Global Strategy Weekly April 16th 2020

Thanks to a subscriber for this note by Albert Edwards for Soc Gen which maybe of interest. Here is a section:

Here is a link to the full report and here is a section from it:

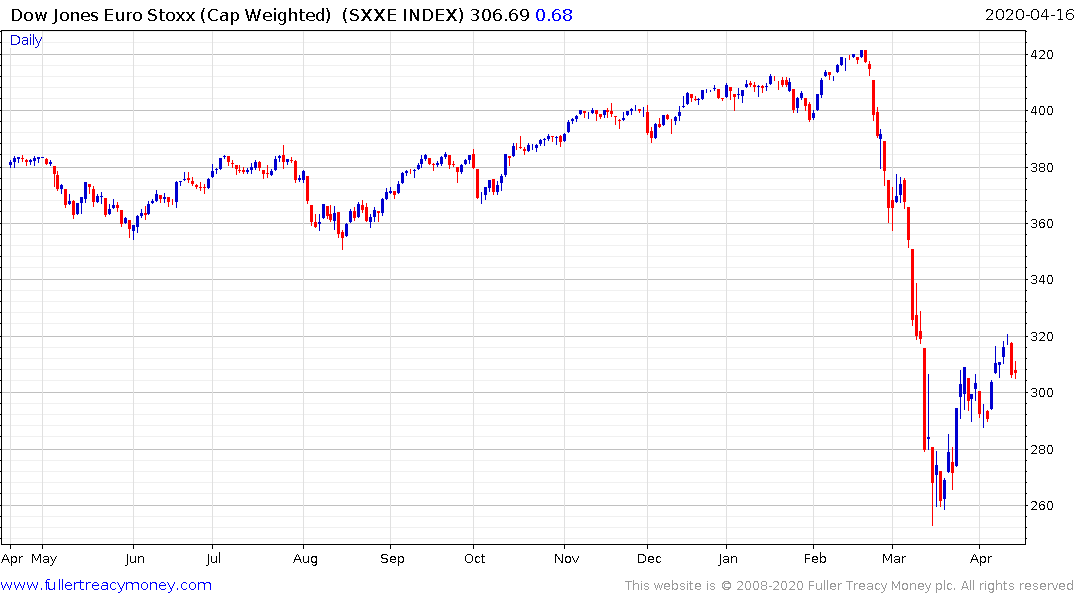

Despite the improvement in mood in the equity market because of the “whatever it takes” policy headlines, perhaps all we have witnessed is a typical technical rally from extremely oversold levels. If this is so, with some commentators having already flipped and called the equity bottom, any relapse to a new low will decidedly sour the mood.

If as seems entirely plausible to me, the equity market renews its slump, how long will we have to wait before the Fed starts buying S&P ETFs to add to its newly acquired "junk" ETF collection? A decline in the S&P below 2190, the intraday 23 March low, will likely get the Fed twitching anxiously, and if it falls 40% from its 19 February 3390 peak to around 2,000, I would expect to see the Fed step in and start buying equities! For many that will certainly mark the bottom and the market will likely surge again. That may not be the end of this equity bear market though - after all the BoJ buying Nikkei ETFs hasn’t worked so well, has it?

Central banks have been particularly firm in stating they will do whatever it takes to support the market. If the measures currently in place do not succeed in that ambition, I have no doubt purchasing equities will be a part of future suite of policy initiatives.

Apple, Microsoft, Alphabet, Amazon and Facebook have more than $500 billion in cash on their balance sheets. Berkshire Hathaway is sitting on over $120 billion. Meanwhile private equity and distressed debt funds are rapidly raising capital aimed at prospering from significant mispricing in the travel/leisure sectors.

It is possible the Fed will buy ETFs or stocks outright. Additionally, the massive cash accumulation of mega-cap shares could possibly be deployed in quasi-banking lending programs. Meanwhile there are clearly going to be fortunate distressed investors that step in to buy beaten down stocks.

The biggest point is stocks are more reliable credits than governments right now. It is easy to highlight buying ETFs has not led to an explosive move in Japanese equities but they are trading close to 25-year highs. Meanwhile Switzerland has been buying US equities for a number of years and that continues to support the Franc. It seems to me the real earnings of companies trump the value of bonds when governments are boosting the supply of currency.

Could we still have deflation pressures for another quarter or two. Absolutely. Will there be high default rates in commercial property, auto loans and potentially mortgages There are certainly likely to be spots of severe pressure. We are almost certainly going to get some consolidation of the rebound quite soon. For the weaker markets that suggests they will post new lows. For stronger markets the lows might well be in.