Global Insight: Stability opens a window of opportunity

Thanks to a subscriber for this report from Morgan Stanley which may be of interest to subscribers. Here is a section:

Lessons from history: The 'size at all costs' strategy, as gold prices lifted to unprecedented levels between 2000-2012 (real), left the Gold industry ill prepared for the sharp pullback, limiting the post-capex 'harvest' period and almost complete capital destruction for the global seniors. Understandably, gold equity values pulled back sharply – Morgan Stanley Global coverage down ~35% 2014 to-date, while the bullion price fell 10%. Our coverage now trades on 20yr low trailing P/CF and EBITDA multiples, creating a window of opportunity for select gold exposures – those finally moving to 'harvest' and those exposed to industry cost tail winds.

Capital allocation discipline emerging – who is moving to 'harvest': A shift in focus from adding ounces to financial returns has driven reductions in capital spending. Global capex is declining about 6%-10% p.a. on aggregate, allowing miners to focus on cash flow and enter the 'harvest' phase.

Here is a link to the full report.

A great deal of bad news has already been priced into gold equities but with capex budgets virtually eliminated from balance sheets there is potential for profit growth as some of the investment in new supply pays off.

.png)

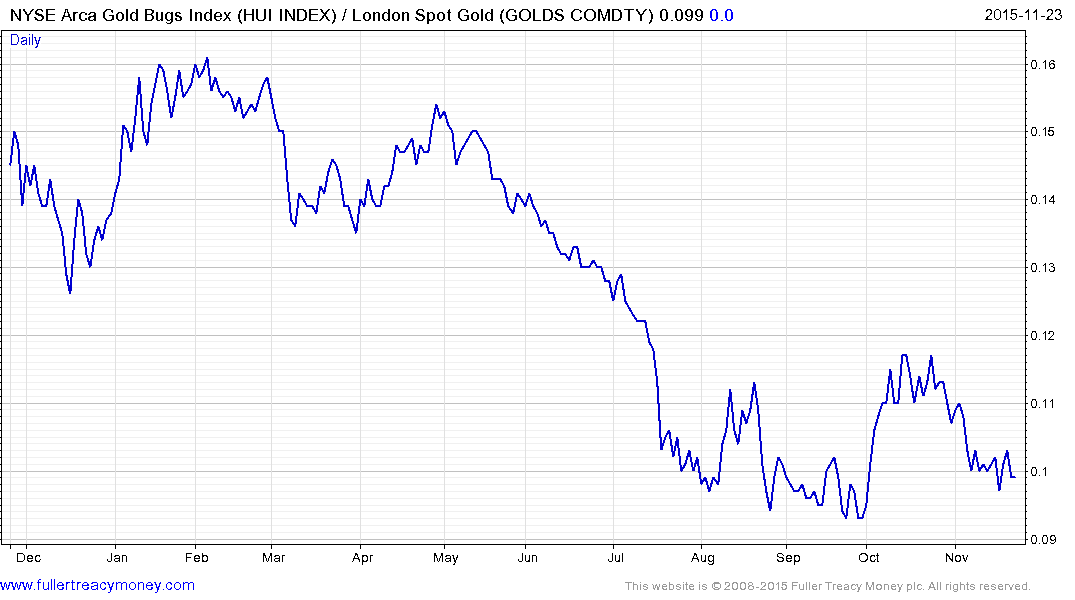

It is worth considering that while the NYSE Arca Gold BUGS Index underperformed the gold price by a wide margin from 2011 that has not been the case more recently. Gold hit a new reaction low a week ago but golds shares have mostly held within their ranges. This is particularly noteworthy since gold shares have already fallen so much versus the metal price and are at historic relative lows.

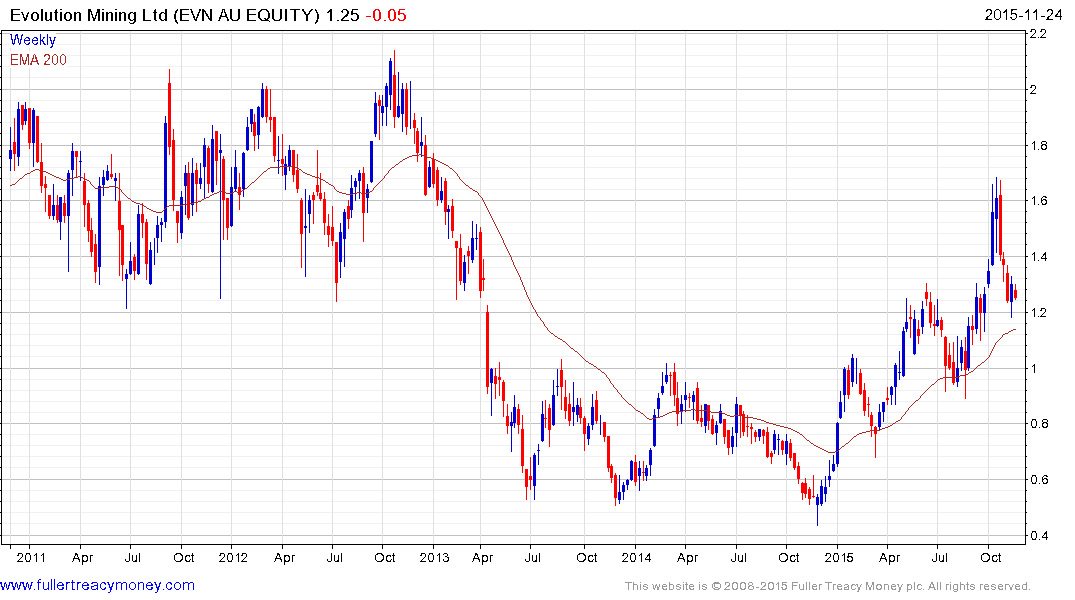

Australian listed Evolution Mining (Est P/E 6.48, DY 1.55%) has been trending higher in a volatile manner for most of this year and has returned to test the region of the 200-day MA. It will need to hold the A$1.10 level if the advance is to remain reasonably consistent.

