Global bond burn from Brexit may now force fiscal response

This article by Mike Dolan for Reuters may be of interest to subscribers. Here is a section:

To be sure, fiscal policy has been loosening gradually this year across the major economies, according to HSBC. Growth in government spending globally in 2016 was already set to be the fastest since 2009's coordinated G20 push even before June 23.

"One way or another, we suspect fiscal policy will likely have a larger role to play in many countries from here," wrote HSBC's Global Chief Economist Janet Henry. "But not just any fiscal stimulus will do."

Henry warned that governments had to make sure budget adjustments either made long-lasting structural reforms or that they led to higher public investment that would then raise productivity and encourage the private sector to follow

Otherwise, "they will never meet the long-term nominal growth rates required to start to lower debt burdens". The combination of "higher debt-to-GDP ratios and persistently higher taxation would be a permanent drag on growth," she said.

JP Morgan economist Jan Loeys reckons the economic and political rationale for fiscal stimuli is now compelling.

"Growth remains at snail’s pace. It is not making voters happy; they are clamoring for better," he wrote. "Monetary policy has done a heroic job keeping the world economy afloat, but it does not have much left to give. It is probably time to pass on the baton to fiscal policy."

We are all well aware of the fact central banks favour inflation in order to make the job of paying down debt a less burdensome process. In the same way politicians anxious to hold onto their jobs often resort to spending their way out of the problem regardless of whether that contributes to potentially larger issues later.

The rise of populism in both Europe and the USA highlights how restive electorates have become following years where asset prices have risen but standards of living have deteriorated. The stealth inflation we see in our monthly household expenses (insurance, education, services) but which does not show up in official measures is felt most acutely by those who have not benefitted from the appreciation of the stock or bond markets. Unfortunately for policy makers these voters far outnumber those who have benefitted most from extraordinary monetary policy.

If the EU is going to overcome the challenge posed by the UK’s decision to leave and increasingly loud calls for similar plebiscites in other countries, it is going to have to come up with a solution that offers the prospect of improving standards of living to more people. Despite German and other creditor nation angst, loosening the fiscal noose could represent the most expedient way of achieving that goal.

For the USA, Donald Trump would appear to be most likely to employ a fiscal easing strategy not least to achieve his stated goal of improving the economic condition of ordinary people as well as his personal comfort with the debt markets. On the side of the aisle if Hilary Clinton is to be elected she will need to appeal to the mostly young supporters of Bernie Sanders who have a “tax everyone else and spend on us mentality” and she is already employing greater protectionist rhetoric in response to the clear message of voter disquiet that came through from the primaries. That would suggest she is also likely to favour a fiscal bump.

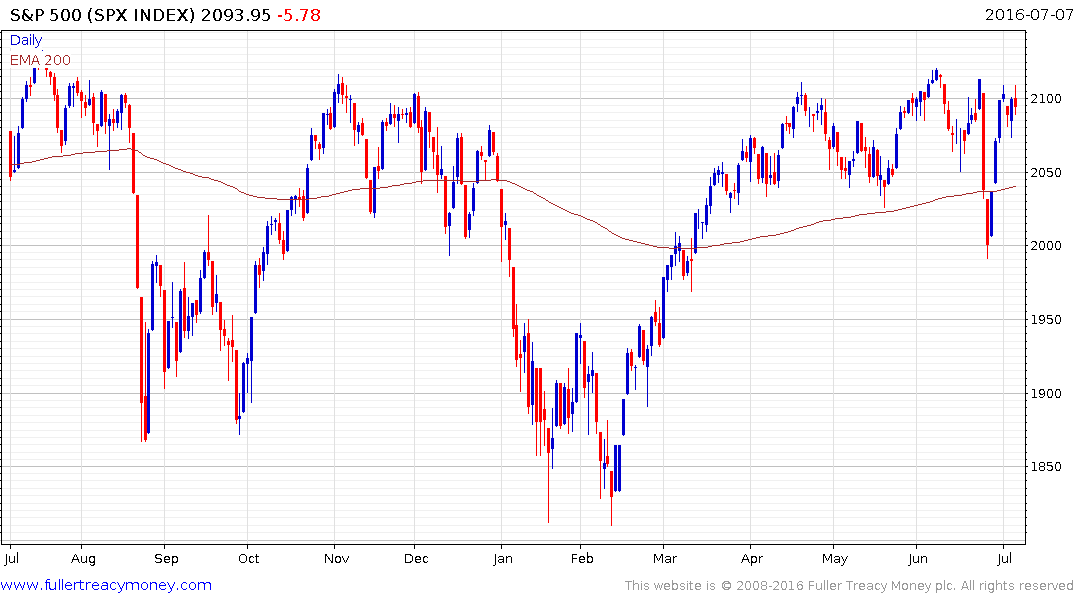

Putting more money in people’s pockets and increased government spending is generally good news for corporate earnings. Despite a large number of worrying events so far this year there is no arguing with the reality provided by the market. The S&P500 has been confined to a relatively shallow range, mostly above the 200-day MA since April. So far there is no reason to conclude this congestion area does not represent a consolidation in the region of the upper side of the larger 18-month range.

Since the Index is within 1% of the all-time peak, there is potential for an upward break but little to be achieved by pre-empting it, since the potential drawdown required to question the consolidation hypothesis is a decline in the order of 5% or below the psychological 2000. Nevertheless the prospects for a fiscal bump could potentially act as a catalyst for a resumption of medium-term uptrends in related markets.

This article on the rise of populist candidates Italia may also be of interest.

Back to top