Global Money Notes #28 Lombard Street and Pandemics

Thanks to a subscriber for this edition of Zoltan Pozsar’s report on global money market liquidity. Here is a section:

Here is a link to the full report and here is a section from it.

The swap lines were originally designed to help the funding needs of banks during 2008; they work by the Fed lending dollars to other central banks which then lend it to banks. But since the financial crisis, non-banks eclipsed banks as the biggest borrowers in the FX swap market: a hallmark theme of the post-QE global financial order has been the secular growth of FX hedged fixed income and credit portfolios at non-bank institutions like life insurers and asset managers – the new shadow banking system epitomized by money market funding (FX swaps) of capital market lending (Treasuries and credit).

Unless these non-bank entities get access to dollar auctions – from local central banks – FX swap spreads may remain wide if banks won’t serve as matched-book intermediaries.

There is a growing risk that such intermediation will fracture as the assets that FX swaps fund include not only Treasuries but credit and CLOs too. Credit quality is fast deteriorating across various sectors and that makes it riskier for dealers to fund some life insurers through FX swaps, just like it became riskier to fund some insurers during the 2008 crisis.

Over the past five years balance sheet and the availability of reserves were the main drivers of spreads in the FX swap market. It’s time to think about credit risk creeping in to funding markets through the asset side of some portfolios funded through FX swaps.

Fourth, the geographic reach of the swap lines is too narrow.

The Fed has swap lines only with the BoC, the BoE, the BoJ, the ECB and the SNB, and that’s because the 2008 crisis hit banks mostly in these particular jurisdictions.

But the breadth of the current crisis is wider as every country is struggling to get dollars. The dollar needs of Sweden, Norway, Denmark, Hong Kong, Singapore, South Korea, Taiwan, Australia and Brazil and Mexico seem particularly striking for a variety of reasons.

Scandinavia countries, like Japan have large dollar needs due to institutional investors’ hedging needs and only Norway is endowed with large FX reserves to tap into. Mexico is dealing with a terms of trade shock due to the collapse of oil prices. Southeast Asian countries that serve as banking centers need U.S. dollars to clear dollar payments and countries like South Korea and Taiwan have life insurers with meaningful hedging needs.

The Fed’s dollar swap lines need to go global; the hierarchy needs to flatten.

The message for central banks that emerges from this brief note is this:

backstop not only the banks at the core of the financial system, but also markets and non-banks. The market backstops should include the CD and CP market where we need a buyer of last resort as the structural buyers of paper are losing cash fast; the backstop of the FX swap market should include daily operations at more points along the FX curve.

Like primary dealers offer round the clock liquidity across timezones, dealers of last resort – the central banks of the swap network – should offer dollar liquidity round the clock too.

