Global Bank Indices

Banks are liquidity providers. When they are doing poorly, their inability to increase loan issuance has a knock-on effect for the wider economy. When they do well, loan issuance increases and liquidity flows into the wider economy. That helps to support asset prices. Therefore banking sectors tend to be lead, or at least coincident, indicators for their respective economies.

An inverted yield curve is a particular challenge because the sector’s basic business model is to borrow short-term to lend long term. When that happens, they need alternative business models to supplement income and thriving is more difficult. That’s why the performance of banks around the world at present is such an interesting development.

The Nasdaq Global Bank Index has held a sequence of higher reaction lows since late last year and is now firming from the region of the 200-day MA. Long-term it has been forming a base for the last 15-years. A sustained move above 1000 will be required to confirm a return to demand dominance beyond 18-month bouts of enthusiasm that do not translate into long-term uptrends.

Japan’s Topix Banks Index surged between 2003 and 2006 but then gave up its entire advance and formed a base over the last 17 years. It has now broken out to new recovery highs and is accelerating away from the base formation.

Japan’s Topix Banks Index surged between 2003 and 2006 but then gave up its entire advance and formed a base over the last 17 years. It has now broken out to new recovery highs and is accelerating away from the base formation.

There is a great deal of speculation about the path of Japan’s interest rates. The belly in the yield curve has been ironed out following the easing of Japan’s yield curve control policy. That does lay the ground from an interest rate hike in due course. Japan’s banks have been selling long-dated bonds in advance of that possible outcome and probably welcome the opportunity to make money from a net interest income again.

The Europe STOXX 600 Banks Index is currently firming from the region of the 200-day MA. The Index has been in a long basing pattern since 2009 but an upward bias has been in place since late 2020.

The FTSE-350 Banks Index is also firming from the region of the 200-day MA. Importantly, the Index encountered resistance in the region of the 1000-day MA between 2013 and 2022 but the MA is now providing support.

Singapore’s focus on financial services rather than banking has allowed the sector to outperform.

The South Korean Financial Index has been ranging since 2009. It hit a new recovery high today as it attempts to break out of a yearlong consolidation.

The South Korean Financial Index has been ranging since 2009. It hit a new recovery high today as it attempts to break out of a yearlong consolidation.

With the exception of the pandemic panic, Australia’s S&P/ASX 200 Financials Index has been ranging below the 2007 peak since 2015. It is currently steadying within the most recent 30-month portion of that range.

Canada’s S&P/TSX Banks Index is steadying at the lower side of its range but needs to push back above the 1000-day MA to confirm offset top formation completion characteristics.

Brazil’s Itau Unibanco has been ranging since 2018 but is currently firming from the region of the 200-day MA.

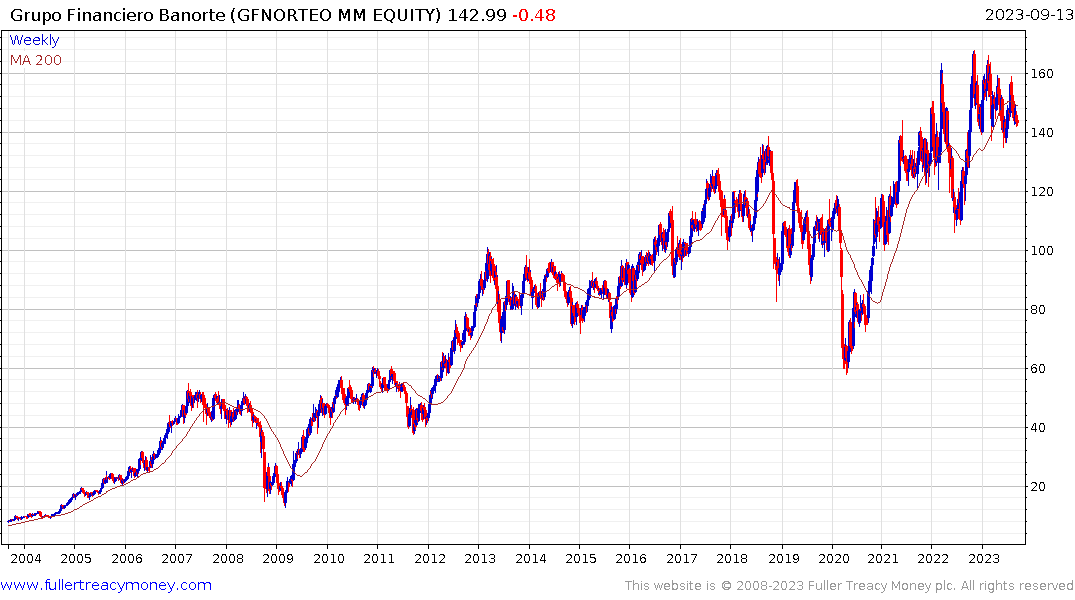

Mexico’s Grupo Financiero Banorte SAB continues to range in the region of the all-time peaks.

