Global Interest Rates in Aggregate

As inflation has continued to surprise on the upside, countries all over the world are accelerating their efforts to raise rates. Brazil’s Selic Target rate is now 12.7% and the EU is beginning to talk about moving deposit rates out of negative territory.

We tend to think of interest rates as barometers of efforts by central banks to control domestic factors. However, there is also the additional point that if interest rates are rising everywhere, the availability of cheap cash is declining and competition for what is available becomes more fervent.

I created a compound index of the short-term rates for the G-20 by taking the respective base rates and totaling them. I had to exclude Mexico, Russia, and Argentina because their data sets don’t go back far enough to give a long-term picture.

I created a compound index of the short-term rates for the G-20 by taking the respective base rates and totaling them. I had to exclude Mexico, Russia, and Argentina because their data sets don’t go back far enough to give a long-term picture.

The resulting chart highlights the fact interest rate compression has been a truly global theme. It also highlights how quickly conditions are tightening globally. The Index has gone up faster than at any time in the last 20 years. It has also achieved aS much tightening in the last 15 months as in the entire hiking cycle between 2004 and 2008.

It’s also worth remembering that Russia’s rate jumped from 4% to 20% and is now 14%. Mexico’s is up from 4% to 7% and Argentina's rates are up from 38% to 49% this year. Pakistan’s KIBOR fixing it is at 14.41%,. Egypt has raised from 8.24% to 11.25% since February.

Goldman Sachs’ Financial Conditions Index continues to rise and is tighter today thaN it was in late 2019. By historical standards this is still not very tight, but the trajectory is clear, and the debt load is much larger now than it was two years ago. That suggests the convexity of the market is much higher now than it was in the past.

Goldman Sachs’ Financial Conditions Index continues to rise and is tighter today thaN it was in late 2019. By historical standards this is still not very tight, but the trajectory is clear, and the debt load is much larger now than it was two years ago. That suggests the convexity of the market is much higher now than it was in the past.

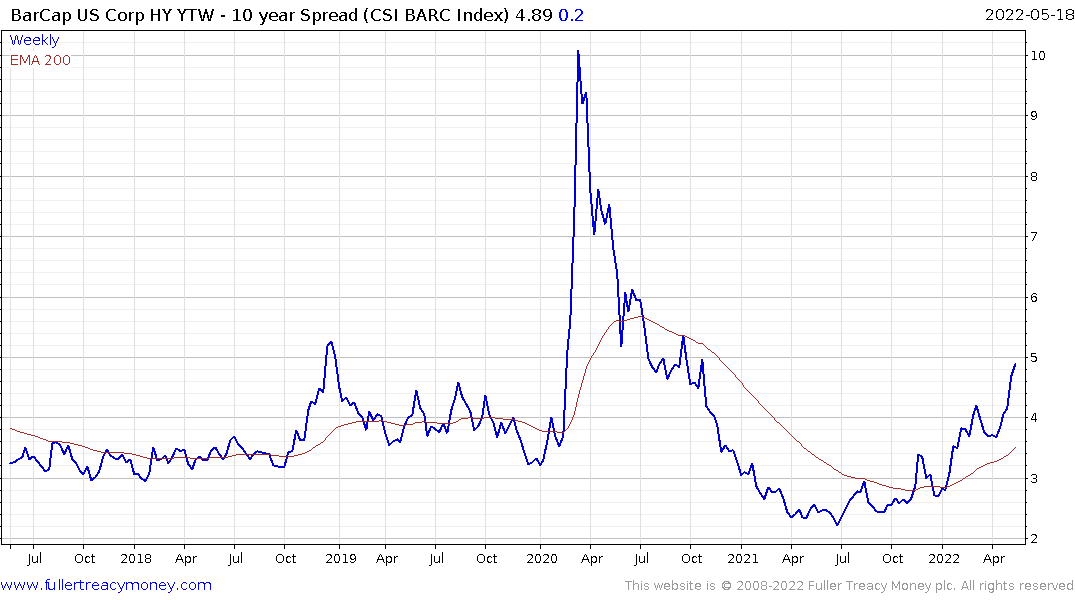

High yield spreads are at 500 basis points. That’s the point where pain becomes clearly evident in the financial system.

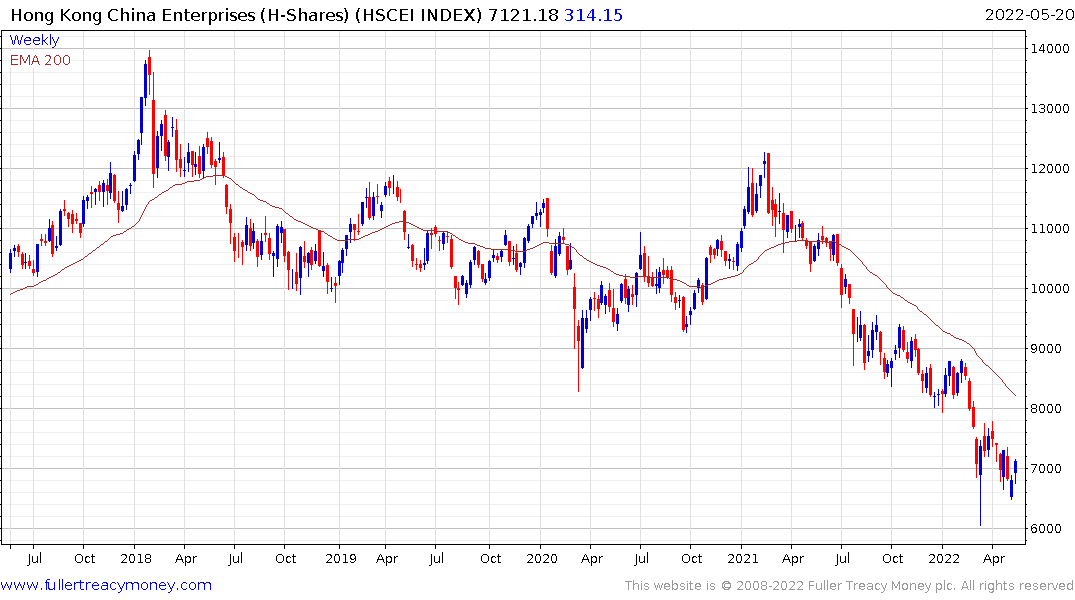

China is cutting rates. The prime rate was cut by 0.15% today. That’s modest easing relative the downward pressure on housing prices and the impending and continuing refinancing headaches of property developers. However, easing is a lot better than tightening and China’s policy is moving in the right direction for markets. There is clear scope for Chinese risk assets to outperform as the rest of the world continues to tighten.

The Hang Seng China Enterprises Index (H-Shares) is firming from the most recent attempt to put in a higher reaction low. A sustained move above 7500 will bolster the view we are back in a demand dominated environment.

The Hang Seng China Enterprises Index (H-Shares) is firming from the most recent attempt to put in a higher reaction low. A sustained move above 7500 will bolster the view we are back in a demand dominated environment.