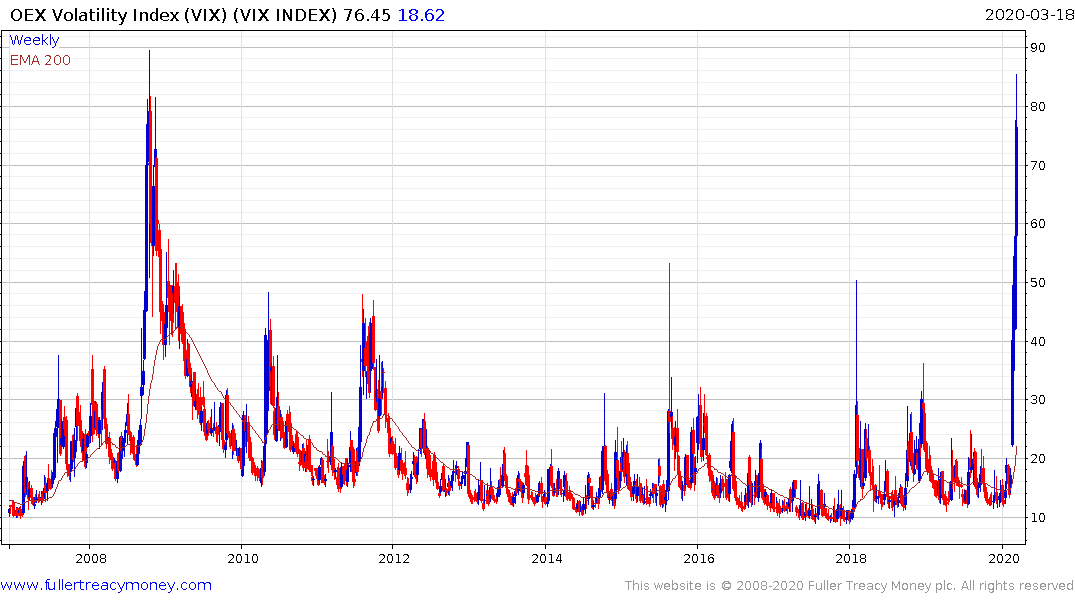

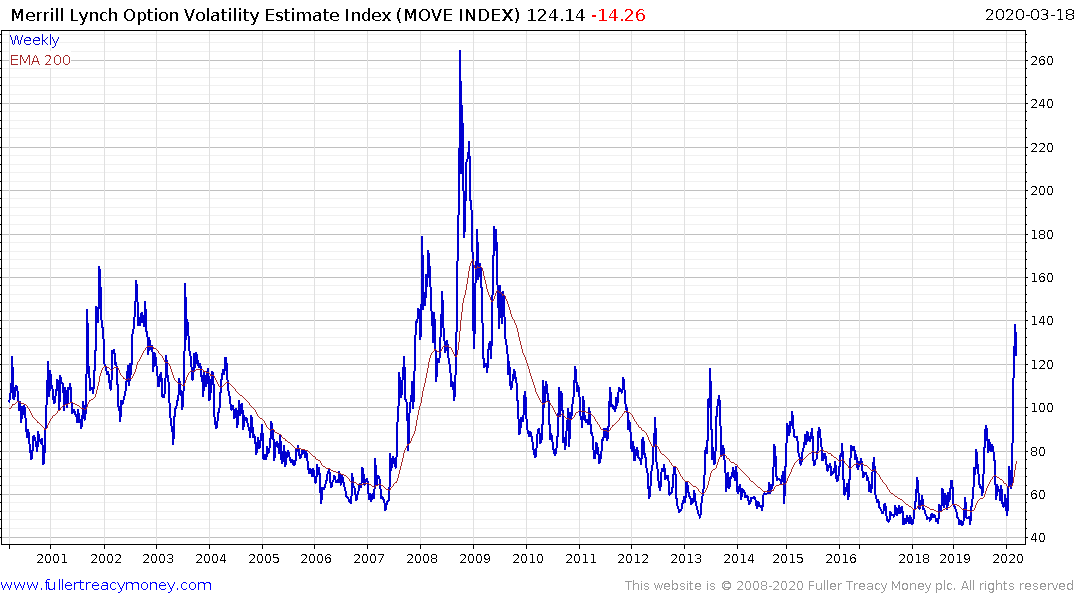

A point I have made repeatedly over the years is understanding how volatility shapes the size of positions in quantitative funds is essential to understanding market structure. The funds which deploy high leverage by betting on low interest rates and record low volatility look like geniuses when times are good but the deleveraging that arises from a spike in volatility can have a swift effect on both performance and the wider market.

Volatility on both equities and bonds is surging. At the same time the inverse relationship between bonds and equities is breaking down. That is particularly deadly for the much-vaunted risk parity strategy which is experiencing its biggest drawdown in years.

I also received this email which has been circulating around trading desks in Asia. It uses more colourful language than the above report but it certainly helps to highlight the fact “nonbank lenders” is a euphemism for hedge funds.

Hope u are well I think we are heading to a total stop in US. This piece is worth your attention...

Guys,

I wanted to share for any input. I’ve been watching what is going on in markets and my conclusion was that Risk Parity has blown up and Citadel and Millennium are in deep trouble. I just received a call from an old GS friend who now runs a large part of a Japanese bank balance sheet in the US and he was highly agitated...

His observation is that Bridgewater has faced massive redemptions from Saudi and others and that is what is caused some of the more dramatic moves last week (gold, bonds, equities and FX). He thinks AQR and 2 Sigma are in the same boat. There is massive forced liquidation of risk parity. All of them run leverage in the strategy, sometimes significant. Sovereign wealth, he thinks, is running for the hills as are others.

As you all know, I think Bridgewater goes under for reason not involving this but the exposure of massive fraud but this will force it.