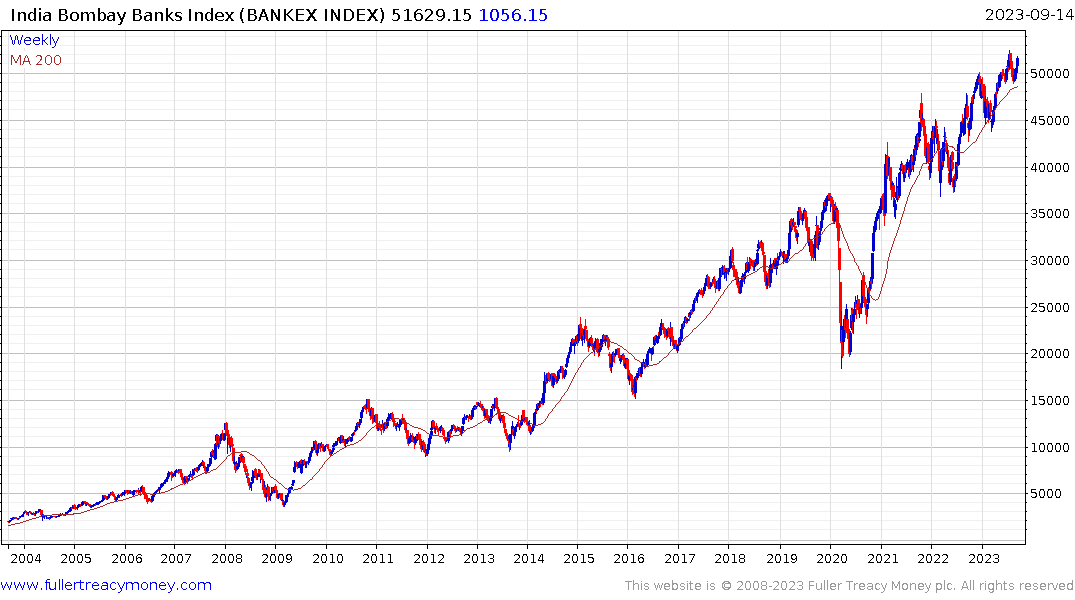

India’s Bombay Banks Index remains in a consistent long-term uptrend.

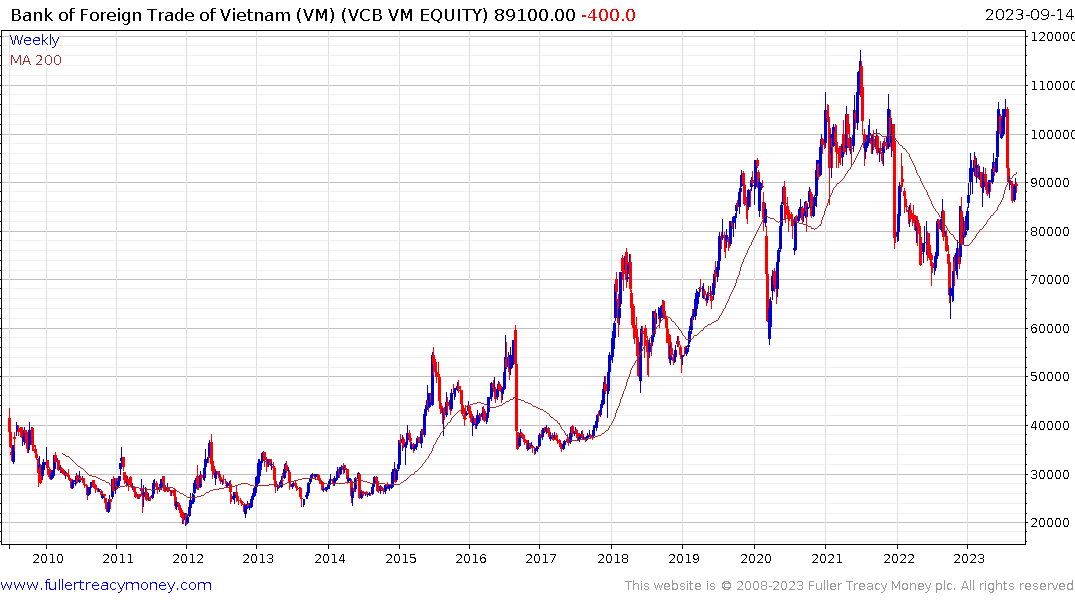

The Bank for Foreign Trade of Vietnam is also trending higher in a consistent manner.

