Global Money Dispatch February 27th 2022

Thanks to a subscriber for this report from Zoltan Pozsar for Credit Suisse. Here is a section:

We believe there is no difference between Lehman unable to pay back money funds because its tri-party clearing agent is unwilling to unwind o/n repo trades, and banks unable to receive and make payments because they are out of SWIFT.

The Herstatt risk – settlement risk – owes its name to a mishap at a single bank. The risk in the current scenario involves an entire country’s banking system. Banks’ inability to make payments due to their exclusion from SWIFT is the same as Lehman’s inability to make payments due to its clearing bank’s unwillingness to send payments on its behalf. History does not repeat itself, but it rhymes…

The consequence of excluding banks from SWIFT is real, and so is the need for central banks to re-activate daily U.S. dollar funds supplying operations.

Excess reserves and o/n RRP balances won’t be enough.

And so the Fed’s balance sheet might expand again before it contracts via QT – and not just because of the swap lines. The FIMA repo facility is also there to turn collateral into dollars – anonymously, away from the prying eye of dealers, if a central bank becomes a friendly correspondent for a sanctioned central bank turning gold into cash. That, or an unforeseen call on unwanted reserves in the o/n RRP facility as the correspondents flood the repo market with collateral…

…before QT even began.

Here is a link to the full report.

Jay Powell warned about unintended consequences from sanctions during his Testimony before Congress today. His comments focused on the difficulty of tackling inflation when there are supply issues pushing prices up. He was also rather testy at the charge the Fed contributed to inflation by funding massive fiscal stimulus. His response was that demand is excessively high because of consumer activity in response to the pandemic. The Fed has repeatedly skipped over the question where did people get the money to fund the demand?

The spike in repo rates in September 2019 was a clear signal Fed tightening was at risk of breaking the money markets. They were forced to inject $75 billion on three successive days to bring the rate back down. That action also helped to ensure the Fed was already biased towards easing when the pandemic hit less than six months later.

The spike in repo rates in September 2019 was a clear signal Fed tightening was at risk of breaking the money markets. They were forced to inject $75 billion on three successive days to bring the rate back down. That action also helped to ensure the Fed was already biased towards easing when the pandemic hit less than six months later.

At present there is no pressure evident in overnight repo rates. It is much more likely that sanctions imposed on Russia will have a much more immediate effect on countries reliant on its exports. That is particularly relevant for much of the Middle East and Africa who import wheat from Russia and Ukraine.

Of course, there are also going to be some pressures on funds holding Russian government bonds who are going to have a hard time collecting coupons or principle.

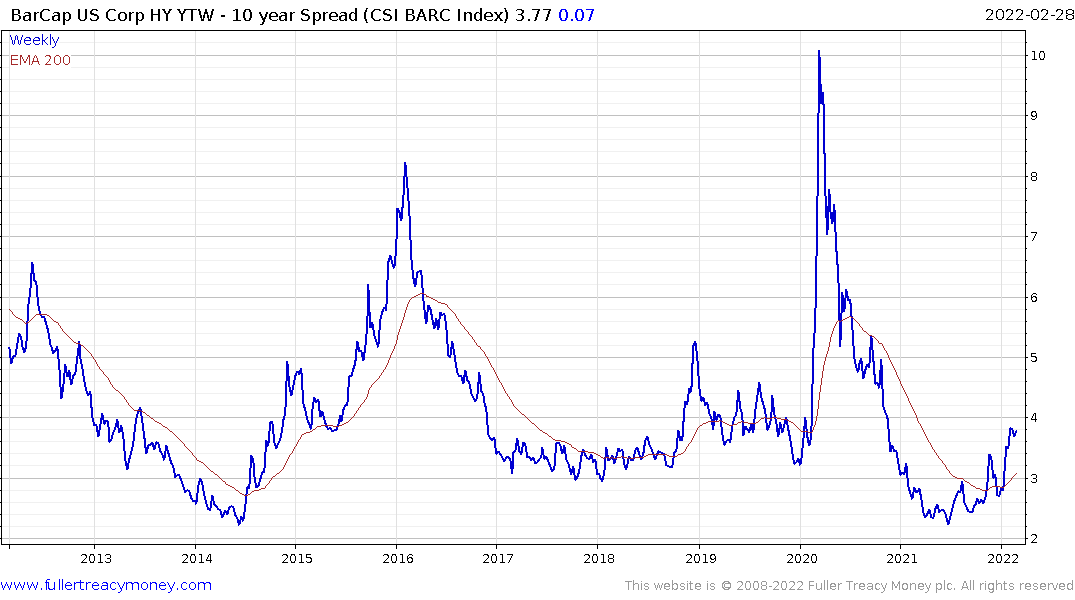

High yield spreads are climbing steadily which suggests funding pressures are percolating through the corporate bond market. The spread is still only at 390 basis points but the uptrend suggests it will likely climb towards troublesome territory, above 500 basis points, before long. The peak in late 2018 coincided with the low Wall Street and so did the much higher peak in March of 2020.

Jay Powell is talking confidently about achieving a soft landing. That implies slower growth and a slow and steady removal of accommodation. There is clear potential the newly admitted to standing repo facility, which is an unlimited liability on the Fed balance sheet, could result in the balance sheet expanding rather than contracting as they pursue a soft landing. Stocks responded favourably to that news and rebounded today to unwind yesterday’s decline.

The rather extraordinary volatility in the government bond markets with a steep decline following yesterday’s surge suggests the Fed’s vision of a soft landing is not going to be anywhere near as easy to achieve as they might wish.

Bitcoin rallied in February to break the three-month sequence of lower rally highs. It then posted a higher reaction low on February 24th. The price is now pausing in the region of the February peak again. As a liquidity dependent asset, it should perform reasonably well as the likelihood of aggressive tightening recedes. A sustained move below the $34,000 level would be required to question recovery potential.