My friend explained that due to the Volker rules, now that vol has risen, we has to cut risk limits by 80% in many areas – to put it in perspective his Dollar Mex position limit has gone from 200m to 12m. Thus, just when he was supposed to prove liquidity, he has to reduce it. His hands are tied. Even worse, he has to hedge counterparty risk with corp borrowers and that is adding to the tail spin of selling. There is no liquidity from the banks.

The same VAR issue, he claims, is hitting Citadel and Millennium but with a twist. He, along with all the banks, is jacking up lending rates to counterparties from Libor +35 to Libor +90 and he has a $1.5trn balance sheet. The funding stress is forcing banks to reduce lending risk. The issue is that the funding stress is coming from Citadel and Millennium it seems. They rely on repo but via the banks but the transmission mechanism is broken (regulation). It appears that Bernanke probably called Powell and asked him to flood with liquidity at repo but instead of $500bn being drawn, only $78 was drawn. The banks don’t need the cash and don’t want to lend to counterparties. And therein lies the problem – a full credit crunch.

With rates going up, all the relative value trades have blown up. Nothing works any more as they were making 12bps in illiquid stuff on massive leverage (off the runs, etc). As funding goes up, they instantly go wildly unprofitable and are stuck either begging for repo funding or having to unwind and realize massive losses. There is no funding. This is big trouble.

These guys are short vol (VAR), short liquidity and short rates. The perfect fucking storms.

Then on top of that, my friend who was almost yelling to me about it, says he cannot take any risk and therefore cannot provide liquidity. His hands are tied.

COVID makes it even worse and liquidity is going to massively dry up next week and for the next few weeks. You see under Series 24 of FINRA, a trader cannot make markets from home. It is illegal. So, everyone is getting sent home but the traders. The problem is the traders are now falling ill – JPM and CS are the two I’ve heard thus far. They will have to go home and each day more do, or decide they want to, the lower liquidity gets. No one can make markets.

Also, in the corp credit markets things are equally fucked up. Credit, due to the liquidity issues, has stopped trading. That is causing IG etc to blow out. When banks lend to corps, a separate desk (CVA or CPM desk) shorts the stock or buys the CDS etc as a hedge (regulations again) and if the loan is still on the books (they are not allowed to own the bonds but can lend to counterparties, bizarrely) they continues to do that as stocks fall or CDS widens. Essentially, they are short gamma, creating a lob sided market. Everyone is a seller and no one is a buyer. The banks have made money on the hedges while the debt markets get worse.

This is causing the equity value of many firms such as Haliburton, to fall below the debt levels. Whether these borrowers have cash on balance sheet or not is irrelevant because of the falling equity value in this market and from the CVA hedging. That is causing spreads to blow out and it will cause downgrades, thus creating a doom loop.

So, we have a total shit storm if vol stays here for any period of time. I do not see vol falling yet and that is going to cause a really big issue with Citadel, Millennium, all the risk parity unwinds, all the risker credit that is being shorted for hedging and the repo that no one wants in the banks but their counterparties desperately need. Every day this situation continues, the more dangerous it is going to get....

We have a big fucking margin call under way.

In my friends opinion, the only way to stop this is to remove the Volker rule under the emergency powers act ( to allow banks to provide liquidity), the Fed to cut to zero and for them to buy corporate bonds. All the banks have been talking to FINRA and they have said go to the government. Problem is Jamie Dimon is in bed. They need him to run the US Treasury as he is the only person who understands all of this and can navigate it through the politics.

This is likely the fix that needs to happen. What happens to Citadel, Millennium, Bridgewater, AQR, 2 Sigma and the corp bond market until they pull that trigger, I have no idea.

The liquidity conditions and counterparty premiums described in the above email is reminiscent of the market conditions before the Lehman bankruptcy. It has been widely accepted that letting Lehman go bankrupt was a mistake so we are likely to see continued measures to try and inject liquidity into the sector by reducing the threshold for what is accepted as collateral and widening the number of institutions who qualify as counterparties.

The problem is nonbank lenders like Millennium and Bridgewater in particular has been basking in the limelight because of the success they have had in building strategies that “never lose money”. How willing is the public going to be to directly bail out billionaires who have been the biggest beneficiaries of quantitative easing, especially as a new round of QE is only just now getting started. At least one of these big quantitative macro funds is likely to go bust in what is a modern day rerun of the Long-Term Capital Management debacle.

As long as bonds and equities are falling together, we can conclude the deleveraging process is still underway. When it ends there are going to be some very attractive buying opportunities because contagion selling is clearly still underway.