Gilead, fueled by latest approval, sees CAR-T sales takes off

This article from Bloomberg may be of interest to subscribers. Here is a section:

Shares of Gilead Sciences ticked up Friday morning after the company’s latest earnings report exceeded Wall Street’s expectations.

The results were, in part, tied to growing sales from Gilead’s cell therapy business, which consists of the marketed cancer drugs Yescarta and Tecartus. Together, sales from the two drugs totaled $398 million in the third quarter, a nearly 80% increase from the same three-month period a year prior.

Gilead’s work in cell therapy, catalyzed by the $12 billion acquisition of Kite Pharma in 2017, hasn’t always sat well with investors. Early sales from Yescarta were slower than some had hoped, and Gilead ultimately acknowledged that some assets from the Kite deal were overvalued.

But in recent months, the company’s cell therapy business has ballooned. Third quarter sales of Tecartus were up 72% year over year, reaching $81 million, while those for Yescarta rose 81% to $317 million. Gilead cited the approval of Yescarta as a “second-line” therapy for a type of hard-to-treat lymphoma, which happened in April, as a main reason for the uptick.

Immunoncology involves re-educating the immune system to target cancers which typically avoid detection by the body’s defenses. Related stocks blossomed in 2015 with a huge rally. They had a brief second coming in 2018 but subsequently collapsed as the route to commercialization proved to be anything but easy.

Companies like Gilead and Bristol Myers Squibb waded in and purchased some of the companies closest to delivering market-ready products. The technology is maturing and some of the production bottlenecks are being smoothed out.

Gilead’s surge today brings the completion of the five-year range in sight. A sustained move above $80 would confirm a return to medium-term demand dominance.

Gilead’s surge today brings the completion of the five-year range in sight. A sustained move above $80 would confirm a return to medium-term demand dominance.

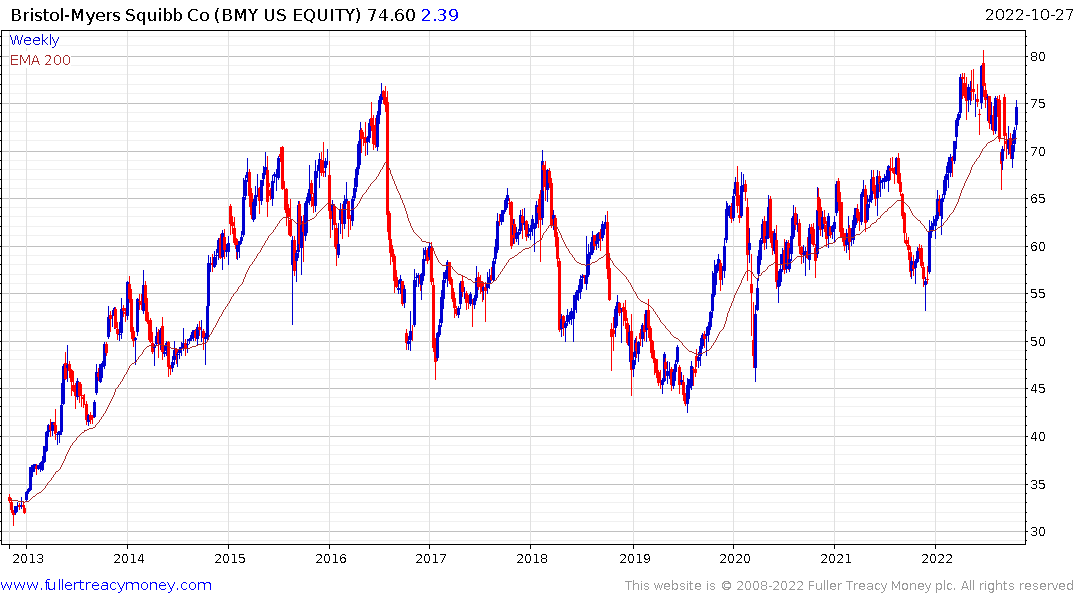

Bristol Myer Squibb is firming within the first step above the six-year range.

Bristol Myer Squibb is firming within the first step above the six-year range.

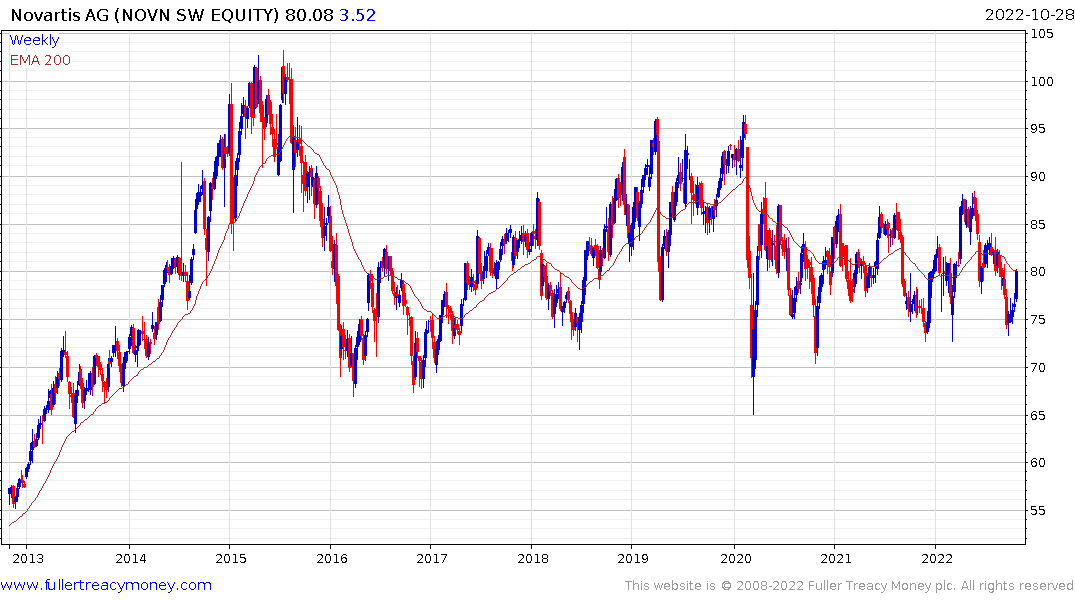

Novartis is firming within the range that has proceeded since the 2020 drawdown.

