Global Metals Playbook 2Q14 Supply Challenges Ahead of a Cyclical Recovery

Thanks to a subscriber for this report by Joel Crane for Morgan Stanley which may be of interest to subscribers. Here is a section:

Sentiment towards the metals sector has been ambivalent over the last couple of years not least as the mining sector trended lower. This forced management teams to address their overly ambitious growth forecasts and to improve free cash flow which has resulted in their share prices stabilising. Decisions to cancel expansion plans, but keep existing mines open, maintains the status quo and explains the predominately rangebound environment. However this also suggests that there will be issues with increasing supply in future.

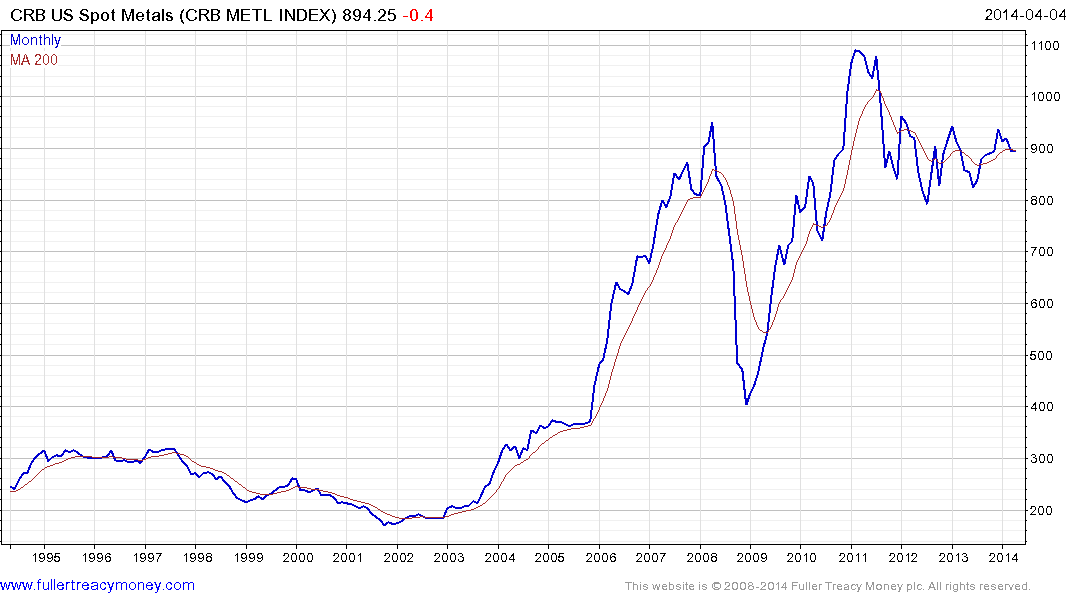

The CRB US Spot Metals Index has been confined to a range above the 800 area for more than three years and has held a progression of higher reaction lows over the last 18-months. It firmed yesterday in the region of the 200-day MA and a sustained move below the trend mean would be required to question medium-term scope for additional higher to lateral ranging.

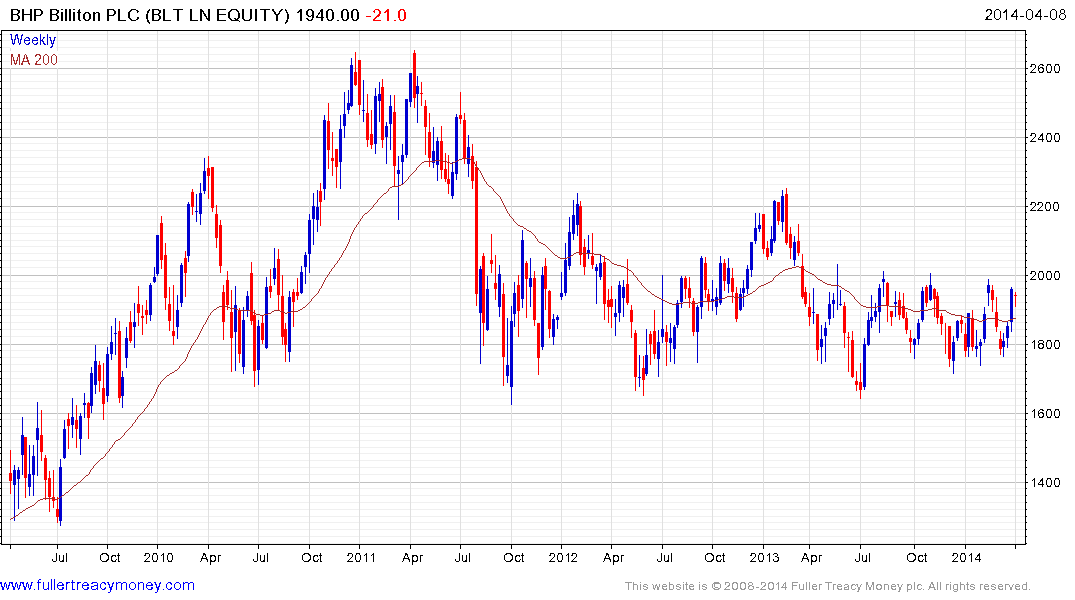

BHP Billiton (P/E 11.91, DY 4.21%) has returned to test the upper side of its range near the psychological 2000p and has at least paused this week. Some consolidation of the short-term overbought condition is likely and it will need to sustain a move above that level to confirm a return to demand dominance beyond the short term.

Back to top