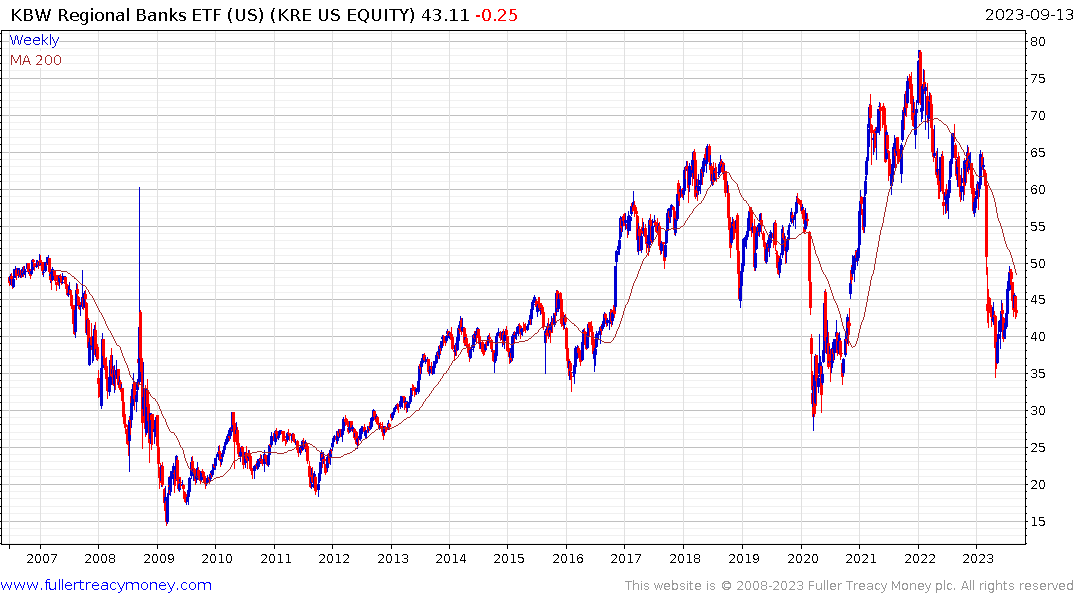

At the other extreme, the USA’s regional banks index is attempting fund support above the March lows.

The S&P500 Banks Index steadied today to confirm a short-term higher reaction low. A sustained move above the 1000-day MA will be required to confirm a change in the medium-term trend.

The S&P500 Banks Index steadied today to confirm a short-term higher reaction low. A sustained move above the 1000-day MA will be required to confirm a change in the medium-term trend.

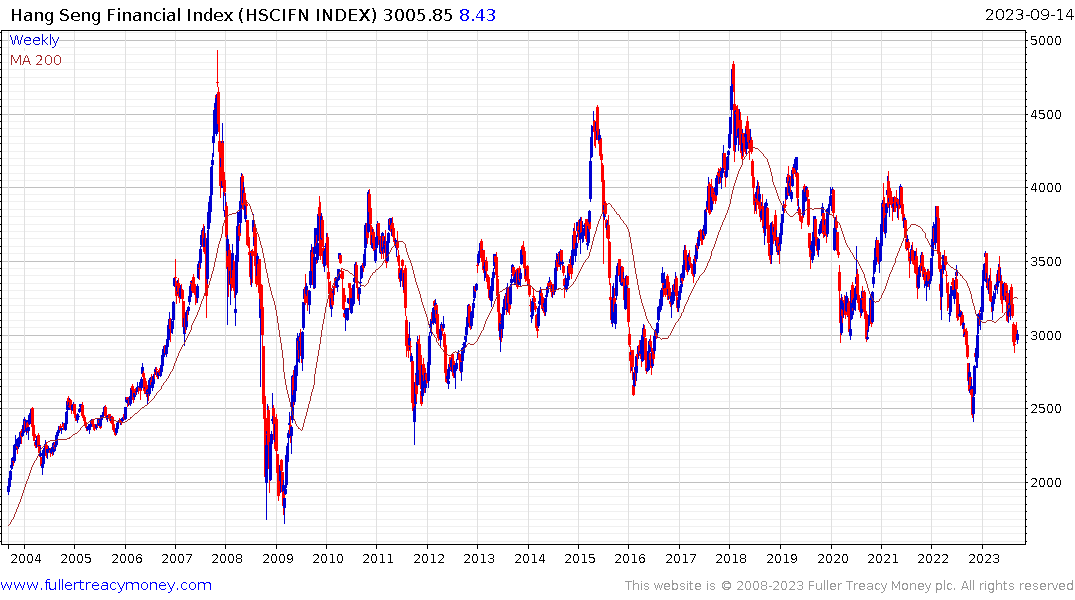

The Hang Seng Finance Index has been ranging since 2007 and attempting to find a short-term low.

The clear picture from these charts is the world outside the USA and China has financial sector shares that are either recovering or trending higher. That’s an important point because it also helps to highlight that the epicentre of risk is in the USA and China rather than elsewhere. When the Dollar's trend of out performance eventually ends, the allure of ex-US markets will be more convincing.

Back to top