Novartis is firming within the range that has proceeded since the 2020 drawdown.

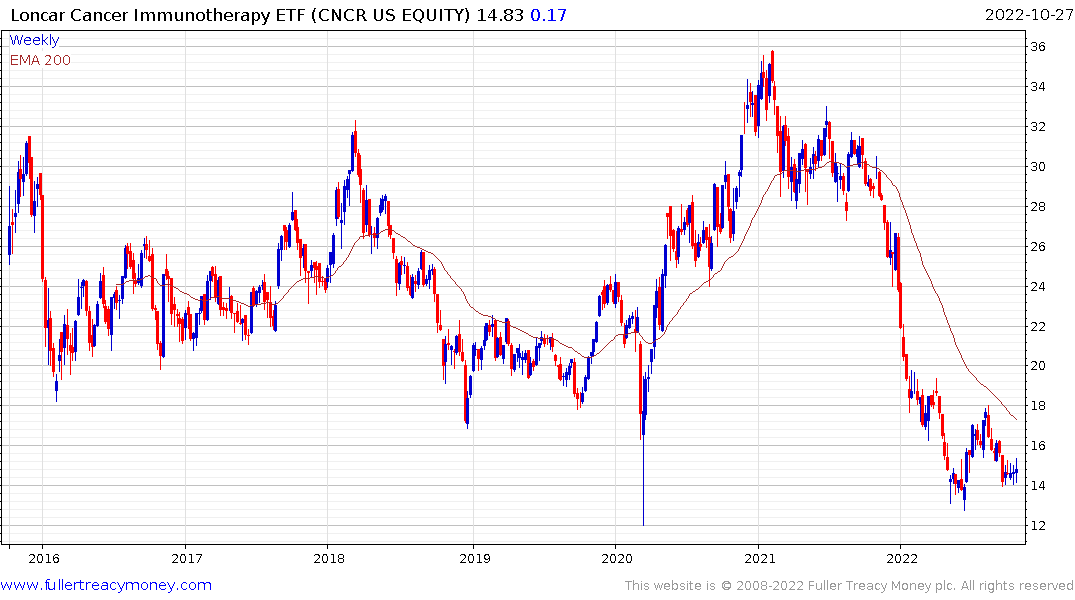

The Loncar Cancer Immunotherapy ETF is attempting to put in a higher reaction low as it builds support in the region of the 2020 lows.

The Loncar Cancer Immunotherapy ETF is attempting to put in a higher reaction low as it builds support in the region of the 2020 lows.

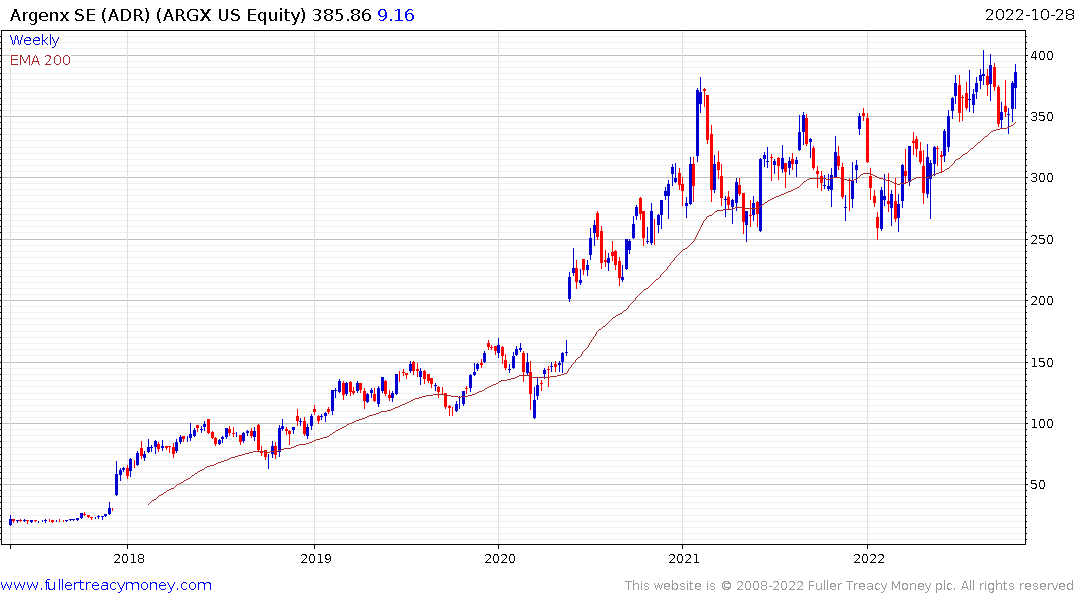

Argenx (Listed in Brussels and USA) remains in a consistent uptrend.

Argenx (Listed in Brussels and USA) remains in a consistent uptrend.