida and Texas. However, the rate of infections in areas which have been hit hard appears to be under control.

We are likely to approach a point over the summer when everyone has become accustomed to the new normal and the stimulus money has been spent. That will be when the economic bounce is most likely to moderate. Therefore, the real risk to the market is not from the virus resurging but from the lack of a catalyst to spur additional monetary and fiscal flows. The fact the market bounced today following news of additional case surges globally supports the view that bad news is good for stocks because of the likelihood it will support additional stimulative measures. The Fed’s announcement today that it will now also buy individual bonds is a case in point.

The best-case scenario for the wider market is today’s lows hold. If the S&P500 can hold the 3000 level that would be a very firm signal of support coming through in the region of a previous area of resistance. Meanwhile, I intend to retain my short in the Nasdaq-100 for a while longer.

Meanwhile gold prices remain steady against the Dollar as investors hedge against downside risks.

The clear message, however, is that stock market performance is coming at the expense of the value of the Dollar. There is now clear potential it will be the primary victim of stimulative policies. That greatly increases scope for inflation to eventually come to the foreground of investor thinking.