Global Recession Looms Amid Broadest Tightening in Five Decades

This article for Bloomberg may be of interest to subscribers. Here is a section:

The global economy may face a recession next year caused by an aggressive wave of policy tightening that could yet prove inadequate to temper inflation, the World Bank said in a new report.

Policy makers around the world are rolling back monetary and fiscal support at a degree of synchronization not seen in half a century, according to the study released in Washington on Thursday. That sets off larger-than-envisioned impacts in sapping financial conditions and deepening the global growth slowdown, it said.

Investors expect central banks to raise global monetary policy rates to almost 4% next year, double the average in 2021, just to keep core inflation at the 5% level. Rates could go as high as 6% if central banks look to wrangle inflation within their target bands, according to the report’s model.

When quantitative easing was first introduced there was a lot of handwringing at the thought of moral hazard. The Federal Reserve waded into public markets to buy sovereign bonds with the stated aim of back stopping government spending and encouraging speculation. It was viewed as a very risky endeavour that would send the wrong signal to speculators; that they can’t lose. In 2012/13 the EU went in the opposite direction and withdrew liquidity for fear that debtor nations would not mend their ways if assistance was too generous.

The one thing the average US consumer has learned over the last three years is the government will do anything to avoid social distress. Direct payments to consumers, moratoriums on evictions, financial support to avoid bankruptcies, debt holidays, cancelling student loans. With that knowledge, why save for the future? Retail sales are still steady and credit card usage continues to recover and consumers expect to be made whole in the event of an economic contraction. That’s a major support for the impression that inflation is entrenched.

The only way to kill off inflation is to disabuse consumers of the idea they will be bailed out from risky behaviour or from deciding to refuse work opportunities. That means tolerating a recession, providing only as much assistance as is required and withdrawing the punchbowl faster than in the last three cycles. Avoiding the risk of a depression would imply a double dip recession with a short bounce of positive growth in between. Without that willingness to inflict pain, inflation will certainly become/remain entrenched.

The biggest issue at present is no one is currently talking about the risk of a crash. The European energy crisis, China’s property bubble potentially bursting, bitcoin under pressure and undisclosed risks in private markets and rising yields everywhere suggest something is going to break. It’s only a question of how much contagion that will cause.

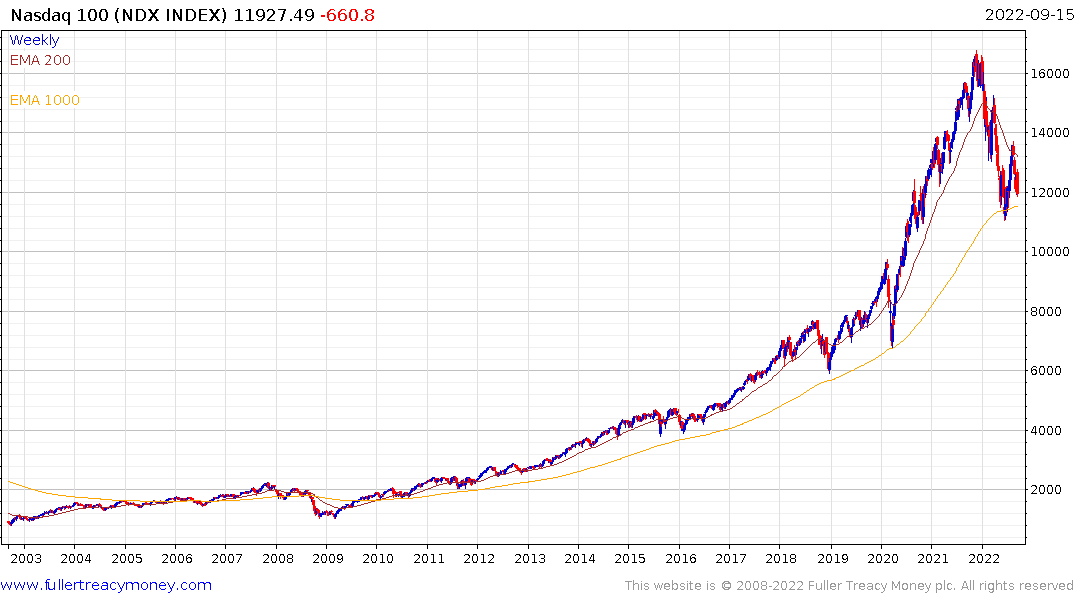

The Nasdaq-100 is testing the 1000-day MA. A sustained move below that secular trend mean would intuitively break the secular trend. That would raise the scope for a secular process of P/E ratio contraction and rising yields.