Gilead Pill Can Stop HIV. So Why Does Almost Nobody Take It?

This article by Caroline Chen for Bloomberg may be of interest to subscribers. Here is a section:

Truvada, Gilead’s HIV drug, has been approved since 2004 for people with the virus. In 2012, use was expanded to people without HIV as a way of preventing transmission -- a practice called PrEP, or pre-exposure prophylaxis. Taken daily, it can prevent infections 92 percent of the time, meaning it could drastically reduce new infections in sexually active gay men, among the U.S.’s highest-risk communities.

Thanks to its use in HIV patients, Truvada’s been a financial success, bringing Gilead $1.79 billion in the U.S last year. Yet out of 3.3 U.S. million prescriptions from January 2012 to March 2014, only 3,200 were for prevention.

There are many reasons: Gilead says PrEP isn’t a moneymaker, so the drugmaker doesn’t pitch the medicine to many of the primary care doctors who see healthy, HIV-negative gay men most likely to benefit from Truvada. Patients and advocates say doctors often don’t know about the medicine, and some insurance plans leave patients with copays as high as $1,300, making use by the healthy less affordable.

The result is thousands of people who could significantly lower their HIV risk, yet don’t. Some 50,000 Americans are diagnosed with HIV each year, with the highest rates among young gay males, according to the U.S. Centers for Disease Control and Prevention.

Yet in November, Gilead said that 42 percent of PrEP prescriptions written through March 2014 were for women, and only 7.4 percent were for men younger than 25.

The list of caveats that come with this description of Truvada’s characteristics should give anyone pause. However the people it is aimed at helping do not have the best record of adopting a cautious lifestyle when it comes to the trade-off between pleasure and well-being, not least because many are young men.

Taking a step back, the commercialisation of such a drug requires a very long lead time. This explains why after the fizz of the Tech Bubble it took so long for the promises of innovation to come to fruition. One of the reasons that biotechnology is such a booming sector today is that a number of important products have reached the commercialisation stage.

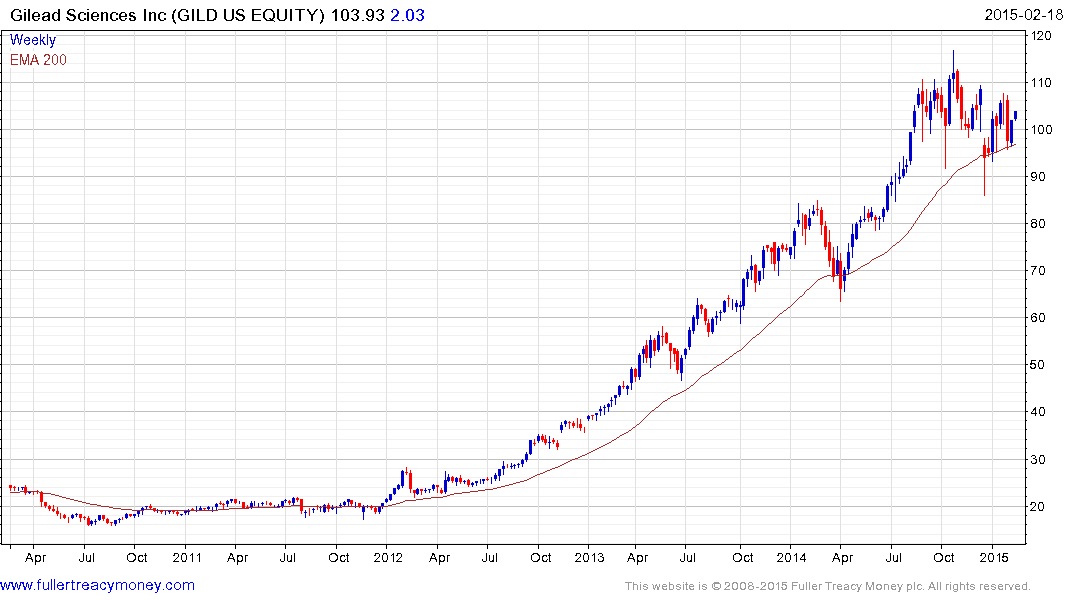

Gilead Sciences (Est P/E 10.83, DY 1.66%) initiated a dividend this month. This follows a trend where successful technology firms are returning at least some capital to investors. The share has been ranging in a relatively gradual process of mean for the last six months and firmed again from that region last week. A sustained move below $90 would be required to question medium-term potential for additional upside.

So far Amgen is only other major biotech companies to pay a dividend. It initiated its pay-out in 2011 and currently yields 2.04%. The share appears to be finding support in the region of the 200-day MA.

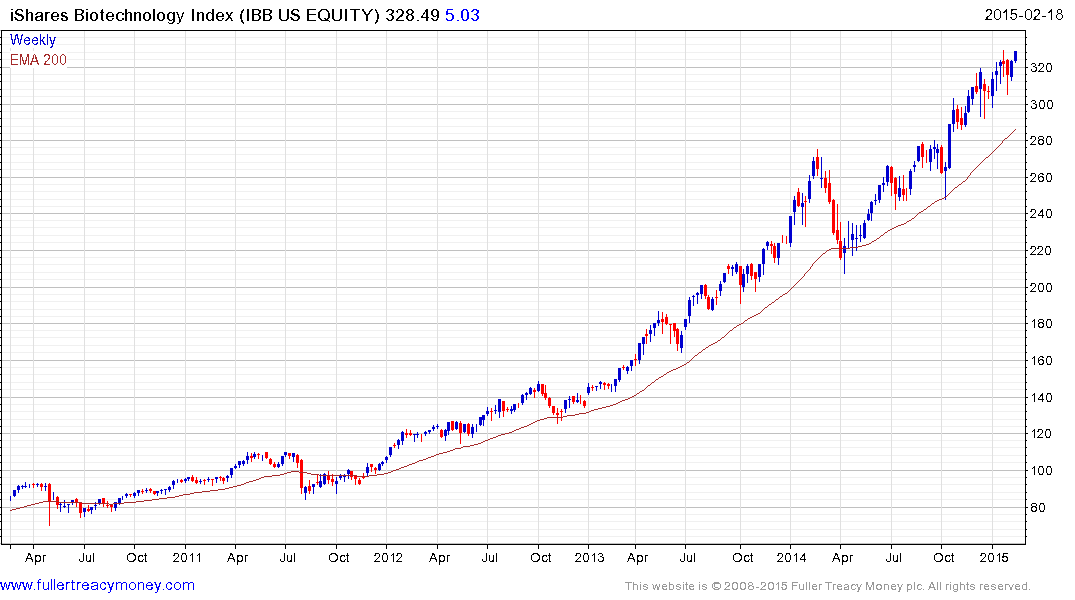

The iShares NASDAQ Biotechnology ETF is currently somewhat overextended relative to the 200-day MA but a break in the progression of higher reaction lows, currently near $300 would be required to signal mean reversion is underway.

Back to top