Global growth: Can productivity save the day in an aging world?

Thanks to a subscriber for this heavyweight 148-page report which I consider indispensable reading over the weekend. Here is a section:

Extrapolating from these case studies, we find sufficient potential to accelerate productivity growth to about 4 percent a year in the G19 and Nigeria. That would be more than enough to compensate for the waning of demographic tailwinds. The persistence of large gaps in the productivity performance of developed economies compared with emerging economies underlines the potential to retool the world’s productivity-growth engine.

We estimate that roughly three-quarters of the total global potential for productivity growth would come from the broader adoption of existing best practices—which we can characterize as “catch-up” productivity improvements. The positive message here is that these types of opportunity are all known to us and exist somewhere in the world. Eighty percent of the overall scope to boost productivity in emerging economies comes from catching up. The remaining one-quarter, or about one percentage point a year, could come from technological, operational, or business innovations that go beyond today’s best practices and that “push the frontier” of the world’s GDP potential. In contrast to some observers, we do not find that a drying up of technological or business innovations will act as a constraint to growth. On the contrary, we see a strong innovation pipeline in both developed and developing economies in the sectors we studied. Our estimate of the potential here is based only on the innovations that we can foresee. It is quite possible that waves of innovation may, in reality, push the frontier far further than we can ascertain based on the current evidence.

Here is a link to the full report.

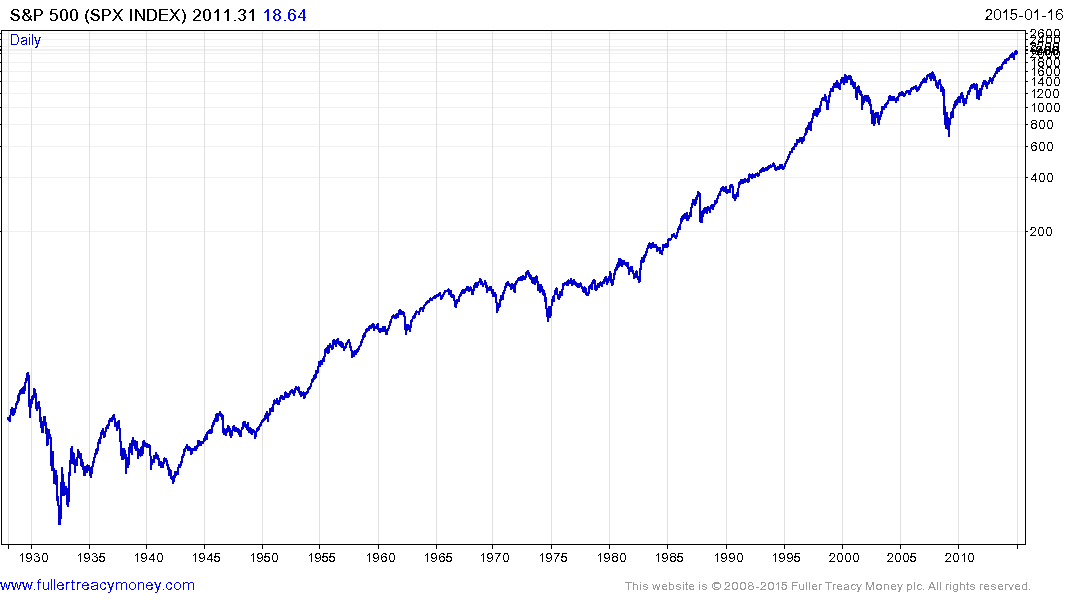

Major secular bull markets don’t just appear out of thin air. In Crowd Money I wrote about the four pillars of an investment theme that need to be in place for it to be sustained beyond the short term. These are the fundamental story, monetary policy/liquidity, governance and price action/crowd psychology. Veteran subscribers will be familiar with our view the necessary elements to support a major bull market are falling into place. Let’s take them in succession:

The investment theme is pretty clear. We are living in the greatest age of humanity ever. There are more people alive today than have lived at any one time in history. This is driving demand for just about everything. Concurrently one of the greatest periods of technological innovation is unfolding. This has contributed to the lower cost of energy we are currently experiencing. If you combine more people with better tools and lower energy costs the result is productivity growth. In order for valuations to justify progressively higher prices, productivity growth is essential. .

The cyclical bull market we have been presented with over the last six years has been liquidity fuelled and there is little prospect of tightening on a global basis as central banks remain on easing trajectories. More broadly, the quantity of money invested in the bond markets dwarfs that in the equity market and represents a large potential pool of capital once monetary policy is normalised.

Governance is Everything has long been an adage at this service and is no less true today. If we are relying on billions of new consumers reaching their productive capacity, the trajectory in standards of governance needs to continue to improve. As acceptance of the capitalist economic model goes increasingly global the ability to provide workers with the best tools, methods and education possible represents a powerful force for improving productivity.

We will of course be guided by the price action. There will always be risks and there will always be something to worry about but so long as the fundamental factors supporting the secular bull market hypothesis remain in place significant pull backs can be viewed as buying opportunities. In the same way significant upward accelerations can be considered opportunities to harvest profits.

Back to top