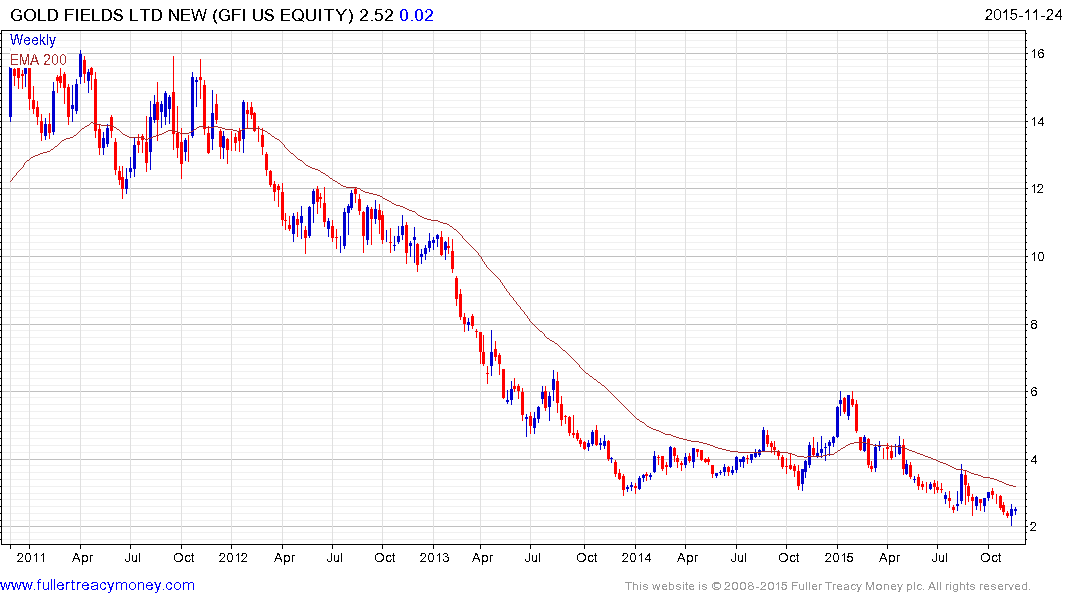

Gold Fields (Est P/E 33.64, DY 0.23%) US listing rallied last week from the psychological $2 area and a clear downward dynamic would be required to question potential for an additional mean reversion rally.

GoldCorp (Est P/E 1111.6, DY 2.03%) has paused in the region of $11.50 but a clear upward dynamic will be required to signal a return to demand dominance and increase the prospect for mean reversion.

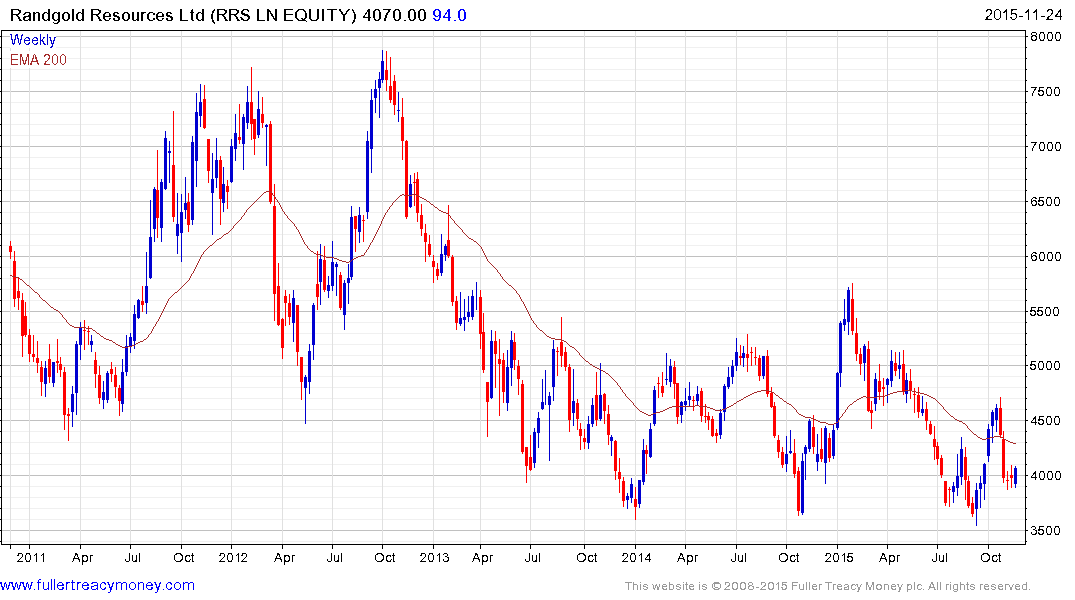

UK listed Randgold Resources (Est P/E 30.59, 0.99%) found support this week above its September low and a clear downward dynamic would be required to question potential for additional higher to lateral ranging.