Glasenberg of Glencore to Rio Tinto, other miners: stop digging

This article by Jeremy Khan for Bloomberg may be of interest to subscribers. Here is a section:

Take iron ore, which is responsible for almost half of Rio Tinto’s revenue and more than two-thirds of its pretax profit. Global yearly output for all miners increased more than 25 percent from 2010 through 2014. Over the same period, the price of Australian iron ore exports to China declined 60 percent. That’s not a coincidence, Glasenberg says.

Yet the world’s miners—including Rio, BHP Billiton, and Vale—plan to increase production by an additional 16 percent by the end of 2018. “That’s what’s killing the supercycle,” Glasenberg said on Glencore’s August 2014 earnings call, referring to the idea that commodities prices had been on a decades-long climb due to surging demand from emerging markets, particularly China.

Glasenberg’s message to the mining industry is simple: You’re in a hole; stop digging. The problem is, mining execs think they’re in the business of digging. “There’s too much focus on big holes in the ground and not enough focus on return for capital,” says Paul Gait, a mining analyst at Sanford C. Bernstein & Co.

Iron-ore prices have paused in the region of $45 but will need to continue to hold the recent lows if we are to conclude that more than temporary support has been found.

Despite the fact that industrial metals prices have at least paused in their declines over the last week, the CRB Metals Index shows little evidence that support has been found. A sustained move above the 200-day MA currently near 760 would be required to question the consistency of the medium-term decline.

The oligarchy of iron-ore miners deliberately withheld supply from the market in the early stages of the commodity bull market. However they responded to increased competition and loss of market share by ramping up production in an effort to drive higher cost producers out of the business.

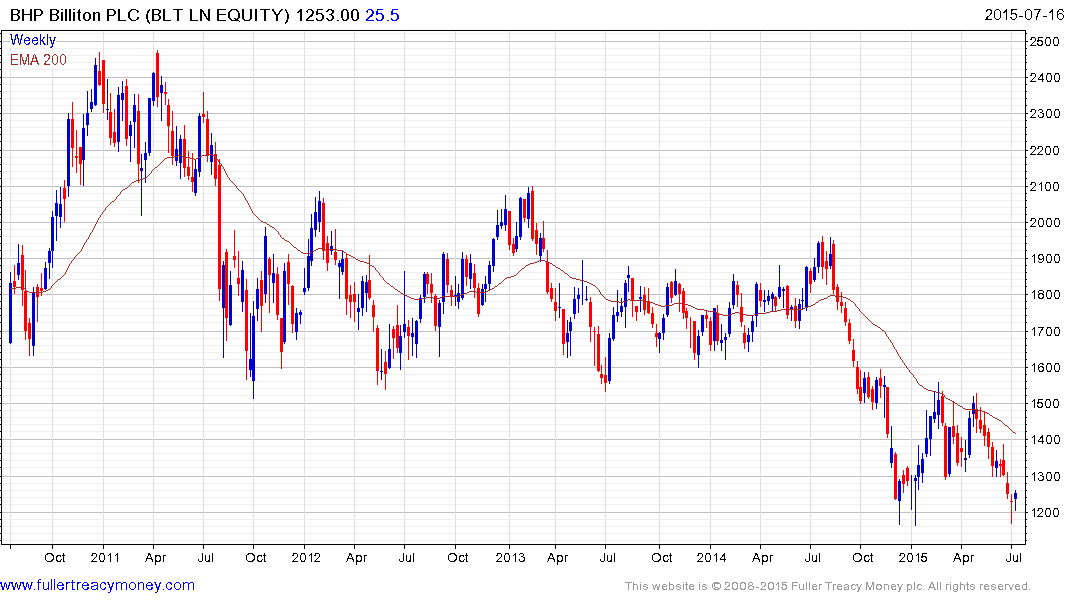

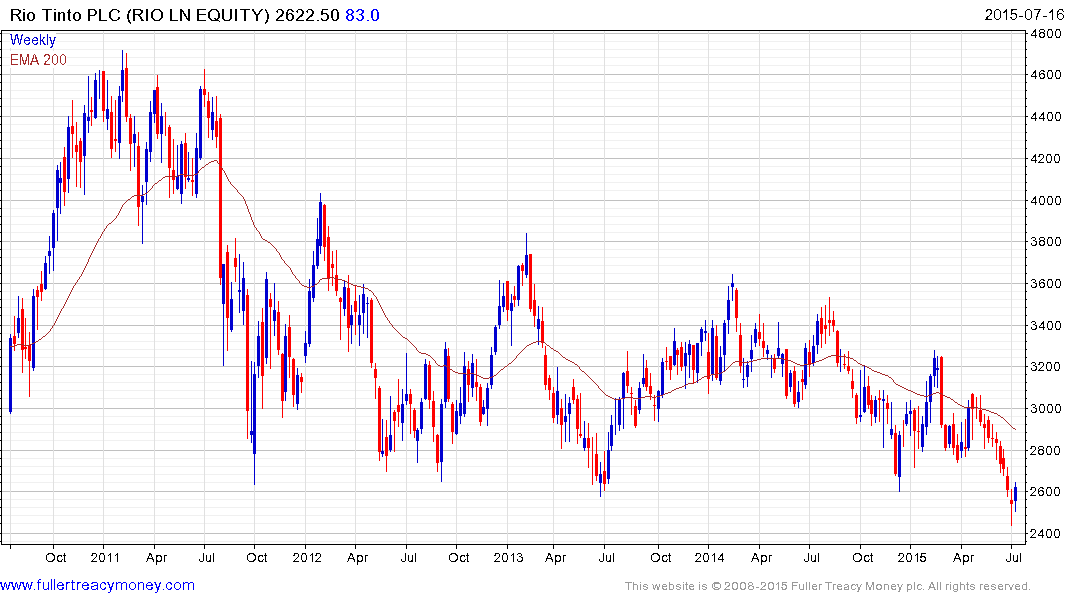

London Mining went bankrupt. African Minerals has been delisted. Atlas Iron Ore is no longer trading and looking to fund managers for A$180 million in financing, China’s steel producers have been buying up iron-ore mines suggesting that the market is at a point where equilibrium might be in reach if the main companies, BHP Billiton, Rio Tinto and VALE cut back on further expansion projects. All three have paused in the region of their respective lows over the last week.

Back to top