Gilead Tops List of Drugmakers That Need to Make M&A Splash

This article by Bailey Lipschultz for Bloomberg may be of interest to subscribers. Here is a section:

Gilead Sciences Inc. has so far been silent on plans to diversify its pipeline as investors clamor for a repeat of last year’s biotech deal boom.

The drug developer leads a group of biopharmaceutical companies that Wall Street expects to join in the sector’s acquisition spree. Earlier on Friday, Eli Lilly & Co. snatched up Dermira Inc. and its skin disorder drug for $1.1 billion.

That news comes as investors and management flock to San Francisco for the JPMorgan Healthcare Conference, which kicks off on Monday. The meeting is viewed as the crown jewel of sell-side events and is a hotbed for companies to announce deals and provide product updates.

The biotech sector is busy commercialising a range of novel therapies to treat cancers and chronic conditions like diabetes, Alzheimer’s and arthritis. The road to full approval and the scope for failure along the way means it is a high-risk strategy to invest in start-ups. Therefore, the bigger companies wait for some verifiable proof a nascent product works and then investigate buying it.

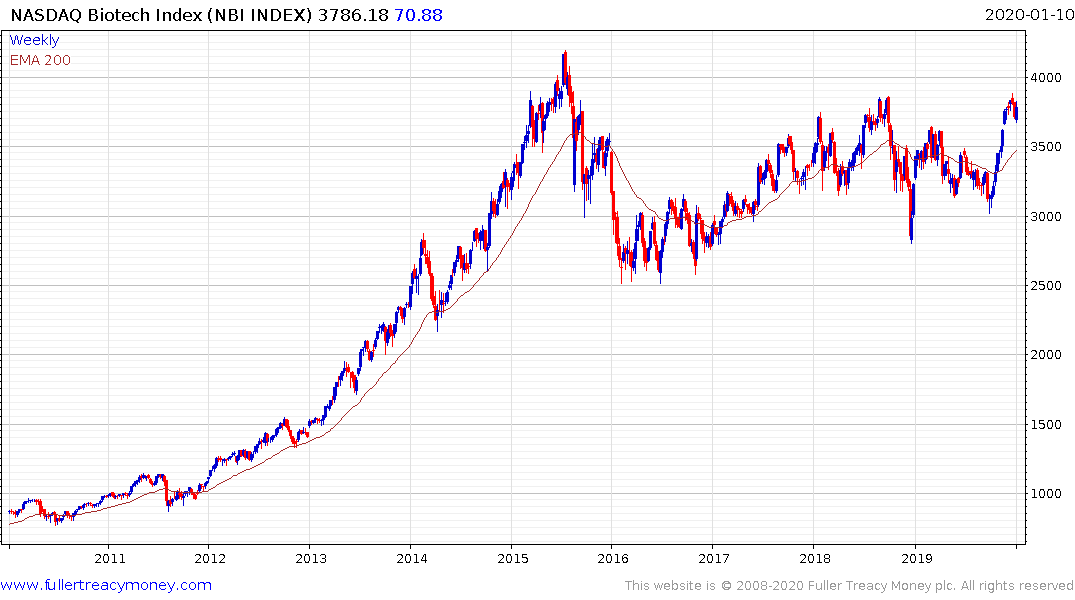

The Nasdaq Biotechnology Index hit a medium-term peak in 2015 and has been in a volatile range since. The rebound since October broke the yearlong sequence of lower rally his and it is now testing the region of the peak near 4000. A sustained move below the trend mean, currently near 3400 would be required to question medium-term scope for continued upside.

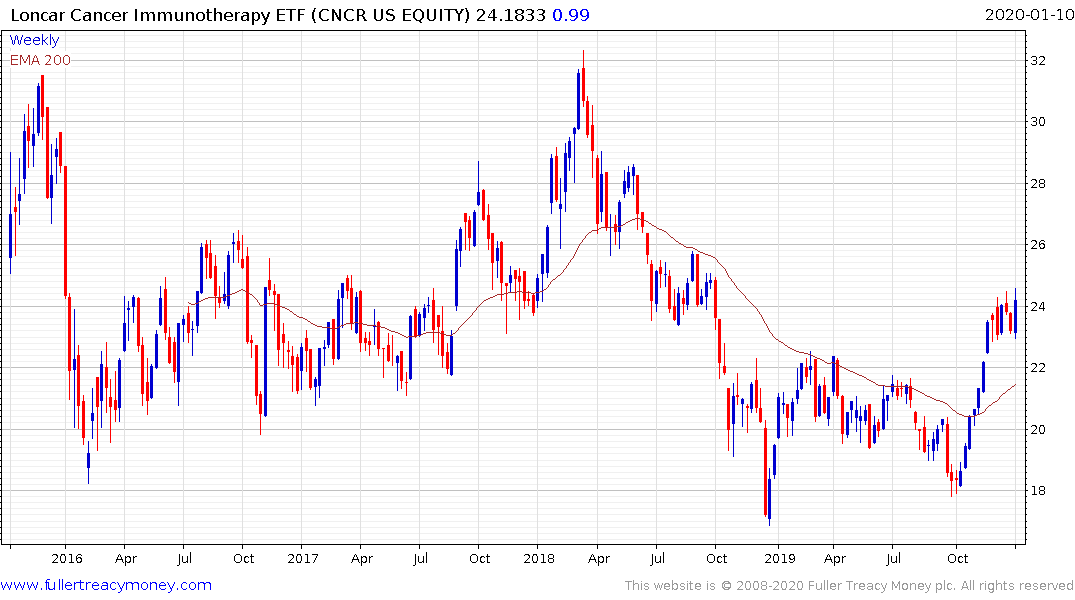

The Loncar Cancer Immunotherapy ETF rallied in December to break an 18-month downtrend to signal recovery is underway.