Global Lenders on Edge as Cyber Attacks Embroil More Banks

This article by Michael Riley, Jordan Robertson and Alan Katz for Bloomberg may be of interest to subscribers. Here is a section:

While Swift has for decades made sure its own financial messaging network was secured, less attention was paid to the security surrounding how member banks -- each with their own codes and varying levels of technology -- were connecting. Even today, when it discusses the cyber attacks, Swift emphasizes that its own network wasn’t breached and says its members are responsible for their own system interfaces.

Some U.S. banks are pushing to open discussions with Swift about whether it should have responded more quickly to the breaches and should now help member banks better secure their systems, according to one of the people familiar with the thinking within a large U.S. bank. BITS, the section of the Financial Services Roundtable aimed at combating cyberfraud and other technological issues, could be tapped to broker those discussions, the person said.

More broadly, some U.S. banks expect Swift to come up with a technological solution that could apply to all connected institutions and would help reduce these risks, another person said.

As more banking is conducted online the need for all counterparties to beef up security, and on a global basis, is no longer about choice but necessity. Cyber criminals both private and government-backed have ample resources to probe the global financial infrastructure for weaknesses they can exploit. Therefore it is necessary to insist on greater security across the network to ensure the thefts seen in Bangladesh and now Vietnam do not become common place.

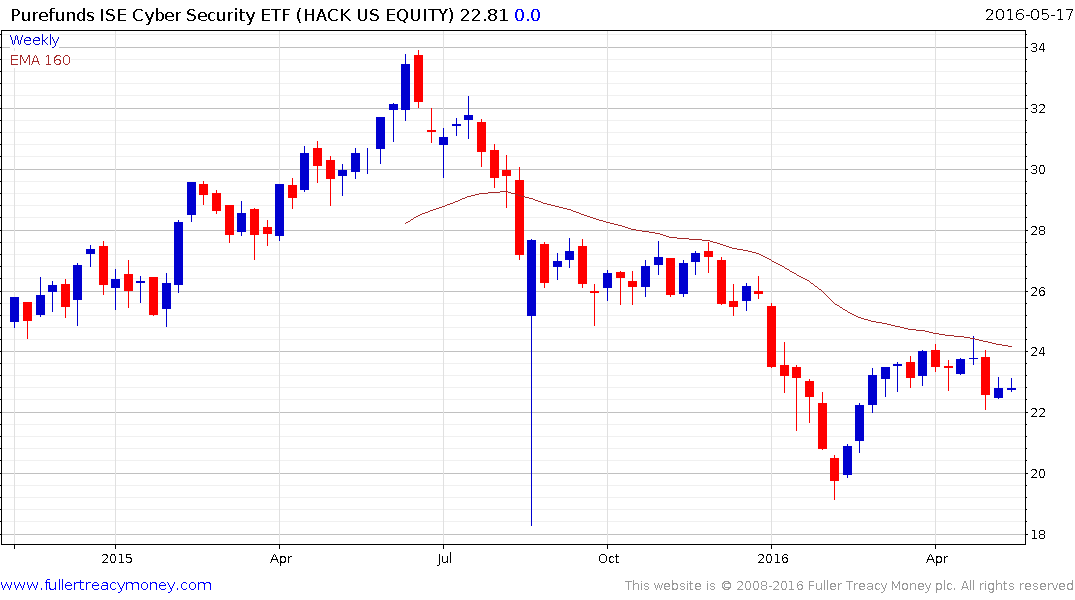

The Purefunds Cyber Security ETF rebounded from the February lows to close the overextension relative to the trend mean and is now consolidating that move. A sustained move above it will be required to signal a return to medium-term demand dominance.